Understanding Different Types of Trading Accounts

Trading accounts serve as the cornerstone of the trading journey, providing individuals access to financial markets where they can buy and sell various assets. These accounts not only facilitate trading activities but also play a crucial role in managing funds, tracking performance, and executing strategies.

However, with numerous options available, selecting the right trading account can be daunting, especially for novice traders. In this guide, we'll unravel the intricacies of trading accounts, compare demo accounts with live ones (Zero | Classic), explore different types of live trading accounts, and offer guidance on choosing the most suitable account type based on individual needs and goals.

Contents

- Demo vs. Live Accounts

- Types of Live Trading Accounts

- Factors to Consider When Choosing an Account

- Guidance on Selecting the Right Account

- Conclusion

Demo vs. Live Accounts

Before diving into the complexities of live trading accounts, it's essential to understand the distinction between demo accounts and live accounts.

Demo accounts, also known as paper trading accounts, provide a simulated environment for practice. They allow traders to test trading strategies, familiarise themselves with platform features, and observe market dynamics. These accounts use virtual money, eliminating financial risk. However, they have limitations: trades aren't executed in real markets, potentially causing time and price discrepancies, and large orders can be filled at unrealistic prices due to artificial liquidity.

While demo accounts offer a risk-free way to gain trading experience, they lack the emotional involvement and psychological challenges present in live trading. This can often become a problem for new traders as they results they observe on a demo account may not be replicated on a live account. This is because risking your own hard-earned cash introduced a plethora of emotions that get in the way of you thinking clearly and making calculated decisions.

Transitioning from a demo account to a live one is a crucial step for aspiring traders. Live accounts involve real money, introducing emotions such as fear, greed, and anxiety into the trading equation. While demo accounts serve as valuable learning tools, they cannot replicate the psychological impact of trading with real funds. Therefore, transitioning to a live account is essential for traders to develop the discipline, emotional resilience, and decision-making skills necessary for success in the live market environment.

Types of Live Trading Accounts

When it comes to live trading accounts, Fusion Markets offers a variety of options tailored to meet the diverse needs and preferences of traders. Let's explore the key features, advantages, and potential drawbacks of each type:

Classic Account

The Classic account option caters to forex traders seeking a straightforward and convenient trading experience. Created with user comfort as a priority, there's no need to fret over commission calculations prior to each trade.

We streamline the process by factoring in costs through spreads, eliminating the hassle of additional fees or complex computations.

With the Classic account, what you see is precisely what you receive, delivering simplicity and peace of mind to traders.

Learn more about our Classic account

Learn more about our Classic account

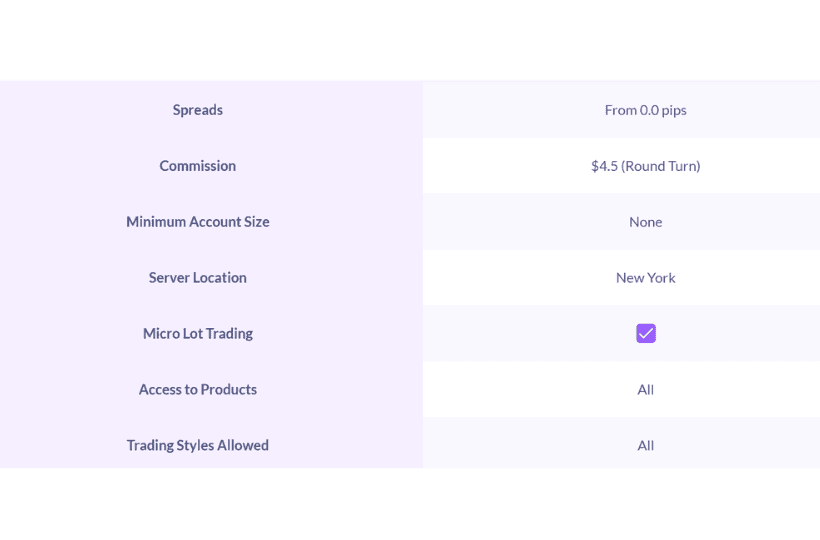

Zero Account

With a commission of $2.25 per side and spreads at 0.0, our Zero Account allows clients to engage in trading with raw spreads, offering a seamless and cost-effective trading experience. This account option appeals particularly to traders accustomed to managing their own commission calculations.

Ideal for active traders and scalpers seeking tight spreads and low trading costs.

Learn more about our Zero account.

Learn more about our Zero account.

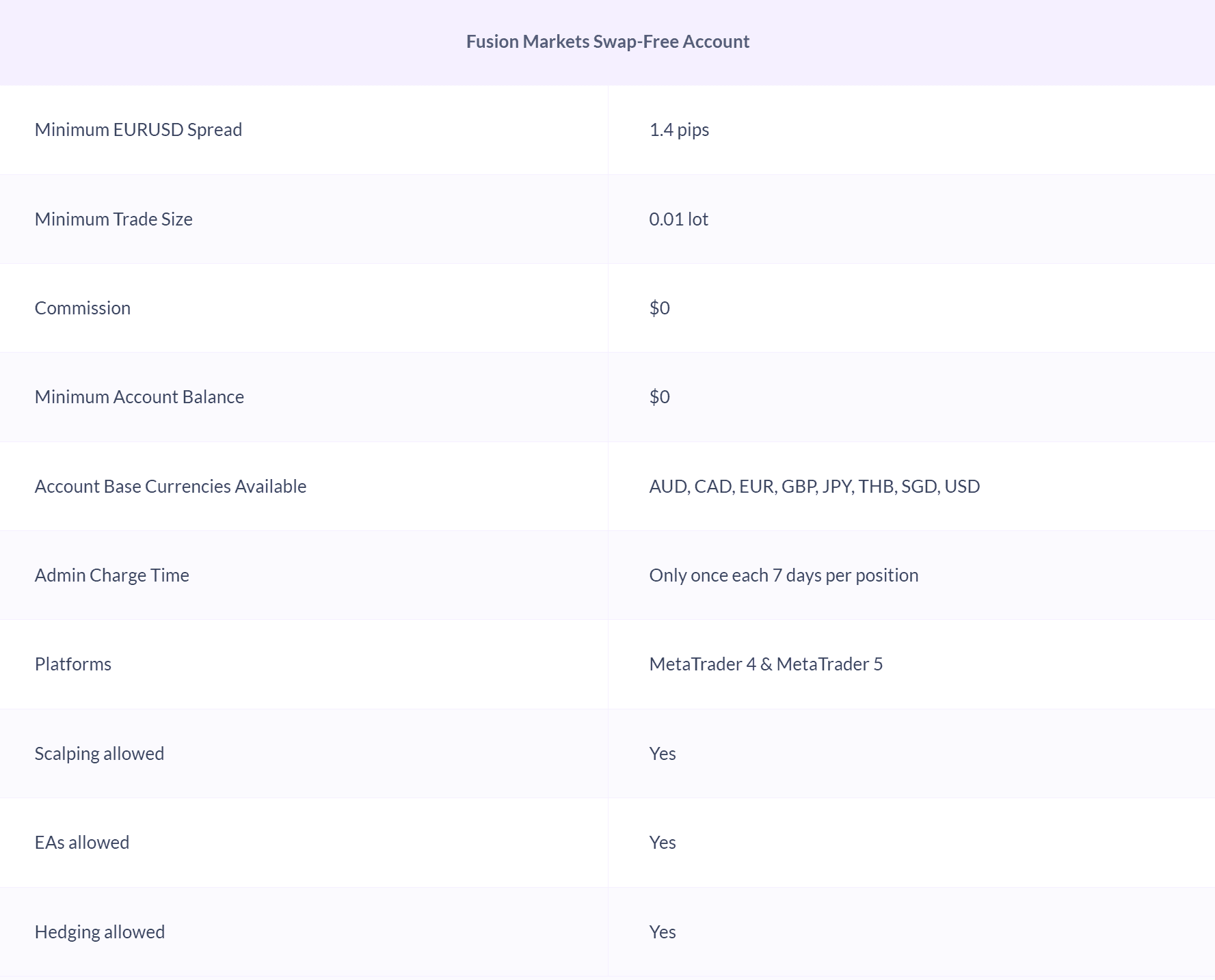

Swap-Free Account

Tailored for traders adhering to religious beliefs prohibiting the receipt or payment of overnight swaps, our Swap-Free Accounts offer a no-interest solution.

Enjoy access to over 50 of the world’s leading financial instruments, including Forex Pairs and Indices, at our signature low rates.

Available across all account types, providing flexibility for traders with specific religious or cultural requirements.

Learn more about our Swap-Free account

Factors to Consider When Choosing an Account

Selecting the right trading account involves careful consideration of various factors to ensure alignment with individual trading goals and preferences. Here are some essential considerations to keep in mind:

Risk Tolerance

Risk tolerance plays a pivotal role in determining the suitability of a forex account type for each trader. It reflects an individual's comfort level with market volatility, potential losses, and overall risk exposure.

When selecting a forex account type, it's crucial to align the account's features and trading conditions with your risk tolerance. For instance, traders with a low risk tolerance may prefer accounts with lower leverage, higher liquidity, and robust risk management features to minimise potential losses.

On the other hand, traders with a higher risk tolerance may opt for accounts with higher leverage and potentially higher returns, albeit with increased risk.

Trading Experience

Trading experience is a key factor to consider when selecting a forex account type as it directly influences a trader's comfort level, skill set, and familiarity with market dynamics.

Novice traders who are new to the forex market may prefer account types that offer simplified trading conditions, educational resources, and demo account options to practice and hone their skills without risking real capital.

Experienced traders with a deep understanding of market mechanics and proven trading strategies may seek advanced account types with features such as customisable leverage, access to advanced trading tools, and stop out levels. By aligning the account type with their trading experience, traders can optimise their trading environment to suit their knowledge level, maximise potential profits, and minimise the likelihood of costly mistakes.

Consider your level of trading experience and opt for an account that suits your skill level, whether you're a novice or seasoned trader.

Account Size and Leverage

Account size and leverage are critical factors to consider when selecting a forex account type, as they directly impact trading capital and risk exposure.

Traders with smaller account sizes may prefer account types that offer lower minimum deposit requirements and more conservative leverage options to manage risk effectively and preserve capital. Whereas traders with larger account sizes may have more flexibility in choosing account types with higher leverage options, allowing them to maximise potential returns while maintaining prudent risk management practices.

Additionally, traders with varying risk preferences may opt for account types that offer customisable leverage settings to align with their risk tolerance and trading strategies. By carefully evaluating account size and leverage options, traders can tailor their trading environment to suit their individual risk preferences, capital constraints, and long-term financial goals. All Fusion accounts have no minimum account size requirements, providing flexibility for traders of all sizes.

Cost of Trading

Spreads and commissions are crucial considerations when selecting a forex account type, as they directly impact trading costs and profitability.

Traders employing high-frequency trading strategies or frequent position turnover may prioritise account types with low spreads and commission rates to optimise trading performance and efficiency. We understand the importance of tight spreads, and you can review our historical spreads to see our commitment to competitive pricing. All our account types offer the same low costs, ensuring consistency and transparency. Conversely, traders with longer-term investment horizons may be less concerned with spreads and commissions and prioritise other account features, such as access to a diverse range of financial instruments or advanced trading tools.

Guidance on Selecting the Right Account

To choose the right trading account, it's essential to conduct thorough research, compare different options, and consider your individual needs and objectives. Here are some practical steps to guide you through the selection process:

Step One – Research Account Types

Explore the features, benefits, and costs of each account type offered by Fusion Markets, and identify the one that best aligns with your trading style and preferences.

Step Two – Assess Trading Conditions

Evaluate the trading conditions, including spreads, execution speed, available assets, and platform compatibility, to ensure optimal trading experience.

Step Three– Start Small

Consider starting with a smaller account size and gradually scaling up as you gain experience and confidence in your trading abilities.

Step Four – Review and Adjust

Regularly review your trading performance and account settings, and be prepared to adjust your chosen account type if necessary to adapt to changing market conditions or evolving trading goals.

Conclusion

Understanding the different types of trading accounts is essential for novice traders embarking on their trading journey. By comparing demo accounts with live ones, exploring various live trading account types, and considering key factors when choosing an account, traders can make informed decisions that align with their goals and preferences.

Explore Fusion Markets' range of account options Fusion Markets Trading Accounts to find the perfect fit for your needs. Remember, selecting the right trading account is a critical step towards achieving success in the dynamic world of financial markets.

We’ll never share your email with third-parties. Opt-out anytime.