When Do You Accept That Your Trade is Wrong? (Part 2 of 2)

Read Time: 5 minutes

In Part 1, we looked at the psychology of letting a trade breathe and knowing when to cut it. This time, we’ll get into the tactical side – the on-chart behaviours that can tip you off that you’re on the wrong side of the trade, and how those moments actually look when price is unfolding. The aim isn’t to obsess over every wiggle. It’s to understand what a breakdown looks like in your setup, so when it happens, you can exit without hesitation or regret.

- Clear Breaks in Market Structure

- Failed Retests

- Divergence That Doesn’t Let Go

- Context Collisions

- Bonus Tip

- Final Thoughts

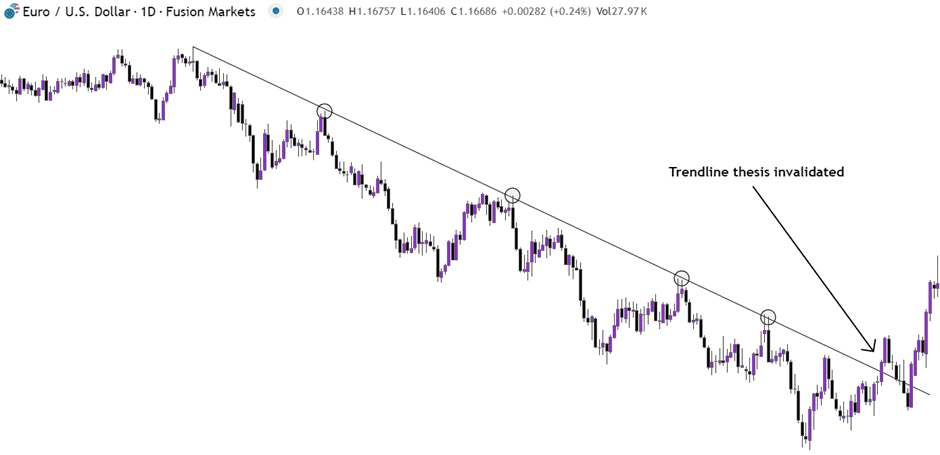

When your trade idea is built on a certain structure – a trendline, a channel, a wedge – the moment price closes through it, the foundation is gone. That doesn’t mean it might work out anyway. It means the market just told you “your reason no longer exists.”

EURUSD – Daily Chart (trendline invalidation)

As shown in the above daily chart of EURUSD, we had four clear touches of the trendline before it eventually broke. If you were trading this trendline, your short thesis would remain in play until the trendline was eventually broken. At that point, you would consider it invalidated.

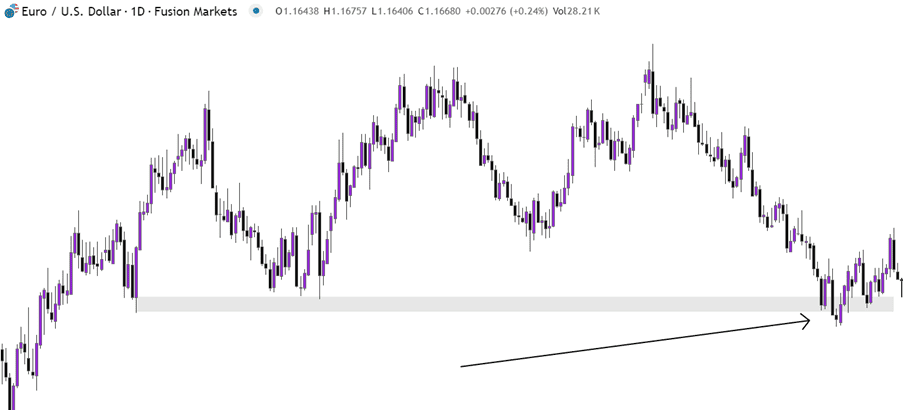

One of the quiet killers of a good trade is the failed retest. You get your breakout, price comes back to “confirm” the level… and instead of bouncing, it slices through and keeps going. It’s a textbook sign the other side just took control.

EURUSD – Daily Chart (failed breakout)

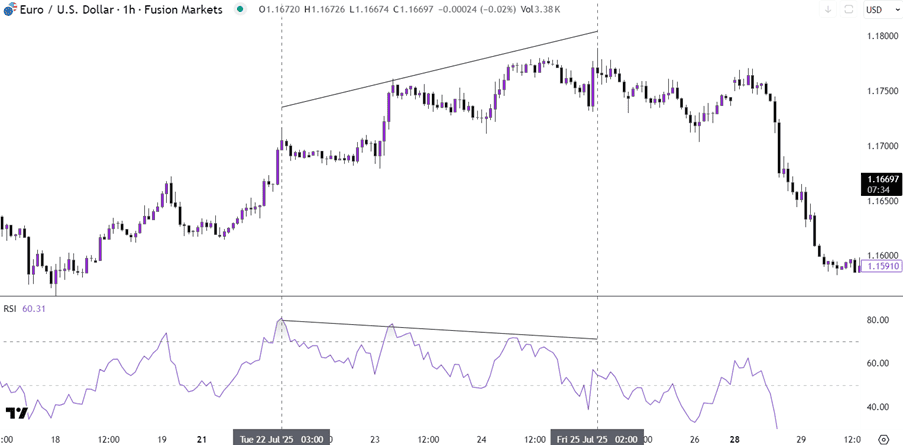

Divergences aren’t an entry trigger here – they’re the canary in the coal mine when you’re already in the trade. If price is grinding higher but momentum indicators are pointing lower, that’s your cue to tighten the leash. One of the most commonly used indicators for identifying divergence is the Relative Strength Index (RSI).

EURUSD – 1-hour chart (RSI divergence)

The above chart is a perfect example of identifying divergence using the RSI indicator. As the bullish trend was losing momentum, this became evident as the RSI began to trend downward whilst price still trended upward. A trader identifying this would begin to look for exit opportunities. Alternatively, the trader could begin to look for shorting opportunities.

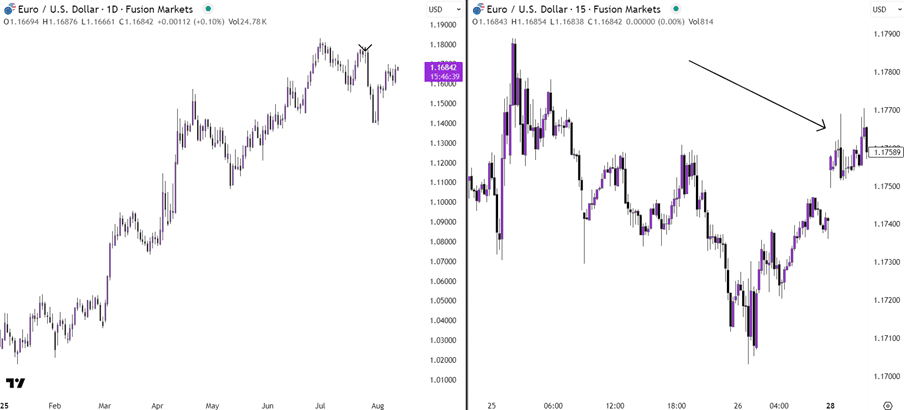

Not every invalidation is technical. Sometimes the higher timeframe tells you you’re trading into a wall. You might be long into a major weekly resistance, or short into a long-term trendline that’s been defended for months.

EURUSD – Daily and 15min charts (example of context collisions)

As shown in the chart above, the 15min chart (right) shows what could be a new bull trend. However, the daily chart (left) shows that price is approaching a very key level.

Trust Your Thesis

It’s important to trust your system, trust your thesis and let the trade play out.

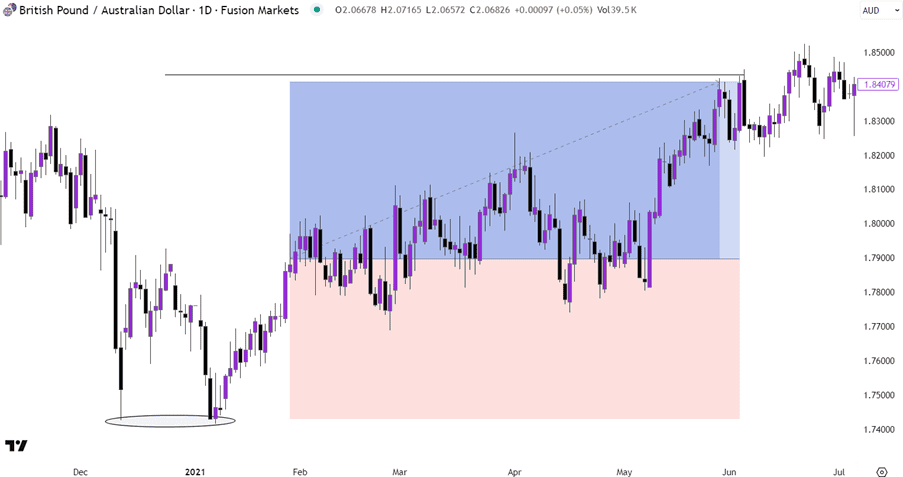

GBPAUD – Daily (double-bottom)

A prime example of this can be observed in the above image. At the end of 2020 GBPAUD formed a nice double-bottom on the daily chart. Assuming you traded this with traditional rules – you would’ve taken heat on your position multiple times before it eventually worked out and hit your target.

One of the key differences between professional traders, and rookies, is that professional traders will hold this position until they have enough conviction to invalidate the trade’s thesis. Rookie traders, on the other hand, will get scared and want to lock in profits, or minimise losses).

The discipline isn’t just in setting a stop. It’s in recognising the moments the market has proven you wrong before your stop is hit. Sometimes it’s structural, sometimes it’s momentum, and sometimes it’s the broader context. When you build your exit plan around these triggers, you don’t need to debate with yourself mid-trade. The chart tells you when it’s over and your job is simply to listen.

We’ll never share your email with third-parties. Opt-out anytime.