The Real Cost of Forex Trading

Read time: 15 minutes.

Understanding the characteristics of the forex market is crucial for success. The concept is simple; forex trading involves buying and selling currencies with the aim of making a profit. However, many new traders dive into this market without fully grasping the real costs involved. In this guide, we'll explore the hidden expenses that can impact your trading profitability and provide tips to incorporate into your trading and avoid any unnecessary costs.

Table of Contents

- Understanding the Hidden Costs

- Tools for Transparent Financial Analysis

- Tips for Transparent Financial Analysis

- Conclusion

Understanding the Hidden Costs

Spread and Commissions

When trading forex, you'll encounter bid and ask prices. The bid price is what buyers are willing to pay, while the ask price is what sellers are asking for. The difference between these two prices is known as the spread. This spread represents the cost of trading and can vary depending on market conditions and the broker you're using. Additionally, account types such as Fusion Markets’ Zero account, don’t have a spread, but rather commissions on each trade. This can be beneficial to traders who are looking for a regular-cost solution.

Understanding the impact of spread on trading costs is essential. Even seemingly small spreads can add up over time, affecting your profitability. Different brokers offer various commission structures, including fixed or variable spreads and commission-based pricing. It's crucial to compare these structures and choose the one that aligns with your trading strategy.

Overnight Financing Fees

When holding positions overnight, you may incur overnight financing fees, also known as swap rates. These fees are charged for the privilege of keeping a position open beyond the trading day. Calculated based on the interest rate differential between the two currencies being traded, overnight financing fees can eat into your profits over time. Long-term traders should carefully consider these fees as they can significantly impact overall profitability if you’re holding a position with a negative swap for multiple days or weeks.

Slippage

Slippage occurs when the execution of a trade differs from the expected price. It can be caused by market volatility, liquidity issues, or delays in order execution. Slippage can lead to unexpected losses or reduced profits, especially during fast-moving markets or when trading large positions.

To minimise slippage, traders can use limit orders, advanced trading algorithms, or avoid trading during periods of high volatility, such as major news releases or the day rollover.

Tools for Transparent Financial Analysis

Trading Journal

Keeping a detailed trading journal is essential for tracking your performance and identifying areas for improvement. Your journal should include details such as entry and exit points, trade duration, position size, and reasons for entering the trade. Analysing this data can help you identify patterns in your performance, enabling you to refine your strategy, and optimise your trading approach.

Performance Metrics

Key performance metrics such as win rate, risk-reward ratio, and drawdown are valuable tools for evaluating your trading performance. A high win rate alone does not necessarily indicate success if the risk-reward ratio is unfavourable or if drawdowns are excessive. By calculating and interpreting these metrics, you can gain insights into the effectiveness of your trading strategy and make adjustments accordingly.

For example, a trader might have a win rate of 70% but still not be profitable. By analysing their performance metrics, the trader can identify that they have an inadequate risk-reward ratio; meaning that their losing trades are, on average, larger in value than their winning trades.

Historical Data Analysis

By leveraging past market movements and trends, traders gain valuable insights for informed decision-making. Whether assessing the viability of a trading strategy or gauging potential risks, historical data provides a rich tapestry of information.

Using historical data, traders can back-test strategies. Back-testing involves testing a trading strategy using historical data to see how it would have performed under past market conditions.

By incorporating historical data into risk management practices, a trader can better anticipate potential risks and adjust their strategies accordingly.

In the ever-changing world of trading, historical data becomes like a guiding light, preparing us for what could happen, based on previous events. In turn, this knowledge allows traders to make more informed decisions. You can view Fusion’s Live and Historical spreads to stay informed.

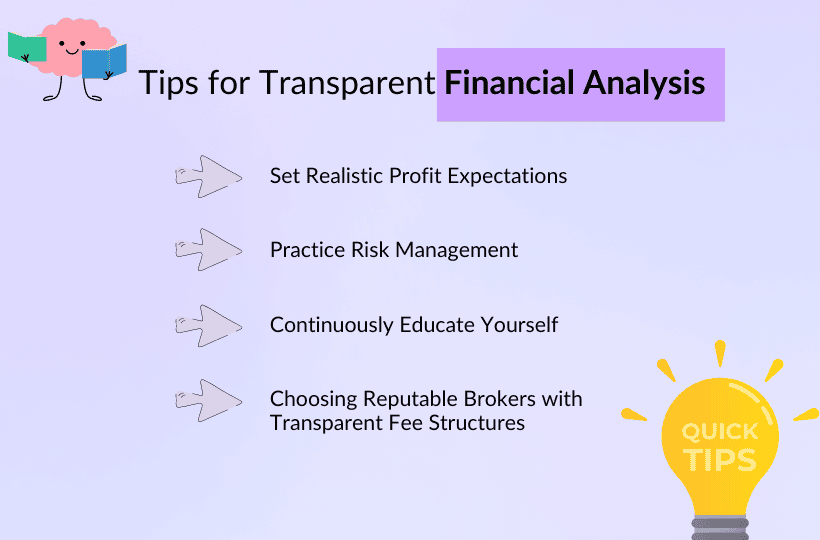

Tips for Transparent Financial Analysis

Set Realistic Profit Expectations

It's essential to set realistic profit expectations based on your trading strategy and risk tolerance. Avoid overestimating potential profits and understand the relationship between risk and reward. Remember that trading involves inherent risks, and losses are inevitable.

Practice Risk Management

Implementing proper risk management techniques is crucial for preserving your capital and long-term success. This includes setting stop-loss orders to limit potential losses and employing position sizing strategies to manage risk exposure effectively.

Managing open trades by tightening your stop as the derivative moves in your intended direction can also boost your R-multiple and improve your return over the long-run.

Continuously Educate Yourself

The forex market is dynamic and constantly evolving, so staying up to date on market trends and developments is essential. Continuously educate yourself through books, online courses, and seminars to refine your skills and stay ahead of the curve.

Choosing Reputable Brokers with Transparent Fee Structures

Selecting a reputable broker with transparent fee structures is paramount. Before committing to a broker, thoroughly research their reputation, regulatory compliance, and fee structures. Don't hesitate to ask questions and seek clarification on costs to ensure transparency and avoid unexpected expenses.

Conclusion

Navigating the hidden costs of forex trading requires a combination of knowledge, skill, and diligence. By understanding the various expenses involved, utilising tools for transparent financial analysis, and practising sound risk management, new traders can increase their chances of success in the forex market. Continuously educate yourself, choose reputable brokers, and always prioritise transparency in your trading endeavours.

If you want to know more about Fusion Markets, our products, fee structures and services, please contact a member of our friendly team or visit our live chat on our site.

We’ll never share your email with third-parties. Opt-out anytime.