When Do You Accept That Your Trade is Wrong? (Part 1 of 2)

Read Time: 5 minutes

There’s no pain quite like watching a trade turn against you. Your entry made sense, your conviction was high. Maybe you even waited days for the setup to form – and yet here you are, staring at red. At what point do you say, “I’m wrong”?

This is one of the toughest calls in trading – not because the answer isn’t out there, but because it requires real honesty with yourself. Are you cutting the trade because your plan was invalidated, or because you’re uncomfortable? Are you respecting the market, or panicking?

This is often an error that rookie traders make – they close their position early because they think they’re wrong. only to watch it then turn around and go where they initially thought it would – but this time without them.

In this post, we’ll break down when you should accept you’re wrong, when you should stick to your guns and, most importantly, how you know you’re wrong and aren’t just panicking.

- Your Strategy Is Your Shield

- Emotion vs. Evidence

- Reframing ‘Wrong’

- Trust-Is-Earned-By-You

- Final Thoughts

The moment you enter a trade without a plan for when it’s wrong, you’re gambling. Every solid strategy has rules for invalidation. That might be a break of structure, a price level, a momentum shift, or simply a stop loss. If you can’t define what “wrong” looks like before you enter, you’re giving yourself room to flinch.

Strategy Criteria

We have strategies for a reason. When you enter a trade, it should be because you’ve gone through the ‘checklist’ and the trade meets at least the majority of requirements for your strategy. You then work out a risk-based position size, select a take profit price and a stop loss price.

Honour the stop-loss

Where a lot of traders go wrong is by placing their “protective” stop at a certain level, then exiting early before price gets there. When you enter a trade, don’t think of your stop-loss as ‘capital protection’, but rather “the point at which I will accept I’m wrong”. Unless there’s some obvious catalyst contradicting your original analysis, then you should believe you’re right even if your trade is in the red. If it hits your stop that should be your signal to think “ok, I was wrong on that one”.

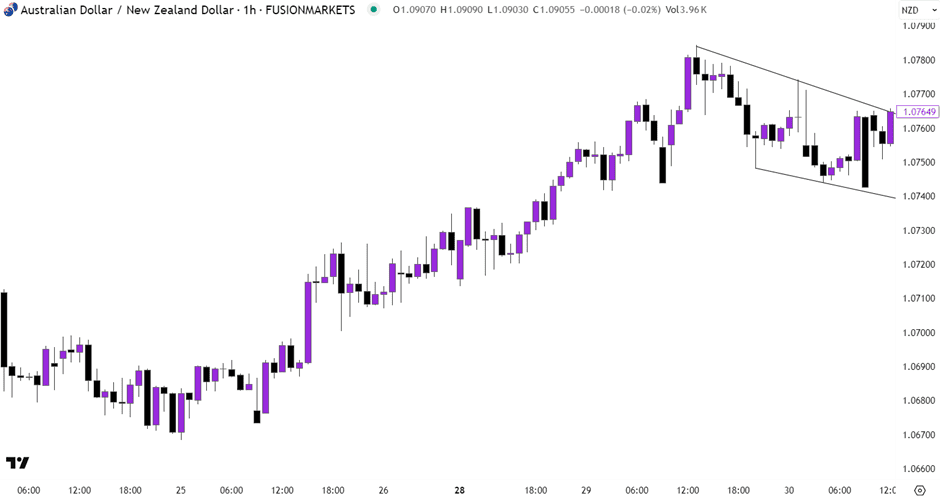

Another common mistake traders make is trailing their stop too soon. Let’s say you enter on a bullish flag (Figure 1).

Figure 1: AUDNZD – 1-hour chart

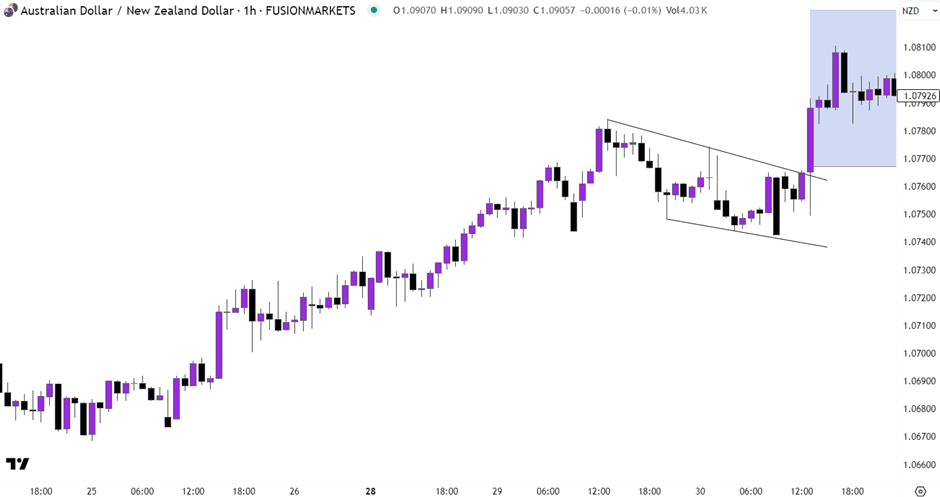

Price moves in your favour, then wobbles and loses momentum. You get spooked and move your stop to breakeven (Figure 2).

Figure 2: AUDNZD – 1-hour chart

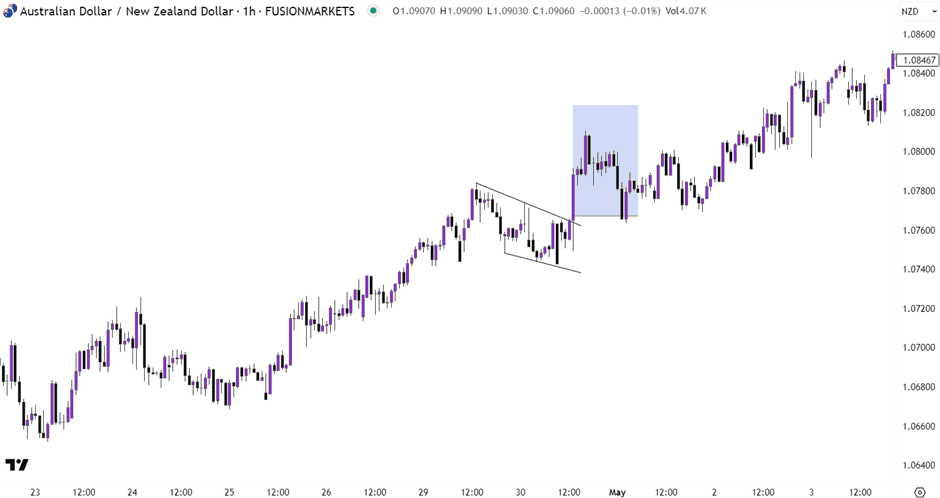

Only to get tapped out right before the pattern completes and surges in your original direction (Figure 3).

Figure 3: AUDNZD – 1-hour chart

What’s really happened here? You abandoned the pattern mid-play because you got scared. You would’ve been telling yourself “this is a fake-out” or any other excuse you could think of and you tightened your stop to ‘protect your capital’.

The market didn’t betray you. You just couldn’t sit through the noise.

The solution? Define your exit before you enter. Not just your stop-loss, but your real point of invalidation. Let the structure complete. Give the market space to move.

Every trader wrestles with emotion. But the difference between pros and amateurs is that pros know which voices to listen to. Your gut might be screaming that something’s off – and sometimes, that’s valuable. But most of the time, emotion whispers one thing: “Get me out of this discomfort.”

Here’s where journaling helps. Look back on your trades. How often did you close early because you “had a bad feeling”? And how often did those exits actually prevent a loss?

Now compare that to the trades where you stuck to your rules – even through drawdown – and they worked out.

The goal isn’t to be a robot. But you do need to filter your instincts through structure. If price hasn’t broken your setup, your job is to hold the line.

Sometimes we treat losing trades as mistakes. That’s not always true. If your setup was valid and you followed your plan, it wasn’t a mistake – it just didn’t work out. This is probability at play.

However, there are times your trade is wrong – and you need to recognise those early. Here are a few red flags:

- The reason for your trade disappears.

Maybe you went long on a breakout, but price slammed back into the range. The breakout failed – your reason is gone. - The broader context shifts.

Say you’re short because of bearish structure, but a higher timeframe trendline or news event invalidates that view. - You realise you forced it.

You entered because you wanted to be in a trade – not because the setup truly met your criteria. - Fundamental and geopolitics

Your trade was right, but then headlines exploded with some important news, causing high volatility and ultimately changing your view on the trade.

In these cases, the right move is to exit. Quickly, cleanly, and without drama. Taking a small loss now avoids a bigger one later.

Many traders ask, “How can I trust my strategy?” But the better question is: Can your strategy trust you?

If you bail early every time price wobbles, or move stops to feel safe, or close trades without a technical reason – your strategy can’t rely on you to carry it through. The best edge in the world is useless if you don’t have the discipline to execute it.

So the next time you feel tempted to exit early, ask yourself: Did the market break the setup, or did I break my nerve?

Accepting you’re wrong is not weakness – it’s a sign of strength. But knowing when you’re wrong takes clarity. You need to distinguish between emotional discomfort and actual invalidation.

Stick to your structure. Let your patterns complete. Give your trades room to breathe. And when the time does come to admit you're wrong, do it decisively – not because you’re scared, but because your process demands it.

That’s how you stay in the game – and that’s how you grow.

We’ll never share your email with third-parties. Opt-out anytime.