When Rate Cuts Don’t Weaken a Currency

Read Time: 3-4 minutes

If you’ve spent any time around currency markets, you’ve probably heard the rule of thumb – when a central bank cuts interest rates, its currency falls. On paper, that makes perfect sense. Lower yields mean investors get less return for holding that currency, so capital should flow elsewhere. But in practice, it’s not always so neat. In some cycles, rate cuts actually strengthen a currency – or at least fail to knock it down. The reason lies in expectations, context, and timing.

- The theory vs. the reality

- Expectations are everything

- Growth, not just rates

- The relative yield game

- Sentiment, flow and narrative

- Bringing it together

The textbook logic goes like this: interest rates and currencies move together because investors chase yield. When the Reserve Bank of Australia (RBA) lowers its cash rate, demand for the Aussie dollar should fall, right? Not always. Markets don’t react to what’s already known – they react to what changes. If a rate cut has been fully priced in for weeks, the move itself can have little or no immediate impact. Sometimes, it can even trigger a rally if traders interpret it as the end of the easing cycle.

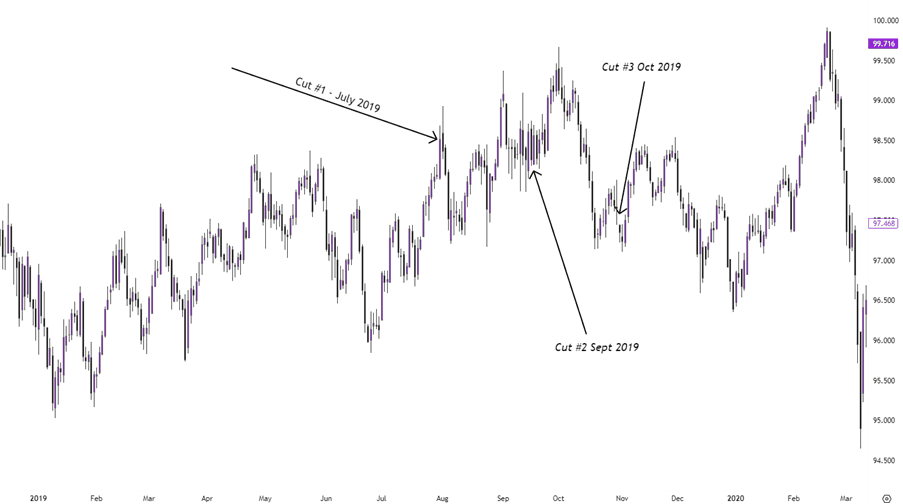

Take the United States in 2019 as an example. The Federal Reserve cut rates three times that year, yet the USD remained stubbornly strong (Figure 1).

Figure 1 – US Dollar (DXY) 2019

Why? Because investors viewed the cuts as a “mid-cycle adjustment” – a small insurance policy against slowing global growth, not the start of a long dovish run. U.S. data held up well, real yields stayed positive, and the dollar stayed bid. The market’s focus was less on the cuts themselves and more on the relative strength of the U.S. economy.

Currencies move on relative shifts, not absolute ones. If every major central bank is easing policy, a single country cutting rates doesn’t necessarily lose ground. What matters is who’s ahead of the curve and who’s behind it.

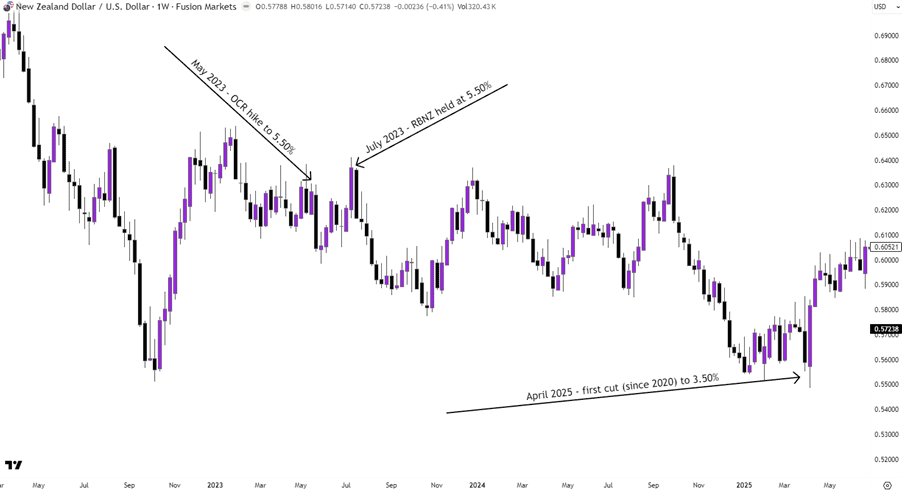

A good example is New Zealand in 2023 (Figure 2). The RBNZ was among the first to tighten aggressively post-pandemic, taking the cash rate to 5.50 per cent. When inflation started to ease, markets priced in rate cuts for early 2024. Yet the kiwi dollar didn’t collapse. By that point, the Federal Reserve and the European Central Bank were also expected to start cutting. The RBNZ’s credibility on inflation and New Zealand’s still-healthy growth backdrop helped cushion the currency. Traders effectively said: “Yes, they’re cutting – but so is everyone else.”

It’s a reminder that markets are forward-looking machines. When investors can see a policy shift coming months in advance, they adjust positioning early. By the time the cut actually happens, the risk-reward often flips. That’s why currencies sometimes rise right after a cut – traders are already looking at what comes next.

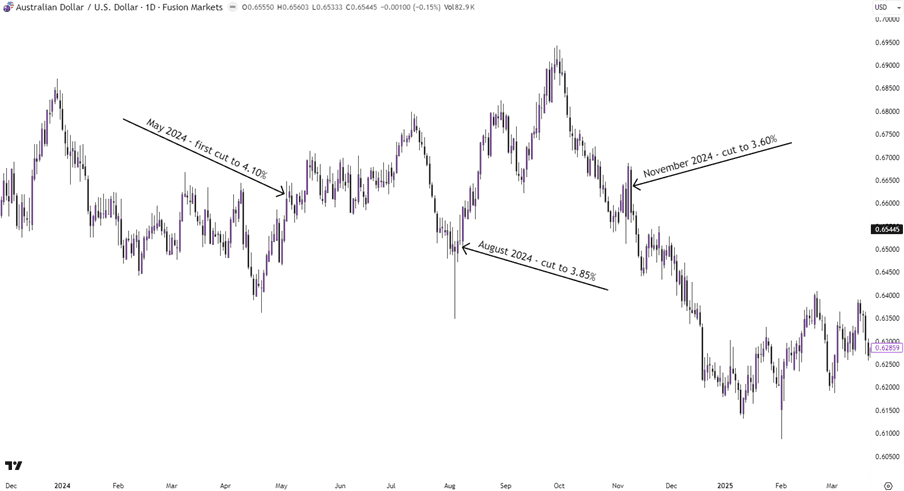

Another reason rate cuts don’t always weaken a currency is that they can be interpreted as supportive of growth. If a central bank acts decisively to prevent a deeper slowdown, it can boost investor confidence. This was the story for the AUD in mid-2024 (Figure 3).

Figure 3 – AUDUSD 2024

The RBA trimmed its cash rate a few times as growth stalled, but rather than collapsing, the Aussie found a floor. Markets saw the RBA as proactive – acting early enough to avoid a recession. When China’s data stabilised and commodities found some footing, AUD/USD bounced despite easier policy.

In contrast, when rate cuts signal panic – as they did during the global financial crisis or the pandemic crash – the outcome is different. Then, it’s not the rate cut itself that weakens the currency but the underlying fear that something is fundamentally wrong. Traders sell first and analyse later.

Rate differentials remain a key driver over time, but they’re always interpreted through a global lens. If the RBA is cutting while the Fed is on hold, the Aussie will likely underperform. If both are cutting but Australia’s economy looks comparatively stronger, the downside can be limited. Similarly, if the European Central Bank moves aggressively dovish while the Fed and RBA hold steady, the euro can weaken even if U.S. rates are falling too. In other words, what matters most isn’t the cut – it’s who’s cutting faster and why.

This relativity also extends to inflation. When a country’s real yields (nominal yields minus inflation) stay higher than peers, the currency can remain supported even as nominal rates fall. Japan has lived the opposite reality for years – low or negative real yields kept the yen suppressed despite ultra-low nominal rates.

Finally, the story traders tell themselves matters. If the macro narrative is that a central bank is “ahead of the curve”, cuts can be bullish because they imply policy competence. If the perception is that the bank is “behind the curve”, they can be bearish because they signal desperation. The line between the two is thin, and it shifts with each cycle.

That’s why post-announcement price action can be so counter-intuitive. A 25-basis-point cut that was 90 per cent priced in might strengthen the currency simply because it removes uncertainty. Investors can re-enter long positions knowing policy clarity has returned.

There’s no denying that, over long horizons, yield differentials still shape FX valuations. But the journey isn’t linear. Rate cuts don’t automatically spell doom for a currency – context does. The “when”, “why”, and “what next” often matter more than the cut itself.

For traders, the key takeaway is to look beyond the headline and into the narrative arc. Ask: is this cut surprising? Is it the start or the end of a cycle? How does it compare with what other central banks are doing? The answer will often explain why a currency moves against conventional wisdom – and why, in FX, timing the turning point in policy is just as important as predicting the move itself.

We’ll never share your email with third-parties. Opt-out anytime.

Relevant articles