Separating Hype from Reality in

Algorithmic Trading

Read time: 6 minutes.

The integration of Artificial Intelligence (AI) in forex trading is reshaping the landscape of financial markets. With the potential to analyse vast data sets and execute trades at incredible speeds, AI offers exciting possibilities. However, traders must navigate the hype and understand the practical realities of AI's capabilities and limitations in the dynamic forex environment.

Table of Contents

- Introduction

- The Promise of AI in Forex

- Current Realities of AI in Forex

- Common Misconceptions

- AI vs. Human: A Balanced Comparison

- The Future of AI in Forex

- Our Final Thoughts

Artificial Intelligence (AI) is revolutionising many industries, and forex trading is no exception. It’s estimated that AI-driven trading could reach US$19 billion in revenue by 2028.

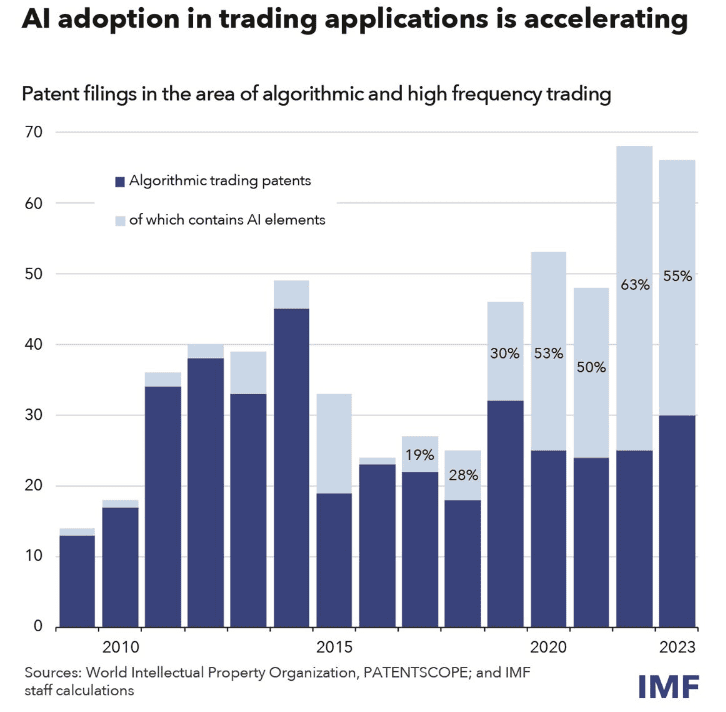

According to the International Monetary Fund (IMF); “the share of AI content in patent applications related to algorithmic trading has risen from 19 percent in 2017 to over 50 percent each year since 2020, suggesting a wave of innovation is coming in this area.”

Although this may be exciting at first, every trader must be sure to distinguish between the hype, and reality.

AI is still evolving, and its application to the forex market is not yet foolproof. AI should be considered as a tool, rather than a solution to guaranteed profits. Although AI can process data incredibly quickly, human discretion is still a pivotal aspect of trading.

AI promises to bring numerous benefits to forex trading, often by outperforming humans in specific areas;

- Enhanced Data Analysis: AI can analyse vast amounts of data in real-time, much quicker than any human ever could. It can quickly identify patterns across multiple currency pairs, interest rates, and economic indicators, something that would take human traders hours, if not, days.

- Faster Trade Execution: In high-frequency trading (HFT), speed is everything. AI algorithms execute trades in milliseconds based on pre-set criteria, enabling traders to capture small, short-term price movements before the competition even reacts.

- Emotion-Free Decision Making: Emotion and trading don’t mix - often leading to costly mistakes. AI removes the element of fear, greed, or hesitation, making decisions purely based on data and predefined algorithms. This is especially beneficial in volatile markets where emotional discipline is paramount.

While the promises are enticing, the reality of AI in forex is far more complex. AI may have seen success in niche areas like high-frequency trading (HFT) and pattern recognition.

However, AI has significant limitations and challenges that traders must be aware of:

- Data Dependency: AI is only as good as the data it’s given. Poor data quality or biased historical data can lead to incorrect predictions. This is why many AI models fail during black swan events that disrupt the market, such as the 2020 pandemic.

- Complexity in Adapting to Market Conditions: AI excels in stable or predictable environments but struggles in a chaotic environment that poses many unforeseen disruptions and volatility. The most recent example, the 2020 Covid-19 pandemic, many institutions had become accustomed to.

As an example, financial institutions have been known to use AI algorithms to exploit small price discrepancies across different markets, leading to some great successes. However, when the 2020 Covid-19 pandemic disrupted markets, AI struggled to adapt to the rapidly changing conditions and, in some cases, leading to large losses for the institutions running them.

For more insights on how AI is evolving in forex trading, you can check out this detailed post on Fusion Markets, where the use of AI tools like ChatGPT is discussed in the context of market analysis and trading strategies.

There’s no shortage of misconceptions about AI's role in forex trading;

- "Set it and forget it" myth: Many traders believe AI can be programmed once and left to generate profits indefinitely. This is far from reality. AI algorithms require constant monitoring, updating, and recalibration to keep pace with the ever-changing dynamics of the market.

- AI guarantees profits: Some traders fall for the myth that AI trading guarantees profits. However, no system—AI or otherwise—can ensure consistent profits. Forex markets are affected by too many unpredictable factors, such as global politics, economic crises, and even natural disasters, for any system to be foolproof.

- AI can predict black swan events: Despite all its power, AI cannot predict rare, unpredictable events like black swans. These events, by their nature, fall outside the scope of traditional data patterns and are difficult for AI to forecast

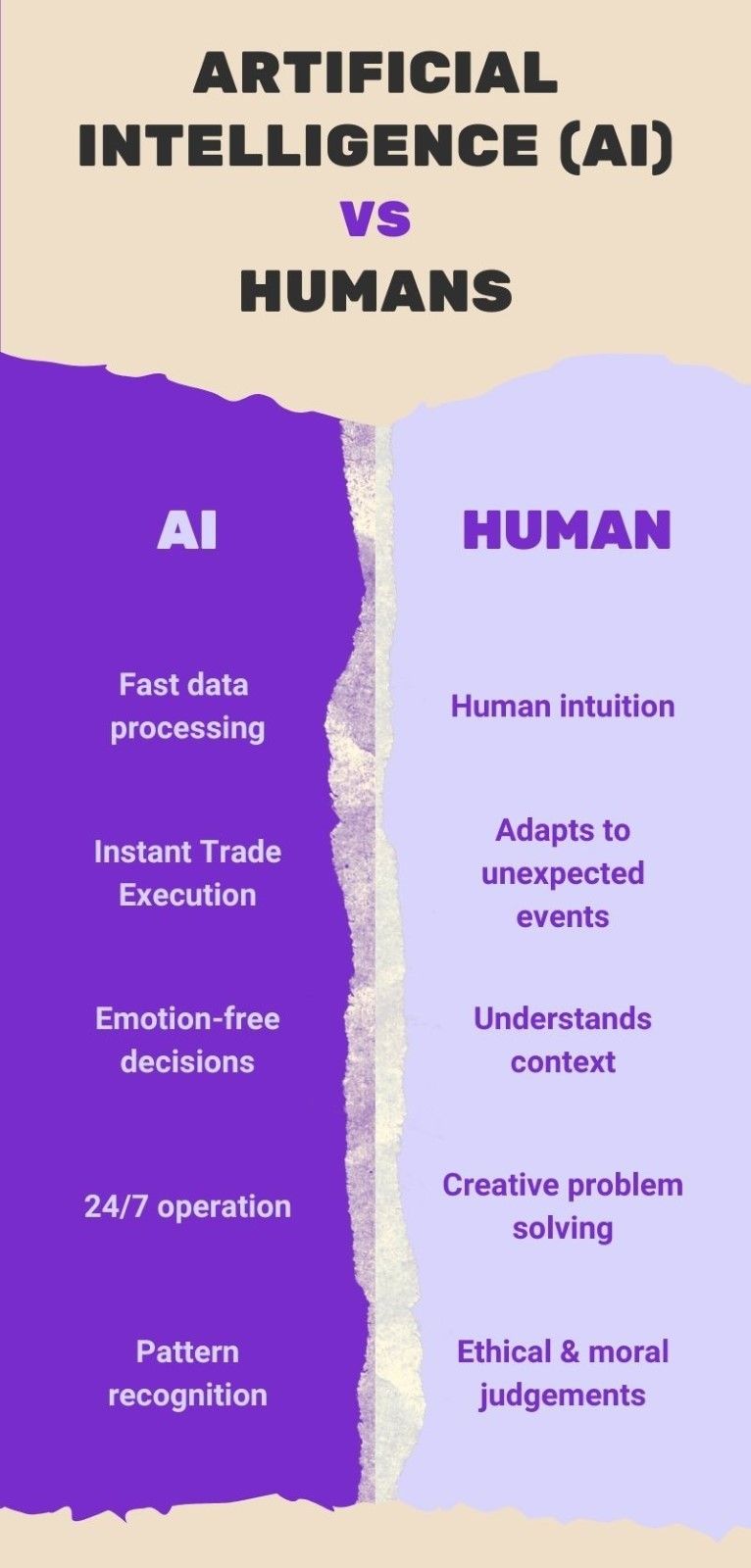

AI and human traders bring different strengths to the table, and understanding these distinctions is key to developing a robust, and successful, trading strategy.

- AI’s Strengths: AI excels at processing massive amounts of data, identifying subtle market patterns, and executing trades with precision and speed. It removes human biases and can operate 24/7 without fatigue.

- Human Trader’s Strengths: On the other hand, human traders excel in areas where AI currently struggles—especially in understanding the broader context behind market movements. Human intuition, experience, and the ability to adapt to unpredictable events are areas where traders can outperform AI. For instance, human traders can weigh the political implications of an unexpected event, such as Brexit, where AI on the other hand might struggle to incorporate in real-time decision-making.

A hybrid approach that combines AI’s strengths with human insight may be the best way forward. AI can manage data processing and execution, while human traders focus on strategy, risk management, and adjusting for unforeseen market conditions.

It’s still early days for AI in forex trading, but it’s rapidly evolving. Emerging technologies such as Natural Language Processing (NLP) and quantum computing are expected to transform AI's role in the financial markets further.

- NLP: This allows AI systems to interpret news articles, social media sentiment, and other forms of unstructured data that can influence market movements. For example, NLP can be used to gauge how a new economic policy or geopolitical event may impact currency pairs.

- Quantum Computing: While still theoretical in many applications, quantum computing holds the potential to perform complex calculations much faster than traditional computers. This could give AI even greater predictive power in markets where speed and computational capacity are crucial.

AI has undeniably transformed many industries, including the forex market. Whilst it can enhance data analysis, execution speed, and remove emotional biases, it’s no holy grail. The best approach is to employ AI with a balanced perspective—recognising its limitations whilst leveraging its strengths to complement your own trading strategies.

In short, AI is a powerful tool, but not a guarantee of success. The key to successful AI-driven trading lies in combining human intuition with algorithmic precision – we, as traders, must keep an eye on these trends but always remain cautious about relying on AI-driven systems.

Happy Trading

We’ll never share your email with third-parties. Opt-out anytime.

Relevant articles

How Global Interest Rate Divergence Is Shaping Forex Opportunities in 2025