Learn

What is a Pending Order?

Video Transcript

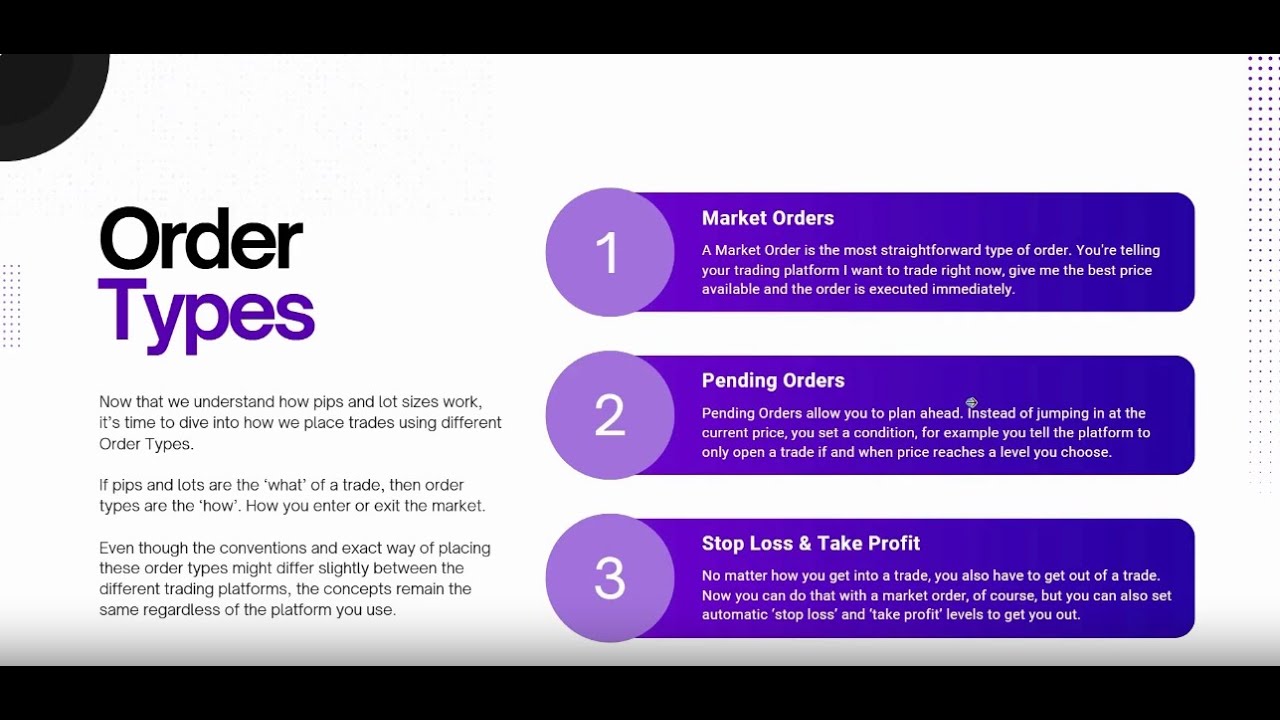

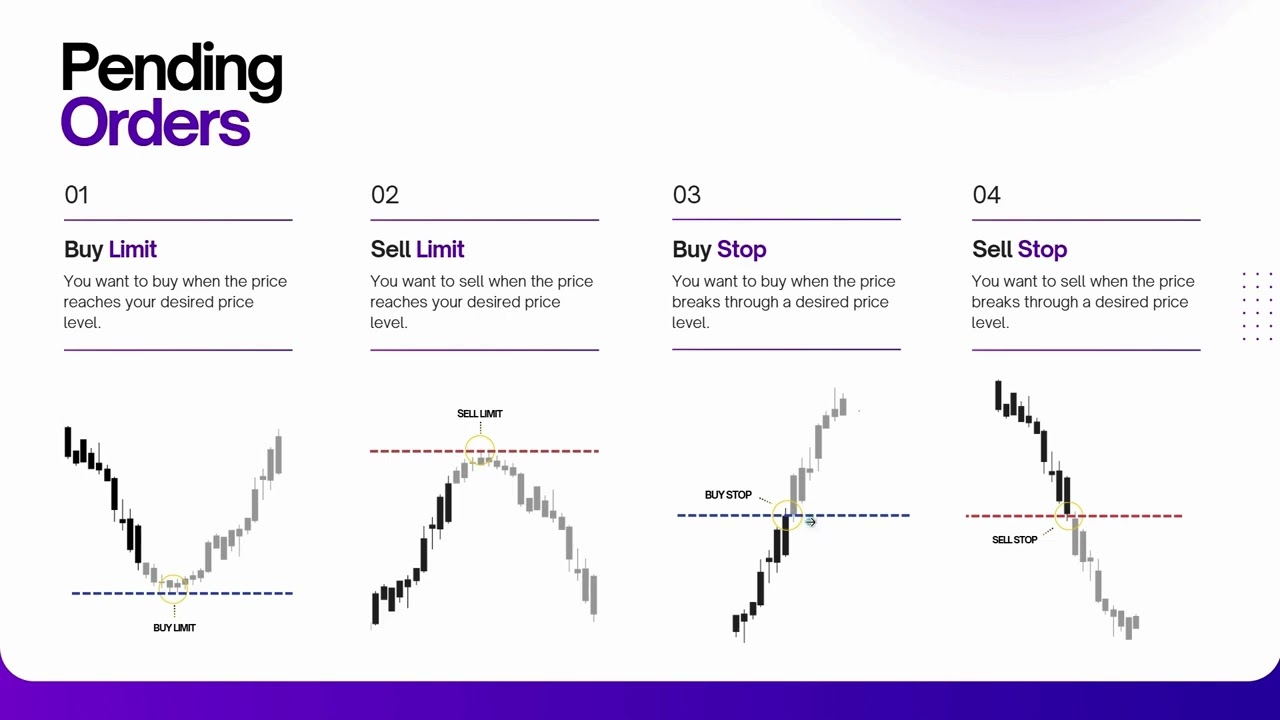

Let’s take a look at the next order type. They are called Pending orders. Pending Orders allow you to plan ahead. Instead of jumping in at the current price, you set a condition. For example, you are telling your trading platform to only place a trade if price reaching a level that you want to choose beforehand. There are four types of Pending Orders, and they fall into two broad categories: Limit Orders and Stop Orders.

A limit order is used when you want to enter at a better price than what’s currently available. For example, let’s say you think price will bounce higher when it reaches a price level, you can set a buy limit, which will open a buy trade when price reaches your specified price level. A sell limit, is just the opposite…If you think price will reject lower once it reaches a price level, you can set a sell limit, which will open a sell trade when price reaches your specified price level. So, in other words, we can use limit orders when we expect price will retrace higher or pullback lower once it reaches a specific price level.

Then we also have buy stops and sell stops. A buy stop or sell stop is used when you want to enter after a breakout. For example, if you think price will break through a resistance zone and continue higher, you can place a buy stop to open a buy trade when price breaks through the price level. Or, if you think price will break through a support zone and continue lower, you can place a sell stop to open a sell trade when price breaks through the price level.

So, in other words, we can use Stop orders when we expect price will break through a level and continue with its trend. Let’s take a quick look at an example of placing a pending trade on a trading platform. So, on this chart, let’s zoom out a bit to get a clearer view. Okay, so let’s assume that we have identified this price level with its double-top price pattern as a key resistance zone or a level where we think price will reject lower when it gets there. Let’s start by marking up the level. Okay, now we want to make sure we get filled on our trade so we want to enter the trade below the actual price level to account for the spread. So, we can right click in this area below our level, and then we can choose a sell limit, because remember we want to open a sell trade when price gets here. Let’s also assume we are happy with our volume of 0.01, which means we can simply go ahead and place the sell limit. And that’s it. We’ve just placed a pending order.

Relevant videos