Do Macro Fundamentals Really Drive Currencies? The Long Game Behind AUD/USD’s Trend Reversals

Read Time: 3-5 minutes

If you zoom out far enough on a chart, the day-to-day noise starts to fade. What’s left are the big swings – those sweeping trends that define a currency’s multi-year journey. The question many traders ask is whether those broad moves are really shaped by macroeconomic fundamentals, or if markets just drift with sentiment.

The truth is that macro does drive foreign exchange – just not always immediately. The Australian dollar’s story since 2020 is a great example of how global cycles, interest-rate policy and commodity dynamics gradually mould a trend that lasts for years.

- The pandemic crash and the birth of a bull market (2020–2021)

- Inflation, the Fed and a turning tide (late 2021–2022)

- The China factor and fading momentum (2023)

- Policy divergence and structural shift (2024)

- How long does macro take to show up?

- Bringing it all together

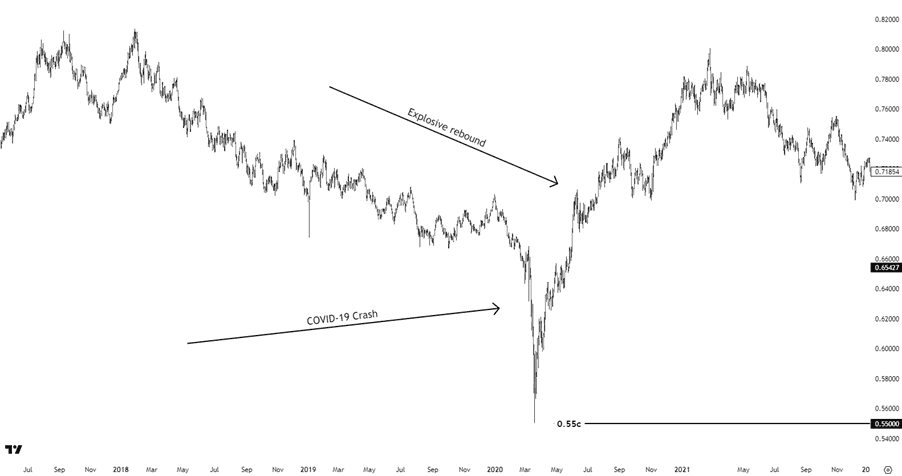

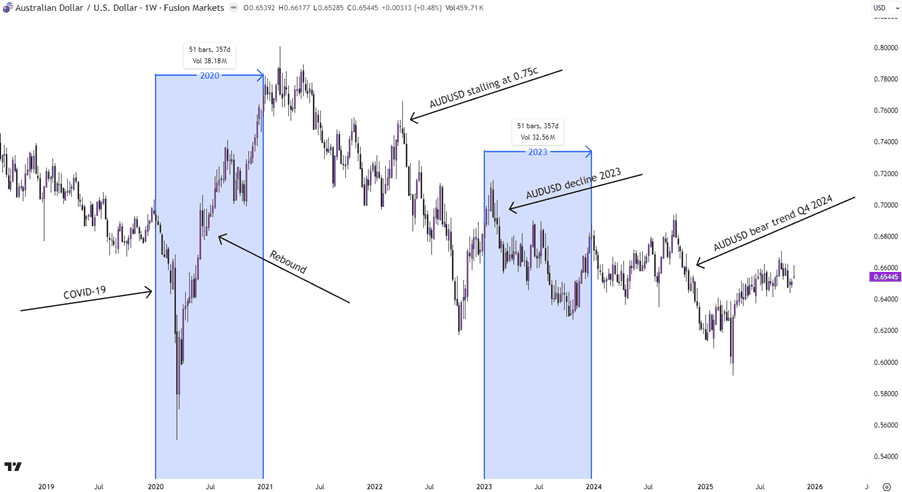

Figure 1 – AUDUSD behaviour during COVID-19

When the COVID-19 pandemic hit in early 2020, AUDUSD collapsed to around 0.55 – its weakest in nearly two decades. But what followed was one of the fastest rebounds on record, as shown in Figure 1 above. Trillions of dollars in global stimulus, rock-bottom interest rates and a surge in demand for iron ore and coal saw the Aussie regain more than 40 per cent in less than a year.

This was classic macro in action. Investors piled into risk assets, yields stayed pinned near zero, and commodity prices exploded. Australia, as a major exporter, was a natural beneficiary. The rally had nothing to do with technical momentum alone – it reflected optimism about growth and the global recovery cycle.

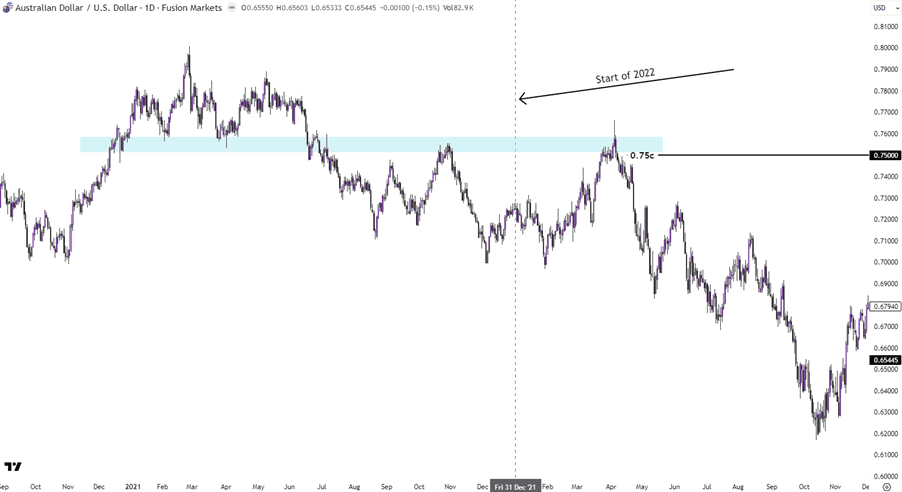

The first signs of strain appeared when inflation started surging in late 2021. The RBA was still saying it didn’t expect to lift rates “until 2024”, while the US Federal Reserve had already turned hawkish. Markets quickly repriced US yields higher, pushing the USD broadly stronger, and eliminating any chance of the Aussie resuming its bull trend. By April 2022, AUD/USD had stalled around 0.75c (Figure 2).

Figure 2 – AUDUSD stalling at 0.75c

Traders began rotating back into the USD as the Fed’s rate-hike campaign gained momentum. Even though the RBA eventually joined in – raising its cash rate from 0.10 to 3.10 per cent by the end of 2022 – the Aussie couldn’t regain traction. Global risk appetite was also fading, equities were rolling over, and commodity prices had softened. Macro had again shifted – but this time against Australia and, ultimately, the Australian Dollar.

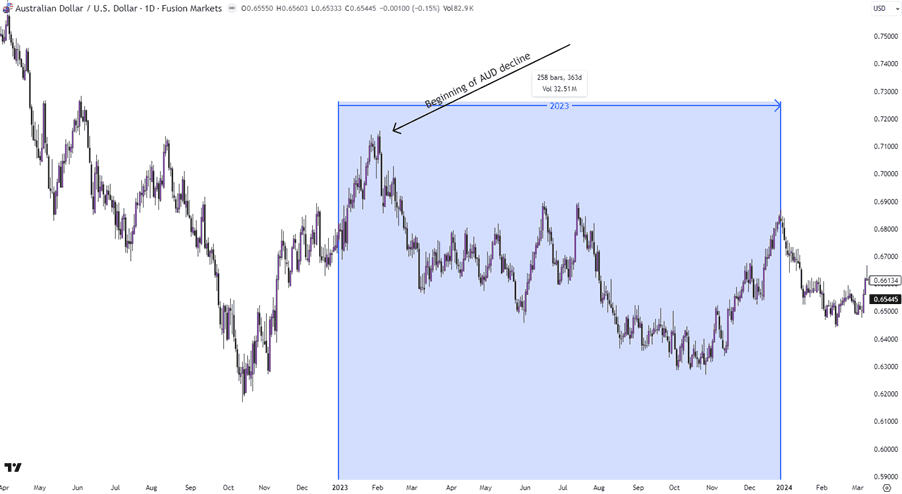

Into 2023, China’s post-COVID reopening somewhat fizzled faster than expected. Iron-ore and coal exports lost steam, Australia’s terms of trade weakened, and the RBA paused its hiking cycle whilst the Fed kept pressing on. The result was a slow, grinding decline in AUDUSD through the mid-0.60s (Figure 3).

Figure 3 – AUDUSD decline through 2023

This period is a good example of lagged macro influence. The underlying fundamentals – a weaker export outlook and narrowing interest-rate gap – slowly eroded investor appetite for the Aussie. It wasn’t one headline or one RBA meeting; it was the cumulative weight of changing economic momentum.

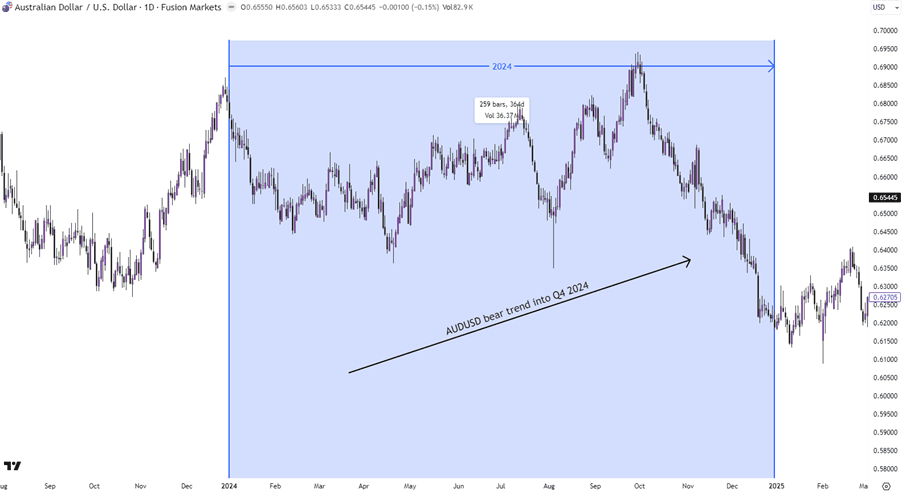

Heading into Q4 2023 the RBA had nudged its cash rate up to 4.35 per cent, but inflation was already cooling. As growth stalled, markets began anticipating rate cuts. Meanwhile, the Fed held firm for longer. Through 2024 the RBA eased several times – down to 3.60 per cent – while the Fed stayed relatively tight.

This divergence created a clear macro headwind for AUDUSD. Investors re-allocated toward USD assets as yield spreads moved back in favour of the US. Add to that the global slowdown and softer commodities, and the AUD’s bullish run had fully reversed into a structural bear trend into Q4 2024 (Figure 4).

Figure 4 – AUDUSD bear trend Q4 2024

What it is: Spreading trades across different pairs or asset classes to reduce reliance on a single outcome.

Example: Instead of loading three positions on EUR/USD, split across EUR/USD, AUD/JPY, and Gold.

Pros:

- Protects you if one market suddenly turns against you.

- Smooths equity curve over time.

Cons:

- Dilutes returns if too many small trades are scattered.

- Doesn’t always protect you in global shocks when correlations rise.

Best for: Swing traders or investors with a large account who take multiple trades across currencies, commodities, and indices.

Looking across these cycles, there’s a clear rhythm. Immediate reactions happen on the day of a surprise, but real trend shifts unfold over quarters. The RBA’s early stance on inflation in 2021 didn’t tank the AUD overnight – it took months of comparative policy divergence and weakening trade data for the reversal to materialise. We can observe this by looking at the long-term chart of AUDUSD in Figure 5 below.

Figure 5 – AUDUSD weekly chart

That’s the essence of macro-driven FX: it’s slow, cumulative, and usually only obvious in hindsight. Traders watching the weekly chart of AUDUSD will see those inflection points clearly aligned with macro turning points – from stimulus and commodity booms to tightening cycles and policy divergence.

So, does macro influence FX rates? Absolutely – but it works like erosion, not an earthquake. Each data print, central-bank speech and trade-balance update is a drop of water shaping the riverbed. Over time, those drops carve out entire trends.

If you plot the key dates above on your weekly chart as we did in Figure 5, you’ll see how sentiment followed fundamentals. The pandemic recovery built a base; inflation and Fed tightening capped it; the China slowdown and RBA easing broke it down again.

The lesson for traders is simple: don’t just watch the headlines – watch the story arc. FX trends begin when the macro narrative shifts, not when the news breaks.

We’ll never share your email with third-parties. Opt-out anytime.