Overview and Analysis of USD/JPY

Extremely liquid and highly traded, the USD/JPY pairing is one of the major pairs of the foreign exchange market, being the second most traded pair by volume behind EUR/USD. Used to denote how much 1 US Dollar (the base currency) converts to Japanese Yen (the quote currency), the volatility, reserve-held status of both currencies, and liquidity have made it a popular trading pair among Forex Traders.

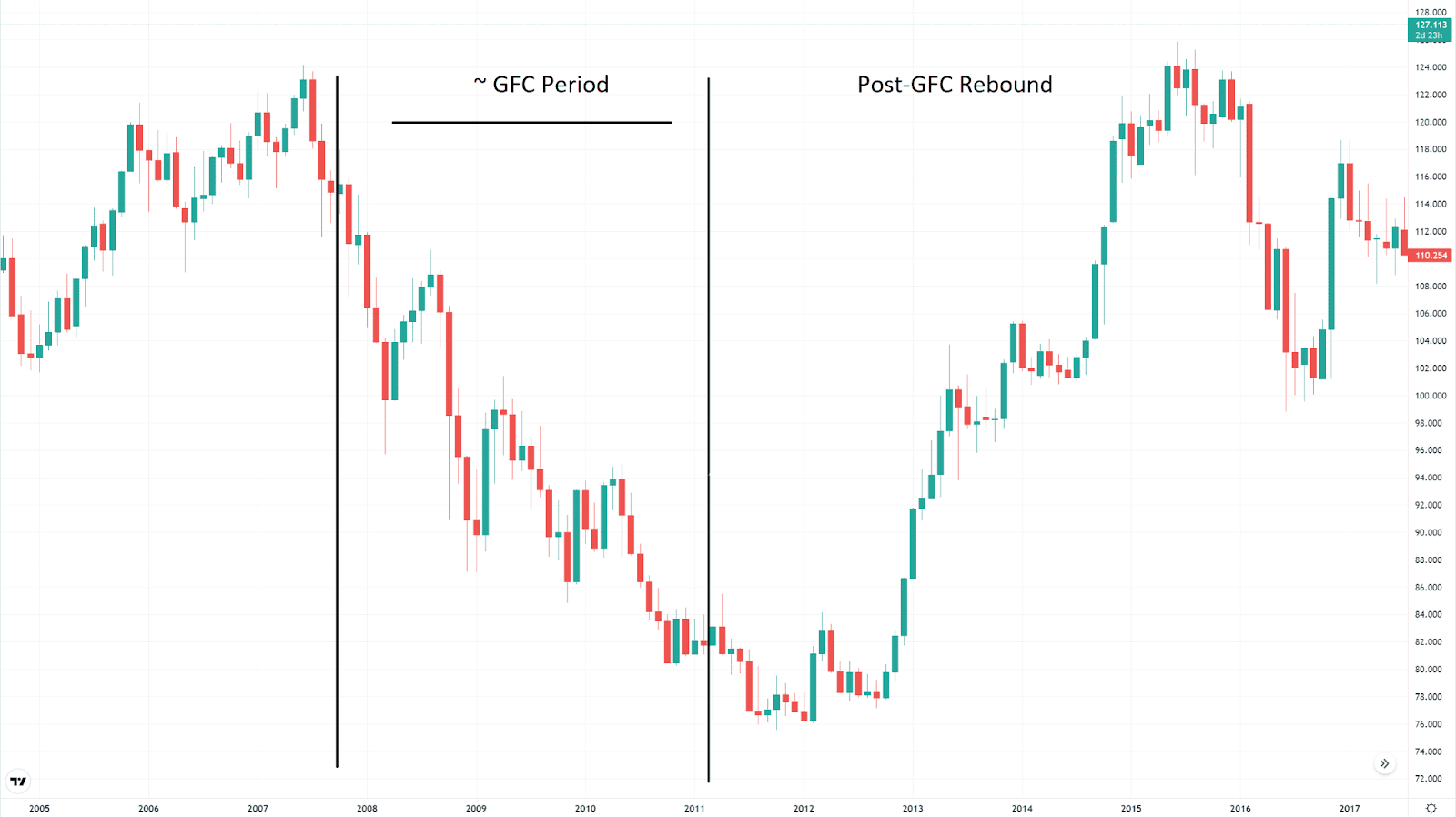

Historically the Japanese Yen has fared well against the US Dollar in times of market turmoil, as many investors view the Yen as a safe-haven currency. This was most apparent during the Global Financial Crisis (GFC) in 2008 and post GFC market rebound.

USD/JPY from 2005-2015

What factors affect USD/JPY?

The USD/JPY pair is influenced by both the US and Japan’s monetary policies, in particular those related to treasuries and interest rates.

Differences in policies and interest rate decisions by the Federal Reserve (FED) and the Bank of Japan (BOJ) are often one of the key drivers of the pair, and have in the past correlated closely with USD/JPY movements.

These differences have further been compounded with Japan’s introduction of Qualitative and Quantitative Easing (QQE) with Yield Curve Control (YCC) in 2016.

Historically, when US treasury prices rise, the USD/JPY pair weakens. Similarly, when US treasuries fall, the US dollar strengthens against the Yen.

With bond yields being a key driver, factors that affect bond yields such as interest rate expectations and inflation can significantly affect the pair. For example, as rising interest rates lead to higher bond yields, it also subsequently leads to the USD/JPY strengthening.

Therefore, when the Fed or BOJ intervenes to control inflation, deflation or stagflation with changes in interest rates it affects USD/JPY.

While treasuries and interest rates are often seen as one of the core drivers of USD/JPY, similar to other Forex markets, a range of other economic factors also play a role in the movement of the pair.

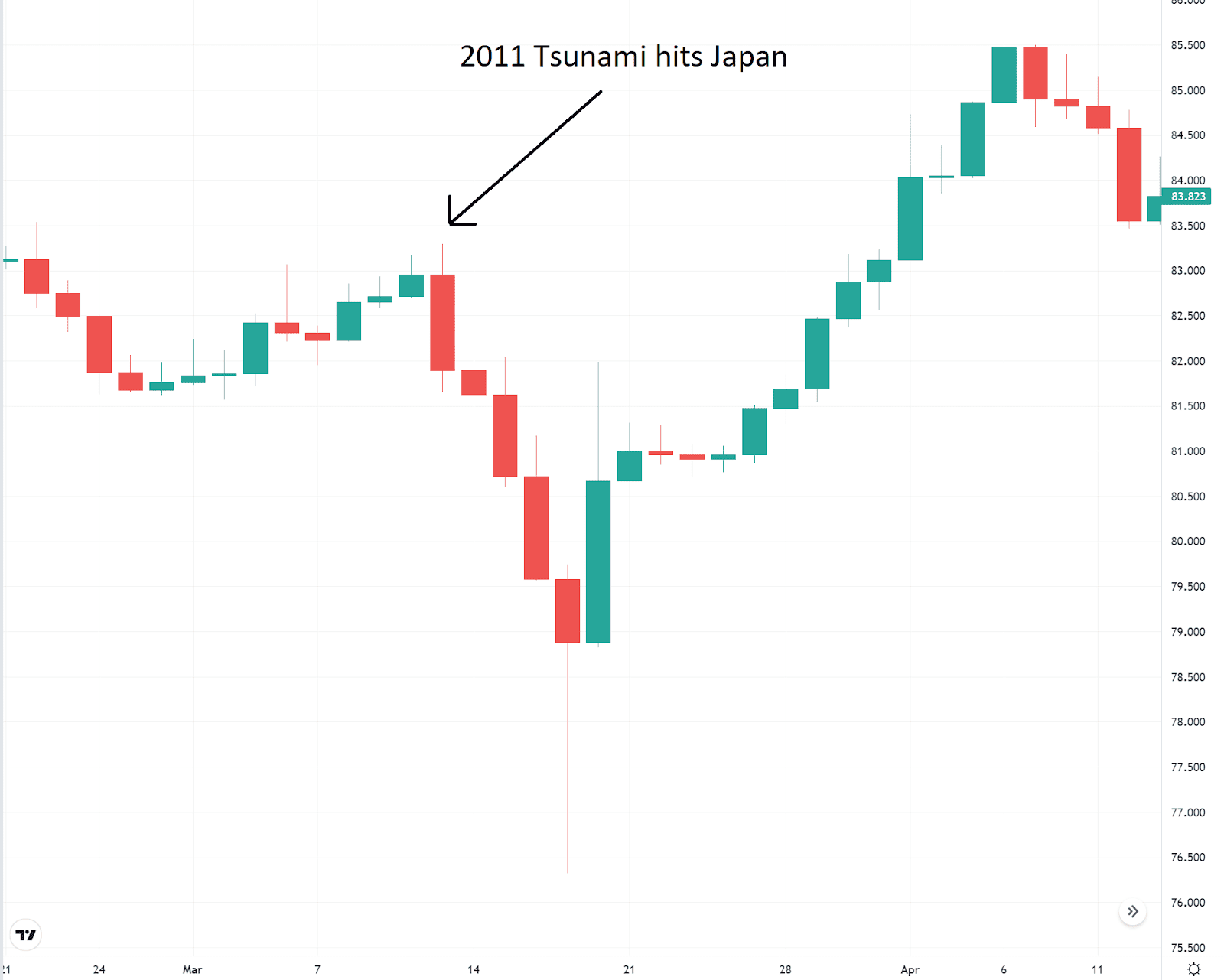

Some other economic factors that have played a role in the past are: Japan’s import/export balance, natural disasters, GDP, CPI, unemployment rate and wage growth. Although these do not influence the pair as much as US treasuries and interest rates, they can create significant price movements depending on how unexpected the event is.

For example, following the 2011 Tsunami in Japan, the Yen surged against the US Dollar with pundits expecting that Japanese investors would have to repatriate to cover the cost of the damages.

USD/JPY March 2011

Why is the Yen weakening and USD/JPY soaring?

As mentioned above, interest rates and monetary policy are some of the biggest drivers of the pair. This was further magnified during the COVID-19 outbreak and the subsequent Quantitative Easing (QE) policies of countries worldwide with stimulus schemes issued by many governments including the US and Japan.

In the case of the US this was one of the major factors to its rising inflation. As such, the US has begun implementing interest rate hikes, and is expected to more aggressively raise interest rates throughout 2022 and 2023.

In comparison, the BOJ has opted to not introduce any interest rate hikes in the short term and instead plans to continue with their stimulus and subsidies packages. Japan’s history with deflation and negative rates makes this position understandable, but the weakening Yen has made Haruhiko Kuroda, the Governor of the BOJ, express concerns.

Japan’s plans to continue with their proposed stimulus has led to the Yen weakening not only against the US Dollar but other foreign currencies where central banks plan to increase interest rates, such as the UK and GBP.

It will be important to keep an eye on USD/JPY as the monetary policies of the FED and BOJ continue to diverge.

How do I trade the USD/JPY pair?

As Treasury bonds tend to affect the pair, looking at yields across different maturities can be a good basis to begin your analysis. This can help forecast the future of the pair, and overall provide a solid fundamentals-based foundation for other analysis.

Another useful indicator, as USD/JPY can represent market confidence, is the S&P 500, as it may provide early warning signs of overall market reversals.

In terms of when to trade the pair, 12:00 to 15:00 GMT (when the Tokyo market isn’t open) has been one of the most volatile and best times to trade the pair. Even though the Tokyo Market isn’t open yet, this period tends to have high volatility as it is when the London and New York markets overlap.

In terms of when not to trade the pair, you want to avoid “quiet” times in the market such as 21:00-24:00 GMT when the New York market is closed, London is sleeping, and the Tokyo market is yet to open. Similarly, 03:00-5:00 GMT is considered another quiet period as the Tokyo market is nearing the end of the day, and the London and New York markets are not open.

Another consideration is your trading strategy. A commonly cited reason that USD/JPY is favoured by some traders is due to Japan’s traditionally low interest rates. These low interest rates make it a good pair to consider for those who are implementing carry trade strategies.

To learn more about currency pairs, and the foreign exchange market sign up to Fusion Markets and keep up with all the latest macroeconomic events.

We’ll never share your email with third-parties. Opt-out anytime.