Read Time: 3-5 minutes

Full-Year Review & What It Means for 2026

If there’s one thing the FX market reminded us of this year, it’s that narratives can flip quickly when rates, politics, and global growth stop moving in the same direction. 2025 didn’t deliver the straight-line trends many traders were hoping for. Instead, we saw a year built on sharp rotations, long stretches of range-trading, and a couple of standout movers that cut through the noise. Now that we’re heading into the final stretch, it’s a good time to step back and make sense of how the major currencies actually performed – and what those moves might be hinting at as we head into 2026.

- The U.S. dollar trended lower

- The Japanese yen was easily the weakest major currency of 2025

- High-yielders quietly put together a solid year

- The Australian dollar spent most of the year stuck in a holding pattern

- The New Zealand Dollar saw a similar, slightly firmer profile

- What really stood out in 2025

Contrary to early-year forecasts, the USD didn’t stay elevated.

US Dollar Index – Daily Chart

Instead, it trended lower for much of the year as the market gradually priced in earlier Fed cuts, softer U.S. inflation, and a cooling labour market. The “higher for longer” narrative faded quicker than expected, and once Treasury yields began sliding, the dollar lost a major pillar of support.

That said, the USD wasn’t in freefall. Growth remained relatively steady compared to Europe and parts of Asia, so any bouts of risk aversion still produced temporary USD inflows. But the overall direction was clearly lower – a reversal of the firm USD backdrop seen in recent years.

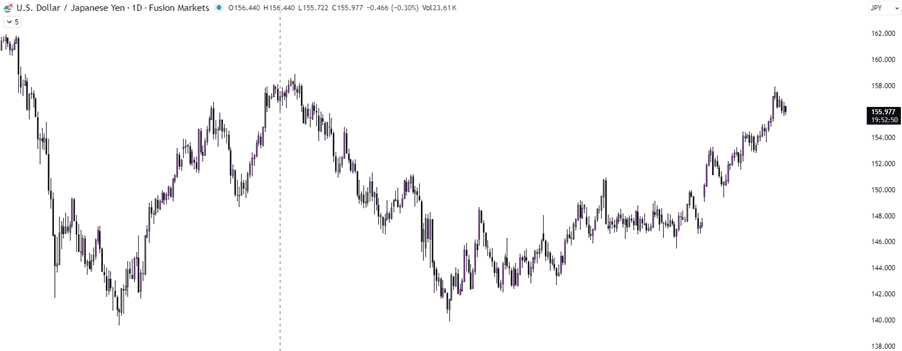

And not by a small margin.

USDJPY – Daily Chart

A lot of the blame sits with the Bank of Japan, which moved cautiously when the market wanted them to move decisively. Even after shifting away from negative rates, they struggled to convince investors they were serious about normalising policy. With global yields still high relative to Japan’s, carry traders had a field day. Every small bounce in the yen was sold almost immediately, and there was no sustained shift in sentiment. Interestingly, late-year positioning now looks stretched enough that we may see occasional spikes higher, but as far as 2025’s scoreboard goes, the yen ended up anchored to the bottom.

Particularly in the emerging-market space

USDMXN – Daily Chart

The Mexican peso, for example, kept rewarding carry-seekers as Banxico stayed cautious on cuts. Even with pockets of political risk, the yield differential was simply too hard to ignore. The Brazilian real was another outperformer early on, although the momentum cooled as fiscal concerns resurfaced.

USDBRL – Daily Chart

Still, both currencies demonstrated something important: when volatility is controlled and the yield gap is wide enough, investors remain willing to sit in EM. It’s a theme that could roll into early 2026 unless growth expectations deteriorate sharply.

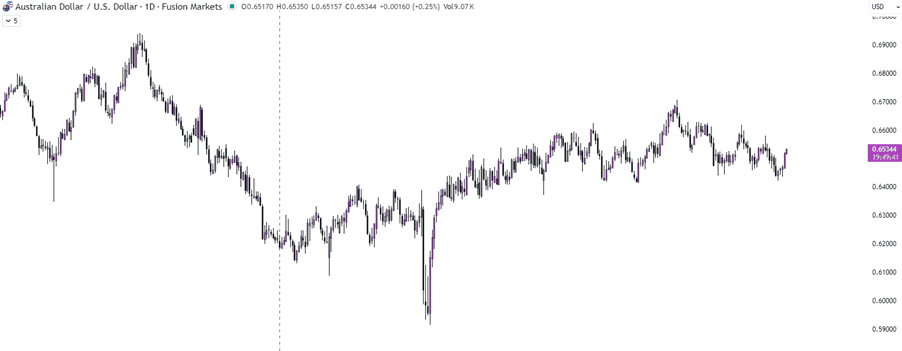

Unable to sustain a breakout in either direction.

AUDUSD – Daily Chart

It was caught between two opposing forces: soft domestic demand and a Reserve Bank that stayed patient on rate cuts. Commodity prices didn’t deliver much help either. Iron ore was choppy, LNG held up, but China’s stop-start recovery kept the AUD capped. For most of 2025, it traded more like a barometer of global sentiment rather than a story of its own, which makes its full-year performance look fairly middle-of-the-road.

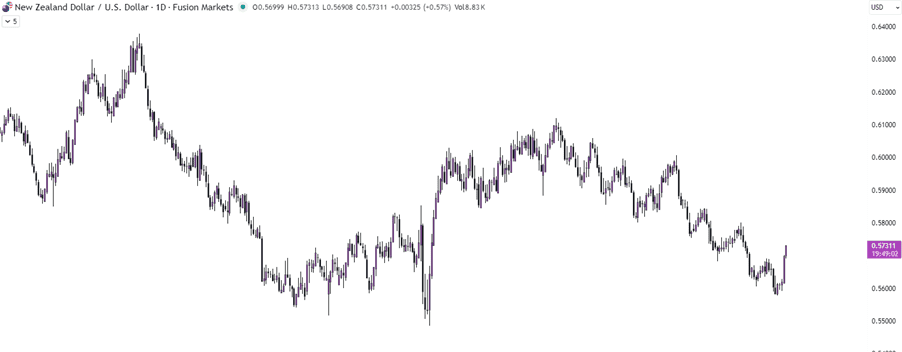

The NZD followed much of the AUD’s pattern, but local inflation was stubborn enough to keep the RBNZ firmly in restrictive territory.

NZDUSD – Daily Chart

That gave NZD occasional support when the market believed the RBNZ would delay cuts relative to its peers. Dairy prices helped at times, and New Zealand’s yield premium over Australia occasionally worked in its favour. Still, the NZD never escaped the broader “Antipodean drift” – muted, choppy, and ultimately driven more by global dynamics than domestic ones.

The RBNZ inevitably did cut in November, but with a more hawkish outlook, ultimately boosting the NZD to finish November off strong.

Rate differentials once again dominated the hierarchy of winners and losers.

Currencies linked to higher real yields outperformed, and those tied to ultra-low policy settings lagged. The softer inflation pulse across the developed world meant investors kept asking the same question all year: “Who’s cutting first, and who’s staying higher for longer?” That simple framing ended up dictating a huge chunk of the flow.

Looking ahead to 2026, the market may be entering a slightly different phase. If the global economy manages a soft landing – and that’s still an “if” – the pressure should shift away from defensive trades and back toward fundamentals like growth momentum, terms of trade, and relative productivity. That could offer an opportunity for laggards like the AUD and NZD to re-establish direction, provided China doesn’t stumble again.

Safe-haven currencies, especially the yen and Swiss franc, could look different next year if volatility picks up. But that hinges on whether central banks attempt to re-synchronise policy after two years of lopsided tightening cycles.

The scoreboard for 2025 tells a clear story: carry remained king, rate divergence held firm, and the currencies with the strongest yield advantage kept most of the power. But swing points are emerging. If you’re watching the FX market heading into 2026, keep an eye on shifts in inflation expectations, any surprise policy recalibrations, and the durability of the global soft-landing narrative. Those will likely decide who sits at the top (and the bottom) of next year’s leaderboard.

We’ll never share your email with third-parties. Opt-out anytime.

Relevant articles