เกี่ยวกับเรา

- เราคือใคร

- ทำไมจึงเลือกฟิวชั่น

- รางวัลที่เราได้รับ

- บทความ

- ใบอนุญาต และระเบียบข้อบังคับ

- เอกสารระบุตัวตน

Fusion Markets

Legal

การเทรด

- ภาพรวมผลิตภัณฑ์และบัญชี

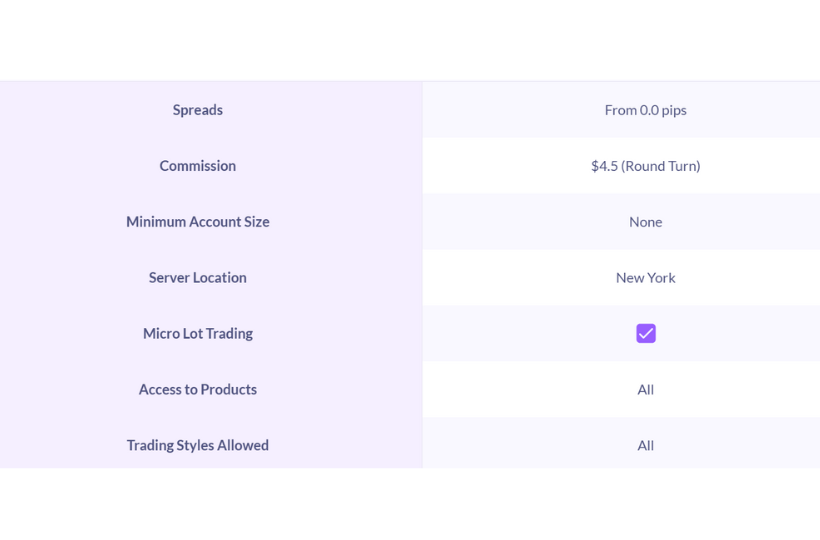

- Zero Account

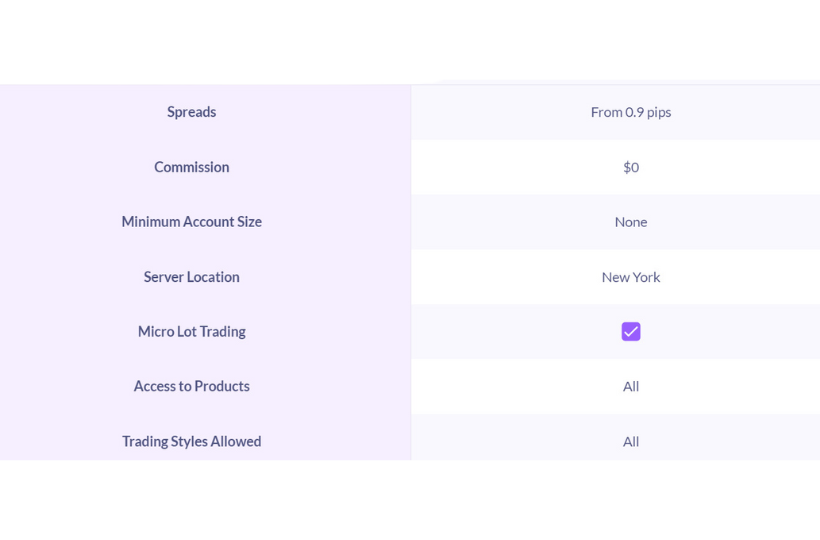

- Classic Account

- Demo Account

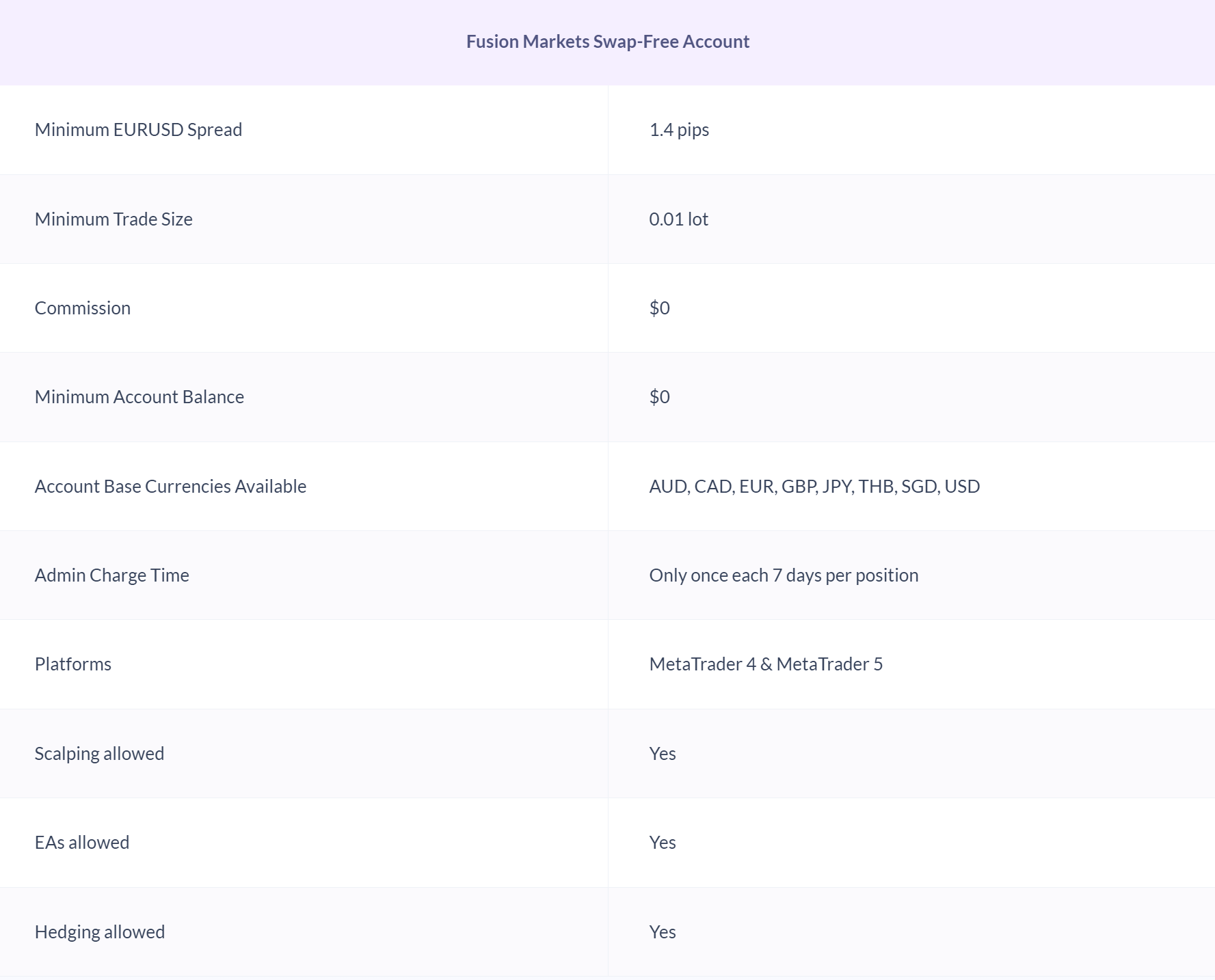

- บัญชี Swap Free

- ฟอเร็กซ์

- โลหะ

- ดัชนี

- พลังงานและผลิตภัณฑ์จากการเพาะปลูก

- เงินดิจิทัล

- CFD หุ้นสหรัฐ

- เงื่อนไขการเทรด

- ตัวเลือกการฝาก

- เครื่องคำนวณการเทรด

- ค่าสเปรด Forex และ CFD

- ตัวเลือกการถอน

- ปฏิทินเศรษฐกิจ

- เครื่องมือการเทรด

- Fusion+ Copy Trading

- Sponsored VPS

ผลิตภัณฑ์ & บัญชี

ตลาด

ทรัพยากร

แพลตฟอร์มและเครื่องมือ

- MetaTrader 4

- MT4 Mobile Apps

- WebTrader for MT4

- MetaTrader 5

- TradingView

- TradingView สำหรับมือถือ

- cTrader Desktop

- cTrader Mobile

- cTrader Web

- Multi Account Manager

- DupliTrade

MetaTrader 4/5

TradingView

cTrader

More Platforms

ร่วมงานกับเรา

ช่วยเหลือ

- ติดต่อเรา

- คำถามที่พบบ่อย

ช่วยเหลือ