How to Use Pine Script for Trading on TradingView

Read Time: 10-12 Minutes

There are a number of ways to automate your trading with the programming language you use depending on the platform you trade on. For example, MetaTrader 4/5 traders use EAs coded in mql4/5, cTrader uses cbots coded in c#, and TradingView traders use Pinescript.

Pine Script is a domain-specific language developed by TradingView that allows traders to create custom technical indicators and strategies, turning the platform into a powerhouse for market analysis.

In this blog post, we will walk you through everything you need to know about using PineScript for Forex trading.

Contents

- What Is PineScript

- Getting Started

- PineScript Syntax

- Developing Strategies

- Backtesting Your Strategy

- Common Pitfalls to Avoid

- Conclusion

What Is PineScript

PineScript is a coding language developed by TradingView specifically for creating indicators and strategies on their platform. It is similar to other programming languages, but with its own unique syntax and functions tailored for trading analysis.

Don't let the idea of coding scare you – the syntax is similar to other popular languages like JavaScript and C++, making it easy for traders with coding experience to pick up. Plus, with the large online community and resources available, you can easily learn and use Pinescript in a matter of days.

Getting Started

To start using PineScript on TradingView, you will need a TradingView account. If you don't have one yet, go ahead and sign up – it's free! Make sure to connect it to your Fusion Markets account. Once you have an account, navigate to the "Pine Editor" tab on the top menu bar.

Next, open the PineScript editor on TradingView and choose from a variety of templates or start from scratch. The editor also includes a preview function that allows you to see how your code will look on a chart in real-time.

You will also need to have a basic understanding of coding concepts such as variables, functions, and conditional statements. If these terms sound foreign to you, don't worry – we’ve got you covered!

PineScript Syntax

At the core of Pine Script's functionality is its syntax, which forms the building blocks of any script. Its power lies in its simplicity and flexibility, enabling users to craft a wide array of technical analysis tools.

Here are a few main things that you should know:

Variables and Data Types

Variables in Pine Script play a crucial role in storing and manipulating data. They come in different types such as integers, floats, bools, strings, and series. Variables in PineScript are declared using the "var" keyword, followed by the variable name and an equal sign (=) before the value assigned to it. For example: `var myVariable = 10;`.

Understanding these data types is fundamental. For instance, a series type is used for time series data, enabling the creation of moving averages, oscillators, and more.

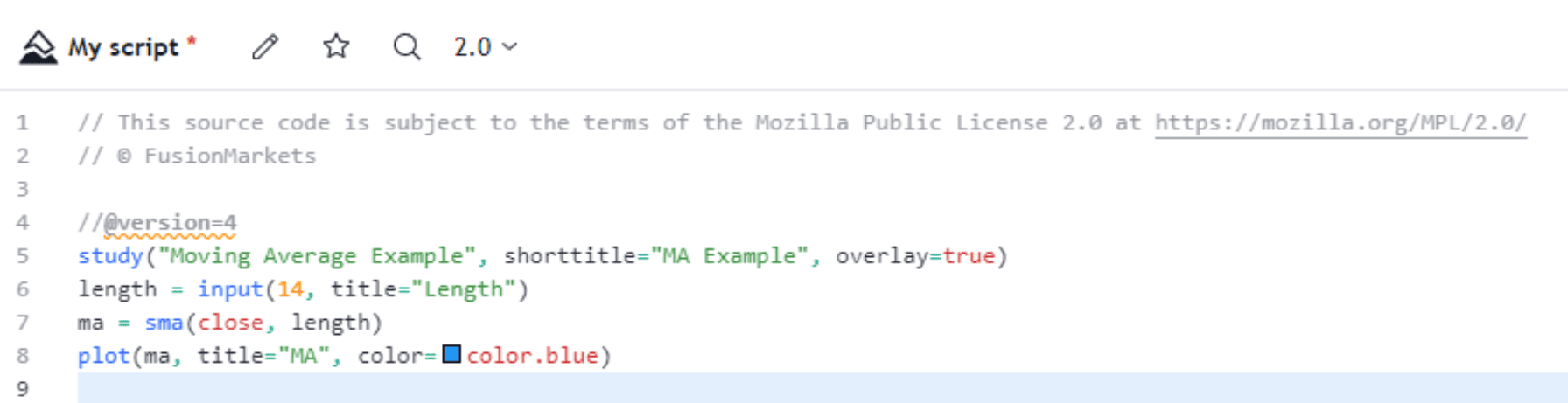

In this example, ` length` is an integer variable that stores the input value for the length of the moving average, and ma is a series variable that stores the moving average data.

Functions and Operators

Pine Script offers an extensive range of built-in functions and operators for performing calculations and executing specific actions. Functions in PineScript start with the "study" keyword, followed by the name of the function and parentheses. For example: `study("My Custom Indicator")`

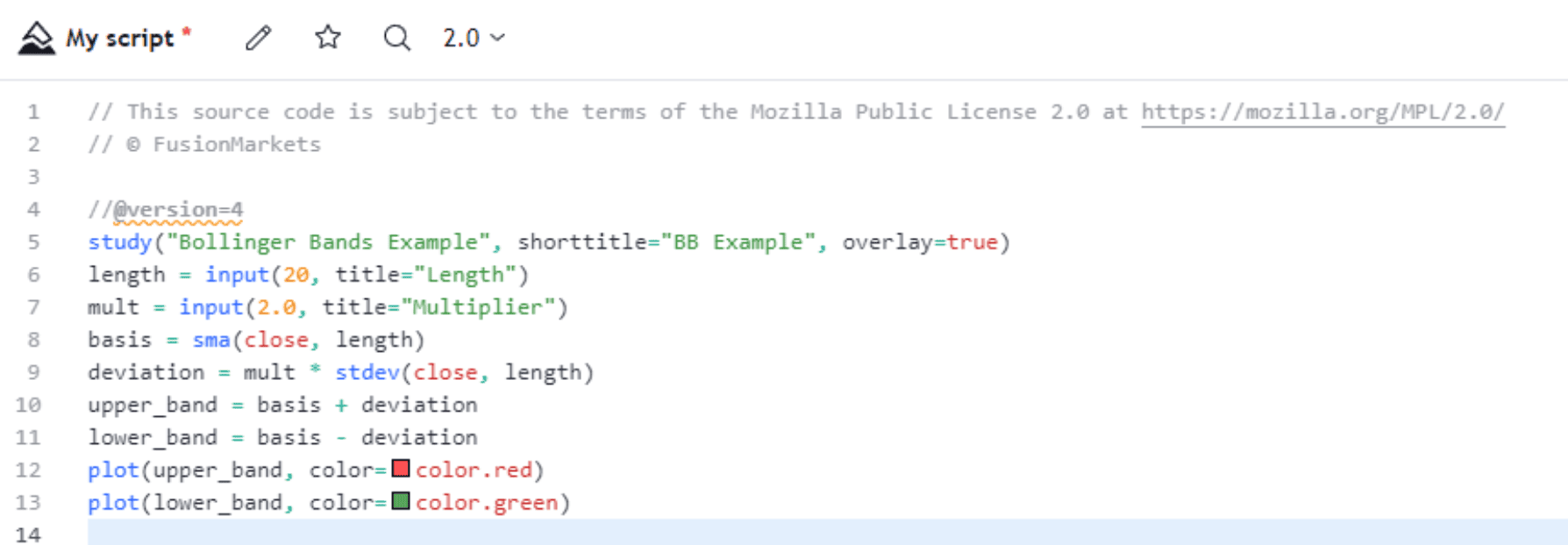

Functions like ` sma() ` (simple moving average) and ` plot() ` aid in technical analysis by computing indicators and displaying plotted lines on the chart.

Here, ` sma() `, ` stdev() `, and arithmetic operators (` + `, ` ` -) are used to compute Bollinger Bands by calculating the moving average, standard deviation, and upper and lower bands.

Conditional Statements and Loops

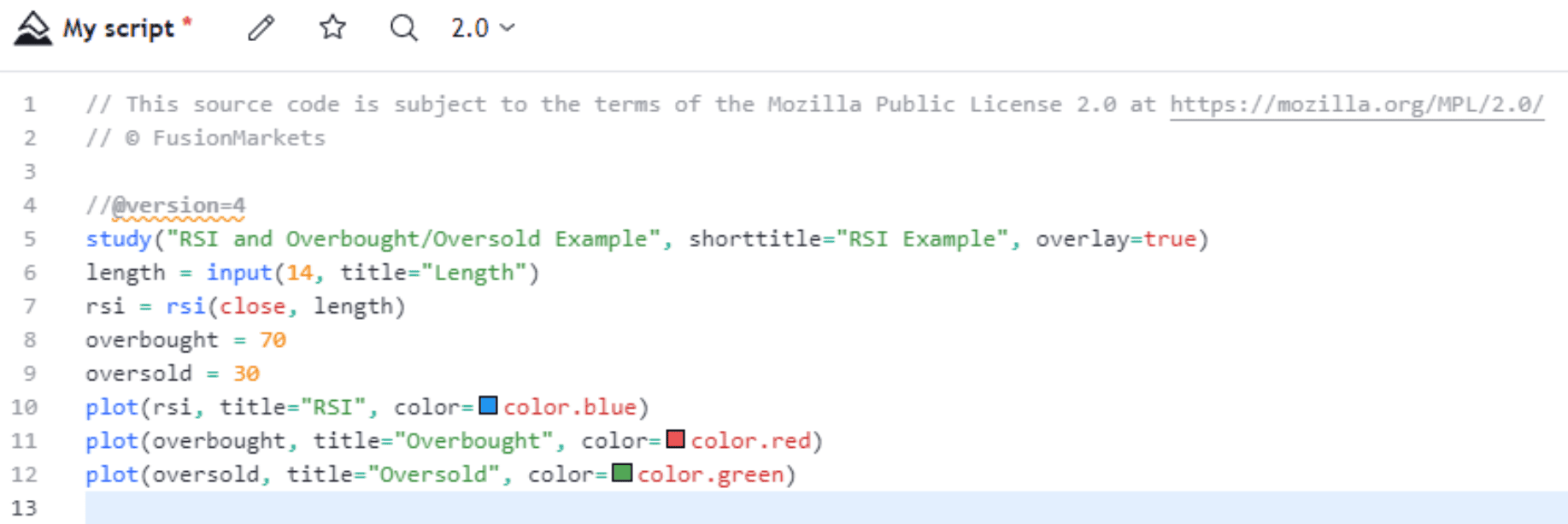

Conditional statements and loops are essential for decision-making and iterative processes. Using ` if-else` statements and ` for ` loops, traders can create dynamic conditions and repetitive actions within their scripts.

In this snippet, an RSI (Relative Strength Index) script displays the RSI values along with overbought and oversold levels. Conditional statements can be applied to trigger alerts or make trading decisions based on RSI levels crossing certain thresholds.

Understanding variables, functions, conditional statements, and loops is pivotal for crafting effective indicators and strategies. With a solid grasp of PineScript syntax, traders can develop personalised trading tools, enhancing their analysis and decision-making in the financial markets. To learn more about the syntax, please refer to the PineScript language manual.

Creating Custom Indicators

One of the most popular uses for PineScript is creating custom indicators. This can range from simple moving averages to complex algorithms that incorporate various technical analysis tools. The possibilities are endless, and with some creativity and testing, you can come up with unique and effective indicators for your trading strategy.

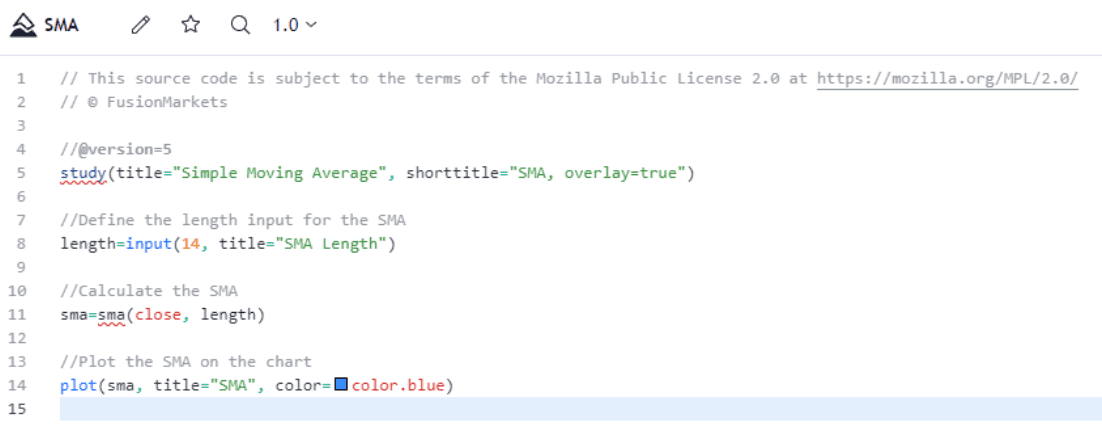

Now, let's walk through the process of creating a simple moving average (SMA) indicator using Pine Script. An SMA is a popular trend-following indicator that smoothens price data to identify the underlying trend.

In this script:

- We specify the title, short title, and overlay properties for the indicator.

- We create an input variable, length, that allows the user to customise the length of the SMA.

- We calculate the SMA using the sma() function.

- We use the plot() function to display the SMA on the chart.

This is just a basic example to get you started. Why don’t we take it up a notch?

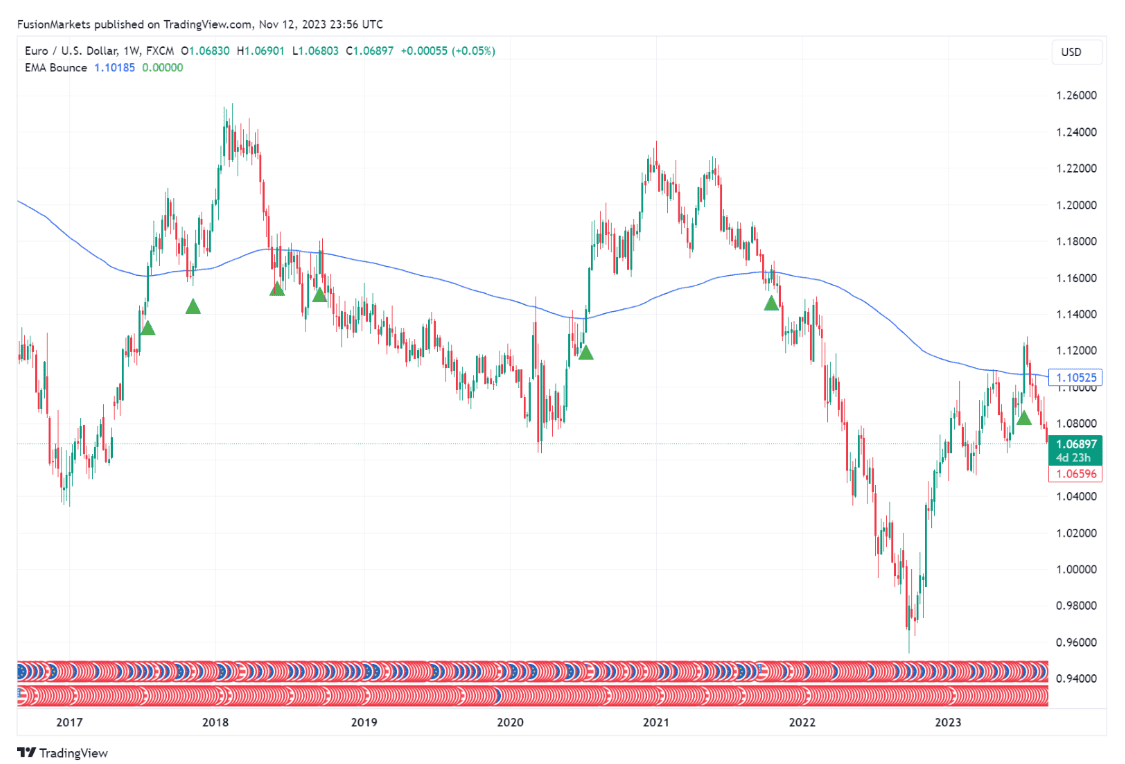

Let’s create a strategy that uses the 200 Exponential Moving Average (EMA) as a basis for making buy (long) signals when the price crosses above this moving average.

Let's break down the code:

- Setting up Strategy Parameters: The script sets the strategy's title, short title, and indicates that it's an overlay on the price chart using strategy().

- Calculating the 200 EMA: It defines a 200-period EMA (ema200) based on the closing prices.

- Plotting the 200 EMA: The script plots the 200 EMA on the chart in blue.

- Identifying EMA Crossover: It calculates the points where the closing price crosses above the 200 EMA using ta.crossover() and assigns these points to the variable emaCrossover.

- Strategy Entry Conditions: When the crossover happens (i.e., when the closing price crosses above the 200 EMA), the strategy generates a "Buy" entry signal using strategy.entry() with the condition when=emaCrossover.

- Plotting Buy Signals: The script uses plotshape() to plot small green triangles below the price bars where the crossover condition is met.

Here’s how it looks on a chart:

EURUSD Weekly Chart

Kindly be aware that the script provided above serves as an example, and it will require adjustments to align with your particular objectives.

In summary, this script creates buy signals (represented by green triangles below the price bars) whenever the closing price crosses above the 200-period Exponential Moving Average. This strategy assumes that such crossovers might indicate a potential upward trend and trigger a buy action.

As you can see, Pine Script is incredibly versatile, and you can create highly sophisticated indicators with complex logic to match your trading strategy.

Developing Strategies

Aside from creating indicators, PineScript also allows you to develop fully automated trading strategies. By combining different technical indicators and conditions, you can create a set of rules for buying and selling that can be backtested and optimised for maximum profitability. This feature is especially beneficial for traders who prefer a systematic approach to trading.

Tips and Tricks

- Start with a clear and well-defined trading strategy: Before jumping into coding, it's essential to have a solid understanding of your trading approach and goals. A clear strategy will make it easier to translate it into code and avoid any confusion during development.

- Use proper risk management techniques: No matter how well-crafted a strategy is, managing risk is crucial in trading. PineScript offers functions for setting stop-loss and take-profit levels, as well as position sizing based on risk percentage. Utilising these functions can help minimise losses and maximize gains.

- Test and refine: Developing a successful trading strategy takes time, patience, and continuous testing. Backtesting with PineScript allows for this refinement process, where traders can analyse the results of their strategies and make necessary adjustments until it meets their expectations.

Backtesting Your Strategy

Once you've written your Pine Script, it's time to test its performance in various market conditions. TradingView makes this process seamless. You can choose the time frame and historical data you want to test your strategy against. The platform will then run your script against that data, showing you how your strategy would have performed. It helps identify any flaws or weaknesses in the strategy and allows for adjustments before risking real capital. This can significantly increase the chances of success in live trading.

Common Pitfalls to Avoid

While Pine Script provides endless possibilities for developing your strategies, there are common pitfalls to avoid:

- Over-Optimisation: Tweaking your strategy too much based on past data can lead to over-optimisation. Your strategy may perform well historically but fail in real-time trading.

- Neglecting Risk Management: Not paying enough attention to risk management can lead to significant losses. It's crucial to protect your capital at all costs.

- Lack of Patience: Don't rush into live trading. The more time you spend testing and refining your strategy, the better it will perform in the long run.

- Ignoring Market Conditions: Markets are not static, and what works in one type of market might not work in another. Keep an eye on market conditions and be ready to adapt.

Conclusion

There's a saying in the world of forex trading - "The trend is your friend". And with PineScript, you can easily identify and follow market trends with custom indicators that suit your trading style. From simple moving averages to complex multi-indicator strategies, PineScript allows you to create and test different approaches until you find the one that works best for you.

But PineScript is not just limited to forex trading. It can also be used in other markets such as stocks and cryptocurrencies. So, if you're a multi-asset trader, learning how to use PineScript can greatly benefit your overall trading strategy and performance.

Furthermore, PineScript is constantly evolving and being updated with new features. This means that there's always something new to learn and experiment with, keeping your trading skills fresh and adaptable.

And don't be intimidated by coding - embrace it with PineScript and see how it can enhance your trading. Who knows, you may even discover a hidden passion for programming along the way!

We’ll never share your email with third-parties. Opt-out anytime.