Giao dịch

- Tổng quan về Sản phẩm và Tài khoản

- Tài khoản ZERO

- Tài khoản Classic

- Tài khoản demo

- Tài khoản không hoán đổi

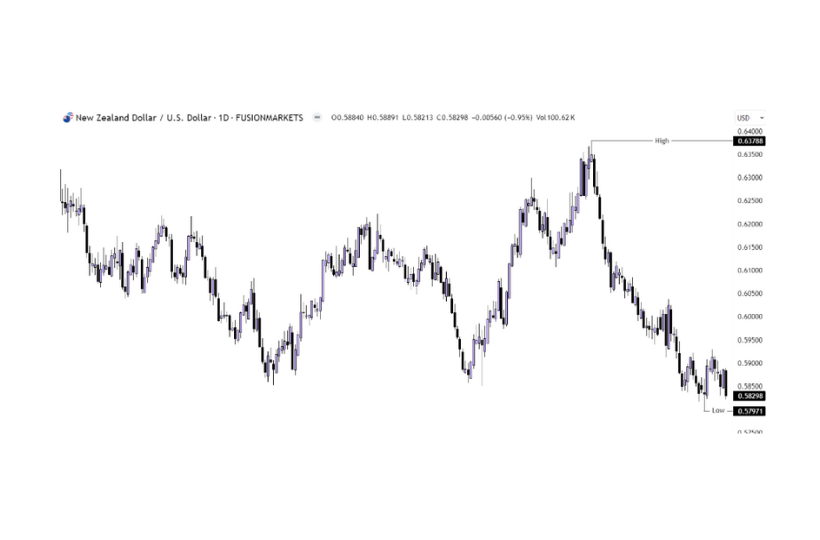

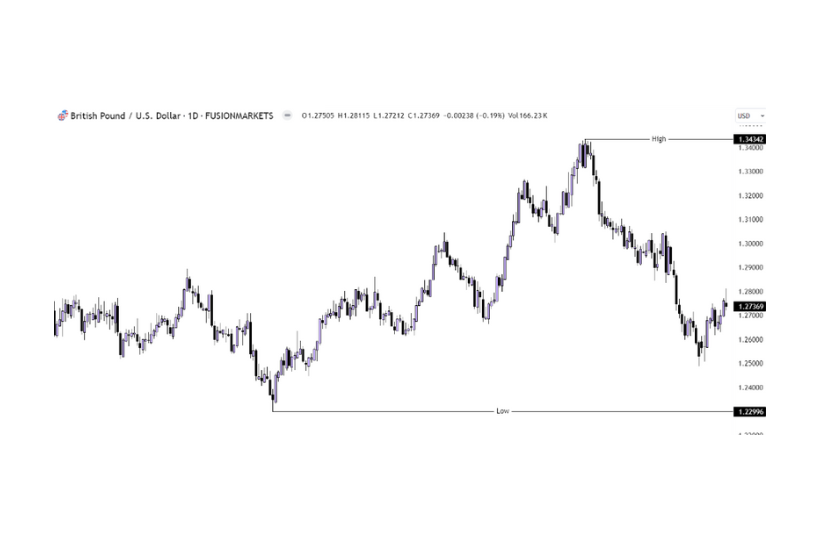

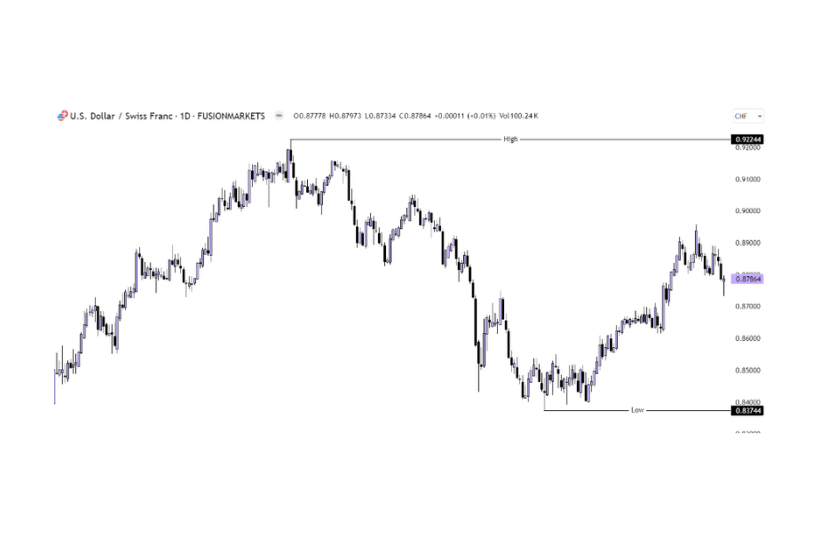

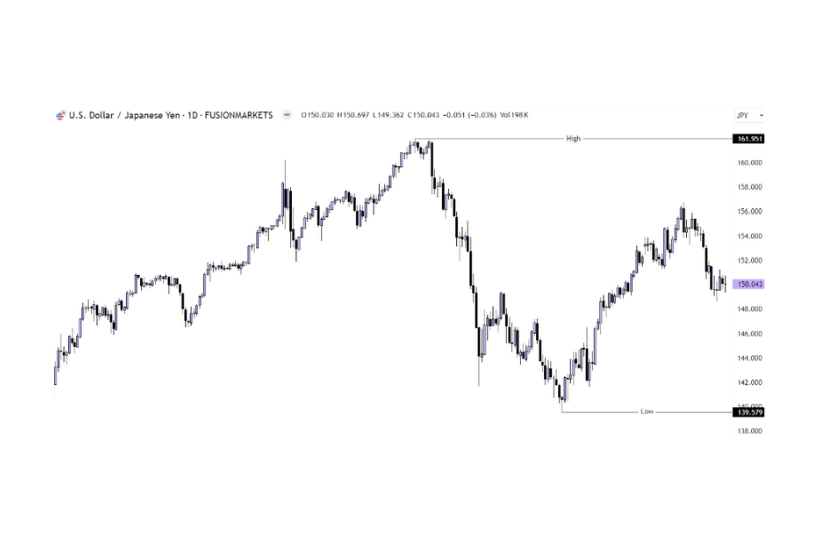

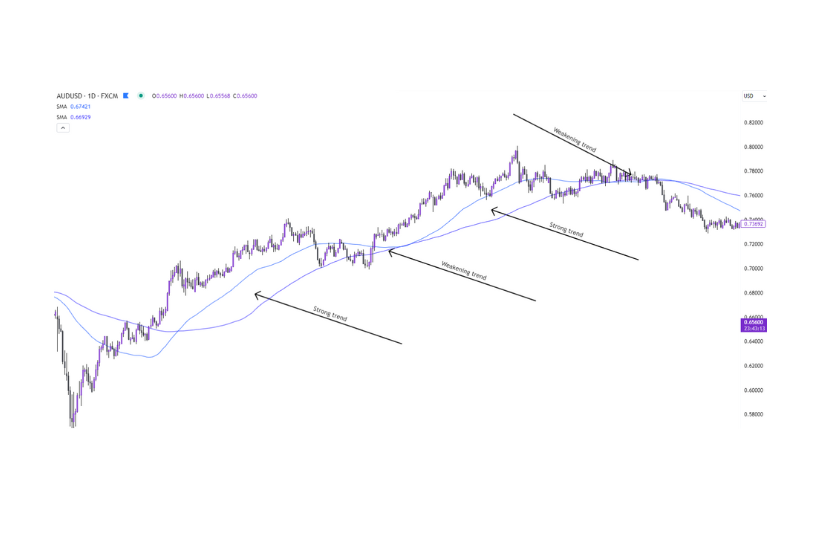

- Ngoại hối

- Kim loại

- Chỉ số

- Năng lượng & Hàng hóa mềm

- Tiền kỹ thuật số

- CFD cổ phiếu

- Điều kiện giao dịch

- Tùy chọn nạp tiền

- Tùy chọn rút tiền

- Máy tính giao dịch

- Lịch kinh tế

- Chênh lệch giá hiện tại và lịch sử

- Công cụ giao dịch

- Sao chép giao dịch trên Fusion+

- VPS được tài trợ

Sản phẩm và tài khoản

Thị trường

Tài nguyên

Nền tảng

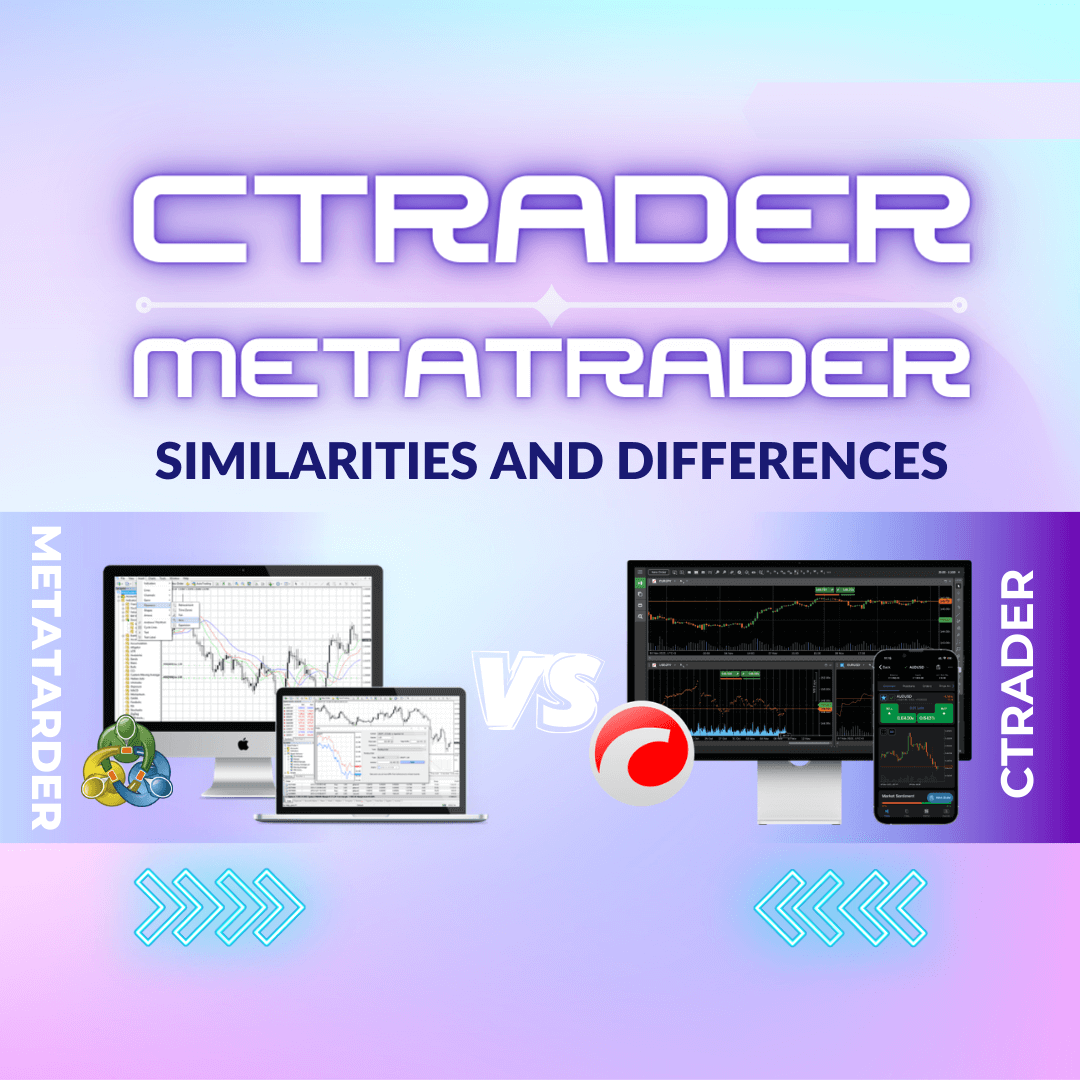

- MetaTrader 4

- Webtrader dành cho MT4

- Ứng dụng MT4 dành cho thiết bị di động

- MetaTrader 5

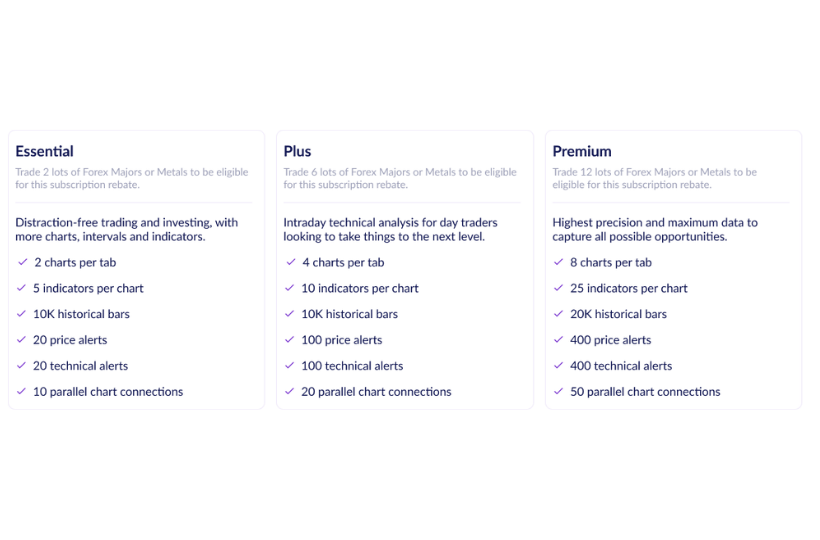

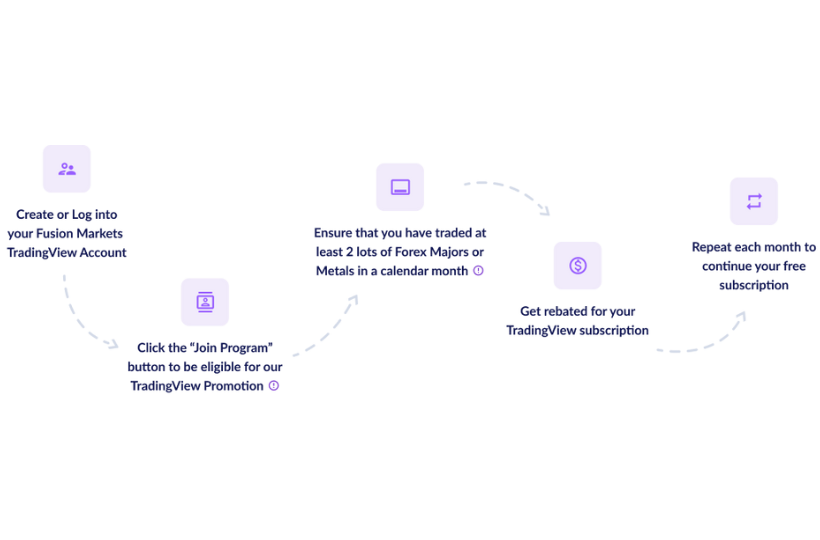

- TradingView

- TradingView dành cho thiết bị di động

- cTrader trên máy tính

- cTrader Web

- Trình quản lý nhiều tài khoản

- DupliTrade

MetaTrader

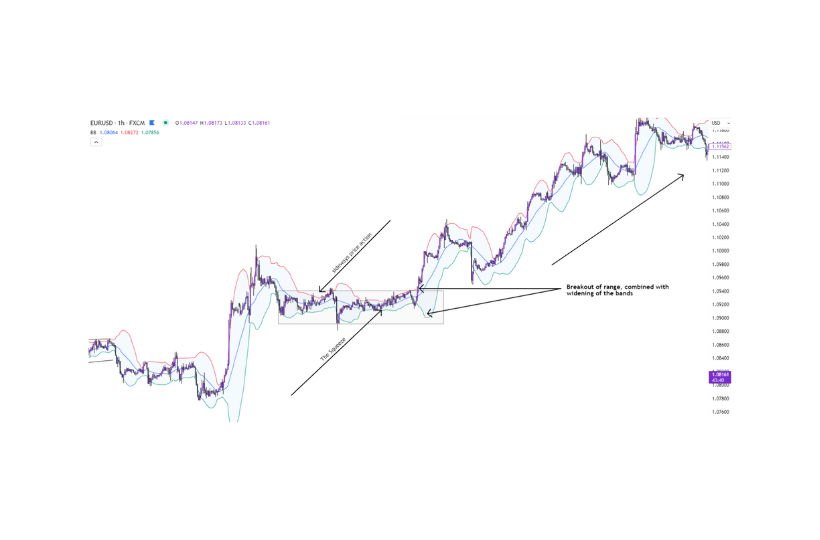

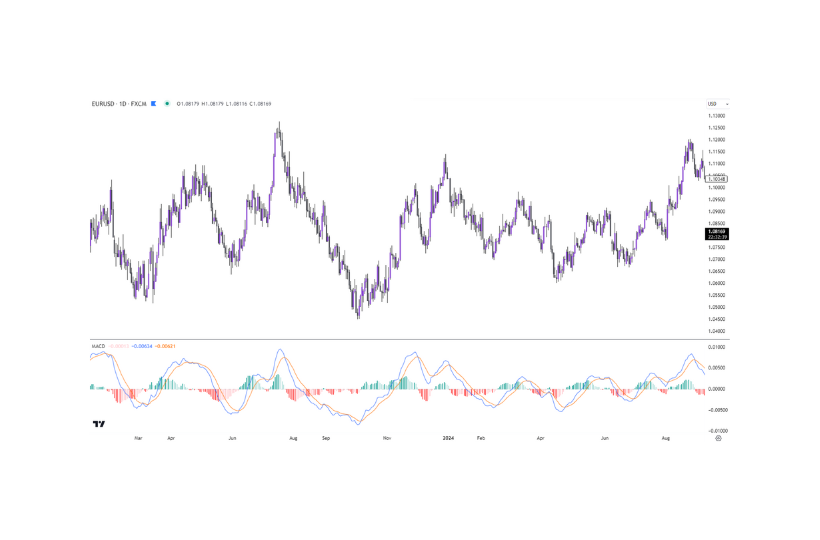

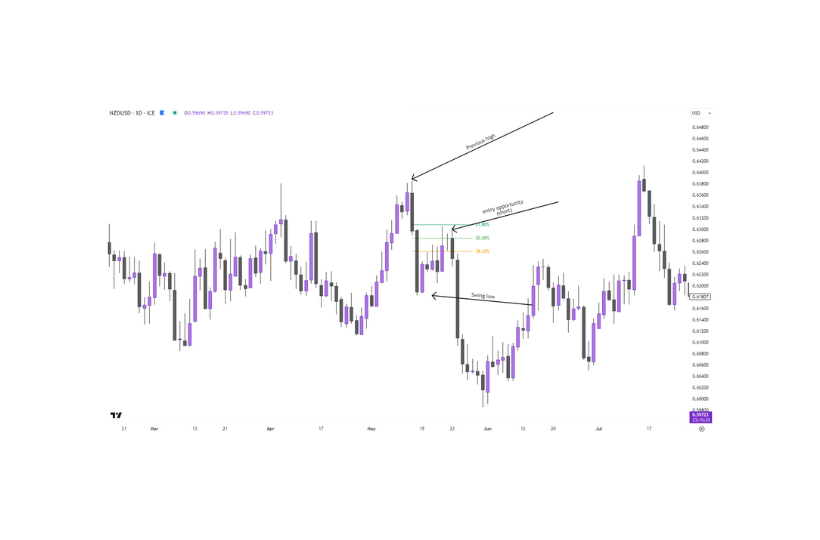

TradingView

cTrader

Thêm Nền tảng

Hợp tác với chúng tôi

Trợ giúp

- Liên hệ với chúng tôi

- Câu hỏi thường gặp

Trợ giúp