Learn

What is a Stop Loss and Take Profit?

Video Transcript

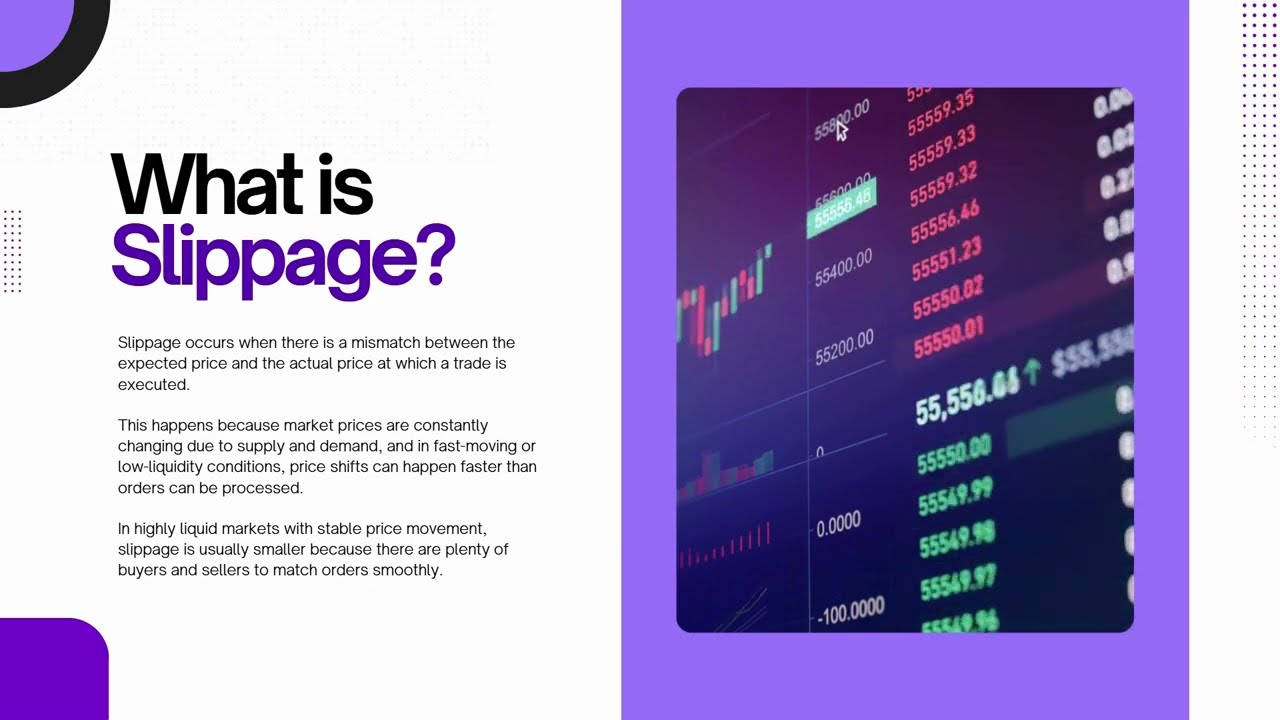

Stop losses and take profits are used to manage our trades and our risk. Think of them as tools that help you plan your trade and avoid emotional decisions. A Stop Loss is an instruction to automatically close your trade if the price moves too far against you. You use it to limit your potential loss before entering the trade. Think of it as your trading seatbelt; it won’t stop a crash, but it can reduce the damage.

The reason why stop losses are beneficial is because…

It protects your capital.

It takes emotion out of decision-making.

It helps you define your risk before the trade even starts.

What about a Take Profit?

A Take Profit is the opposite of a Stop Loss, it closes your trade automatically when price moves in your favor. It’s like ringing the bell and cashing in once your target is reached.

The reason why take profits are beneficial is because…

It helps you stick to your plan and not get greedy.

It removes the need to constantly monitor the screen.

It ensures you lock in gains when price hits your target.

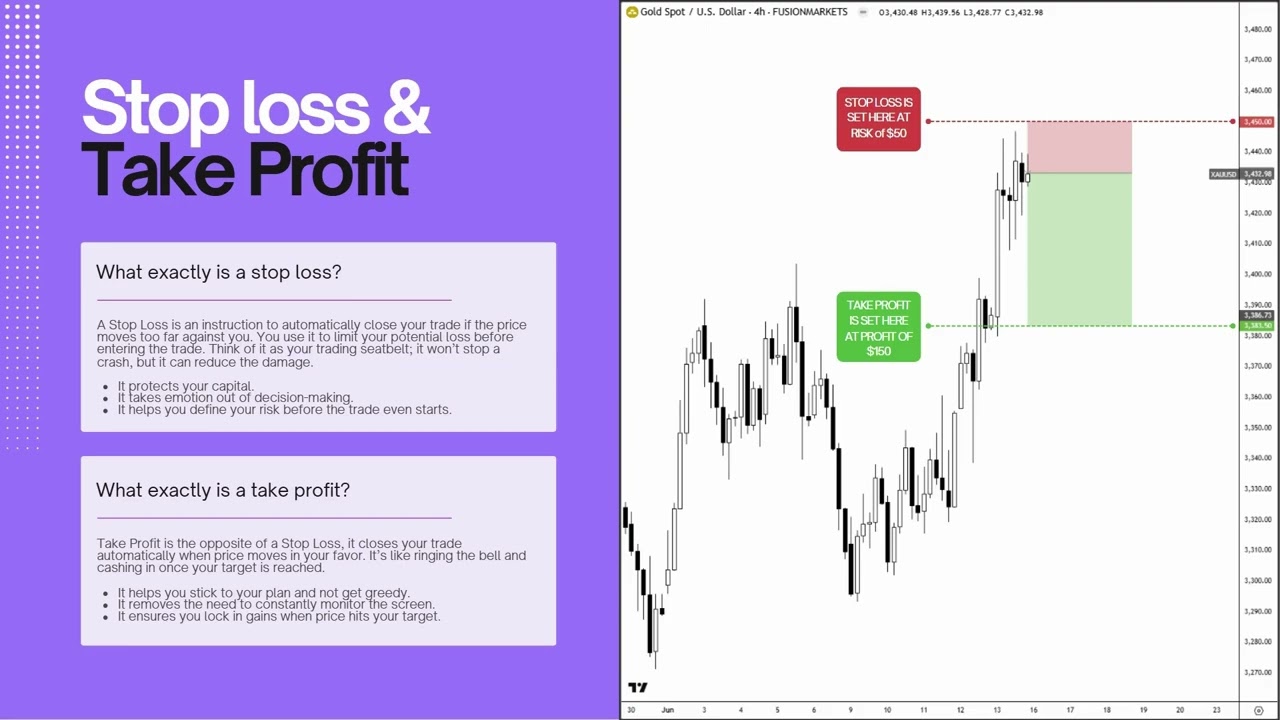

Here is a very quick example of a sell trade in the TradingView platform, with an entry for the trade set at 3432.98, and a stop loss set at 3450 (risking a total of $50), and a take profit set at 3383.50 (with a aimed profit of $150). Now remember our pending order that we set a bit earlier? Let me show you how we can set a stop loss and a take profit for that order…

Now, while we are on the topic of stop losses and take profits, there is a very important thing to always keep in mind about a stop loss and a take profit. Even though they are a fantastic way to manage risk, neither a stop loss or a take profit is a guaranteed price to exit your trades. Let’s use this as a quick illustration. Imagine that we have entered into a SELL TRADE on this asset at 3203. We placed our stop loss at 3210 where we want to limit our risk, and let’s just say we wanted to risk $10 on this trade. We also placed our take profit at 3171. However, we entered into this trade on a Friday before the market closed. Then, over the weekend, something massive happened that caused markets to gap up when prices opened on the Monday…

Relevant videos