交易

平台和工具

- MetaTrader 4

- MT4移动端应用程序

- MT4网页版

- 多账户管理器

- MetaTrader 5

- TradingView

- TradingView 移动版

- cTrader桌面版

- 移动版 cTrader

- cTrader网页版

- 多账户管理器

- DupliTrade

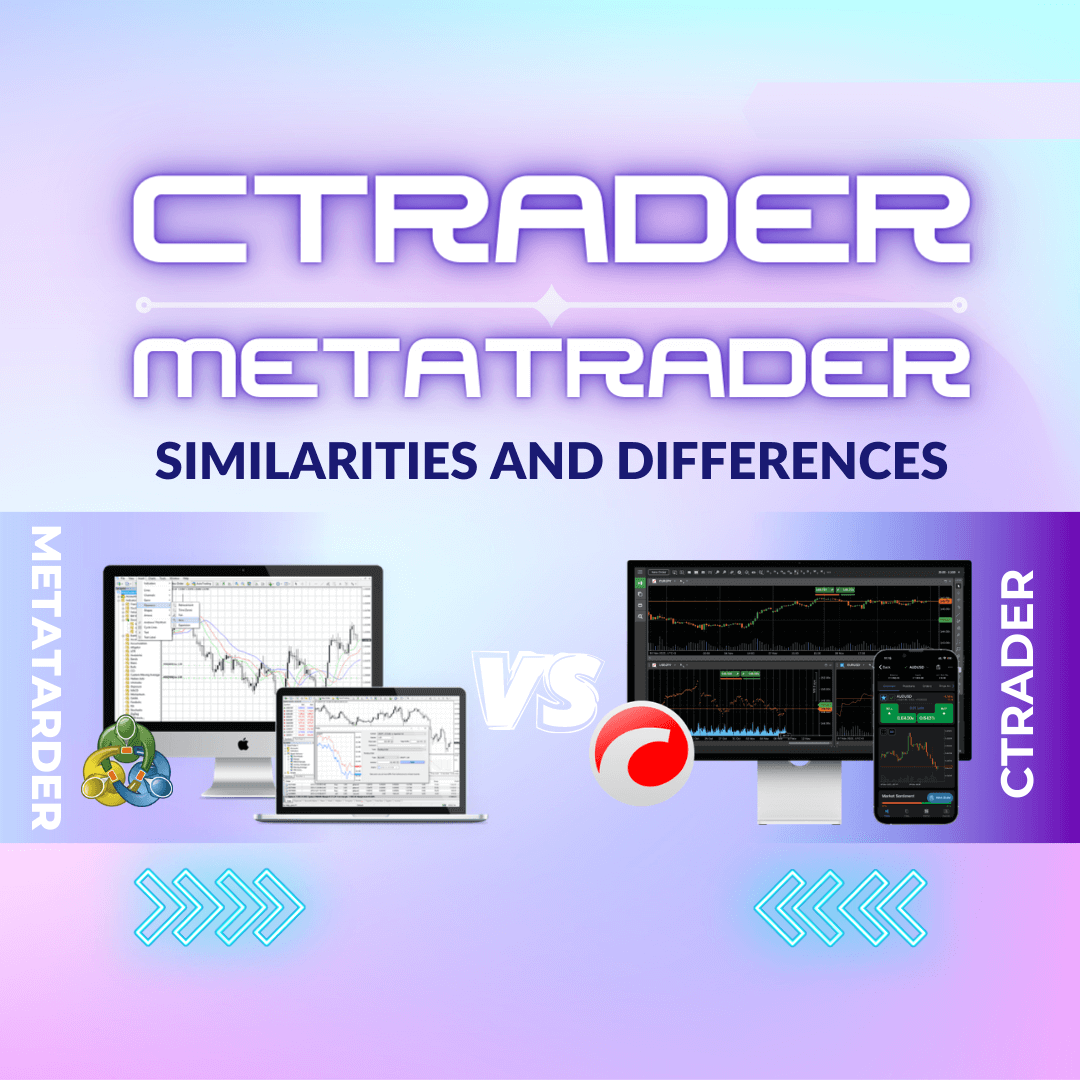

MetaTrader

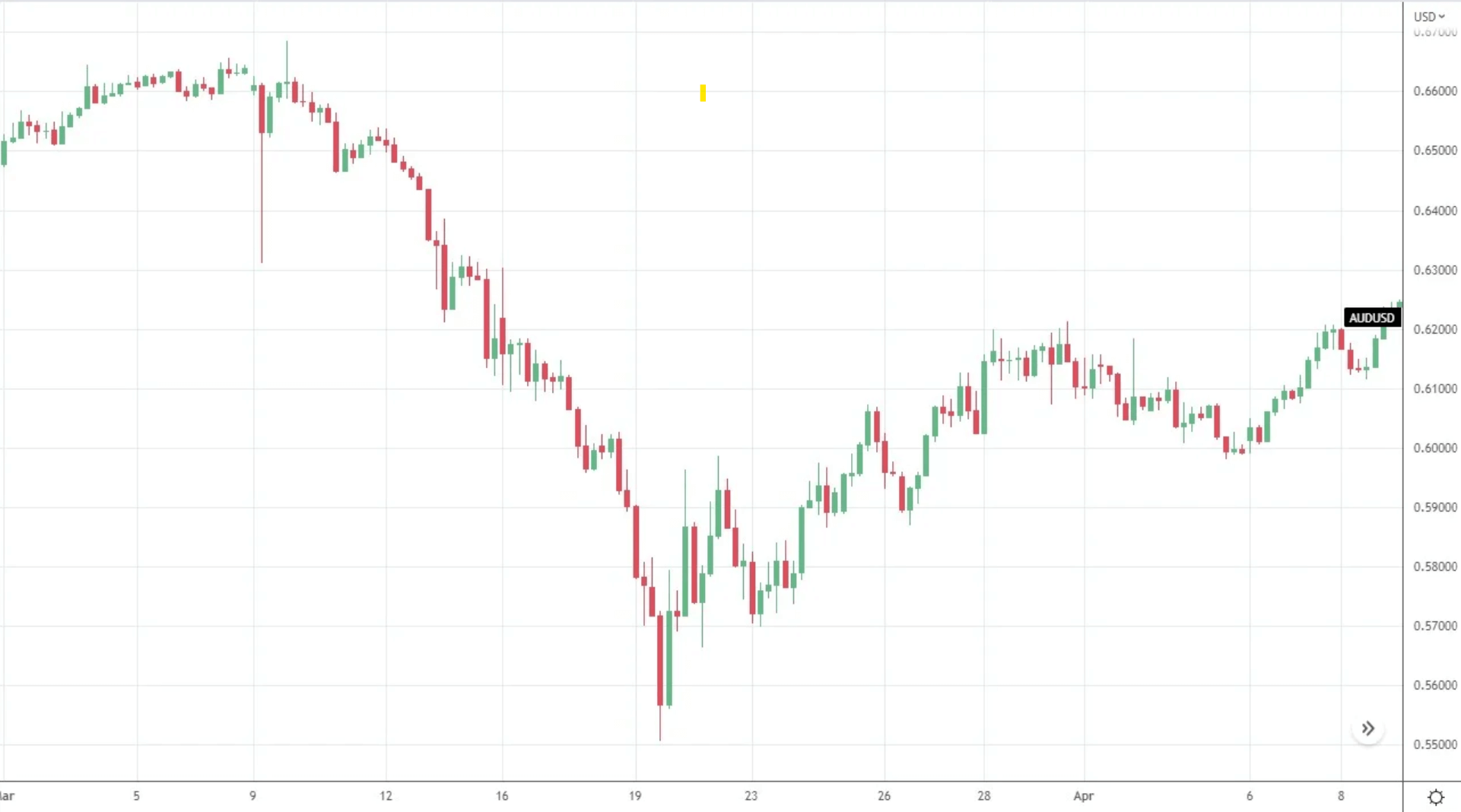

TradingView

cTrader

更多平台