GBP/USD: An Overview

The forex symbol GBP/USD indicates how much the British Pound (abbreviated as GBP) is worth in relation to the US Dollar (abbreviated as USD). This article provides traders information on how much USD is needed to buy one GBP. Forex traders call an exchange of this pair as “trading the cable,” a nod to how New York and London used to transmit trading information.

The GBP/USD pair is among the oldest currency pairs traded in the world. It is also among the most popular pairs to trade and is considered a major forex pair.

If you’re considering trading this pair, read on for a quick dive into the history of these currencies, their dynamics, and how you can trade this pair.

If you want to read more articles about our pairs, check out our posts on: USD/JPY and EUR/CHF.

Currency background

The British Pound (GBP)

GBP is the official currency of the United Kingdom and its territories. Its history can be traced back to continental Europe. With over 1,000 years of history, it is one of the oldest, if not the oldest, currency still in use. In 1694, the Bank of England was established, and banknotes entered circulation shortly after.

The GBP’s importance goes beyond the UK and its territories. It used to be the dominant international currency before USD took over in the 20th century. However, it is still among the most widely used currencies for financial transactions worldwide, along with the USD and the Euro (EUR). Further, as of 2021, the GBP comprised 5% of official foreign reserves (i.e., share of currency reserves held by central banks).

The US Dollar (USD)

USD is the official currency of the United States, dating back to the 18th century. In 1785, the US adopted the dollar sign, which is now, perhaps, the most recognizable currency symbol in the world.

The USD plays a major role in the global economy, dominating international finance. It is the most active currency for international payments. It has also been the top international reserve currency since World War II, with an over 50% share of global reserves. In forex markets, almost 90% of all transactions involve USD.

The Plaza Accord

No background of these two currencies would be complete without mentioning the historic Plaza Accord.

In 1985, the US, UK, France, Germany, and Japan—then known as the G-5—agreed to jointly intervene in the currency markets to correct trade imbalances. The devaluation of USD was meant to reduce the increasing US trade deficits.

In a couple of years that followed the agreement, the USD declined in value by about 50%, while GBP and the other currencies appreciated by about 50%.

Factors you need to consider in trading GBP/USD

The GBP/USD pair is among the most liquid in the forex market, with smooth price movements as there’s enough volume of trade in the market.

Various factors move the prices of currency pairs in the forex market. For most currency pairs, prices are affected by economic trends and geopolitical circumstances, both locally and globally.

Here are some factors that drive the GBP/USD dynamics:

Economy

Both the US and the UK are among the largest economies in the world.

Due to its size and role in the global economy, the economic situation and policies in the US affect many economies and markets worldwide. In general, the GBP/USD rises when the UK economy grows more than US economy.

If you’re trading US-based pairs, you can keep up to date with US economy updates through government data releases and economic reports or Fusion's economic calendar, which includes data such as GDP growth, interest rate decisions and balance of trade.

Trade balance

The US is one of the three largest players in global trade, along with the European Union and China. The US is among UK’s major trading partners, accounting for about 10% of UK imports and receiving over 15% of UK goods exports.

The trade balance situation generates some volatility for GBP/USD. GBP/USD rises when current account balance (i.e., the balance of trade between the two countries) increases for the UK.

Central Bank policies

The Federal Reserve (Fed) sets the monetary policy in the US, a key determinant of currency strength, with the aim of stabilizing US prices and maximizing employment. In the UK, the Bank of England (BoE) sets the interest rate to maintain low and stable inflation. It reviews rates every 6 weeks.

A rule of thumb here is that the pair rises when the BoE interest rates rise more than the Fed rates.

As the USD plays an important role in international markets, movements in interest rates set by the Fed have a critical impact on the movement of many currencies worldwide, including GBP. In 2022, steep rate increases have strengthened the US dollar, causing other currencies to dive as investors rush to USD.

Geopolitical conditions and global risks

Like other currency pairs, the GBP/USD is also driven by political uncertainties and global risks.

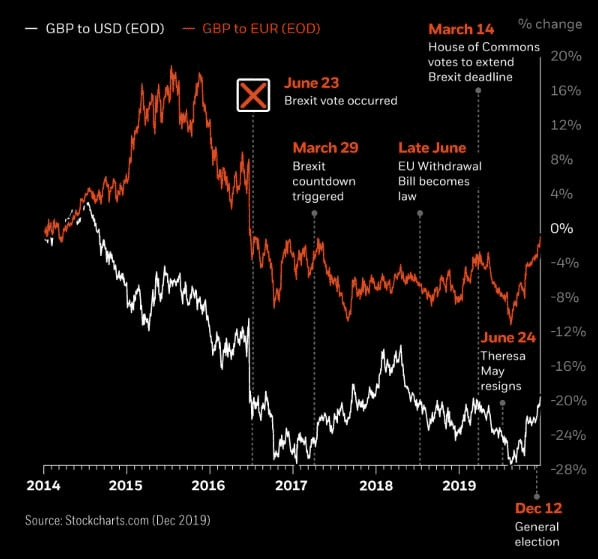

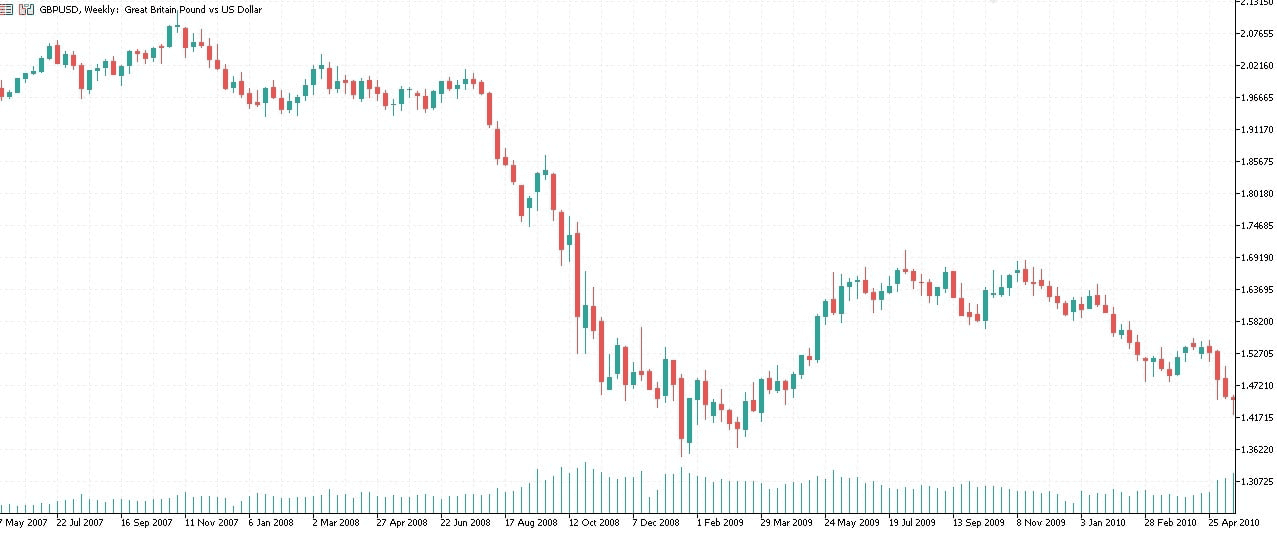

The GBP took a hit following the global recession in the late 2000s. In 2016, after the announcement of Brexit, the GBP dived to its lowest against the USD, as UK’s decision created uncertainties to how its trade prospects would pan out.

GBP/USD and GBP/EUR - 2014-2021

As USD is a global reserve currency, it serves as a haven at times of global uncertainties. During the height of the COVID-19 pandemic in 2020, the GBP/USD rate dropped by 12% as investors sold the GBP and rushed to the safer USD.

GBP/USD and GBP/EUR - 2007-2010

GBP/USD and GBP/EUR - 2007-2010

Conclusion

Is the GBP/USD pair worth going into?

The US and the UK are among the largest economies in the world, with both USD and GBP playing important roles in international finance. The two countries share strong economic relations.

In forex markets, almost 90% of all transactions involve the USD. Post-1980, the pair has been less volatile, with extreme movements stemming from major global and regional events such as the Brexit and the COVID-19 global situation. The pair is one of the most liquid in the market.

If you’re new to the forex market, trading with highly liquid currencies such as GBP/USD could benefit you. This is because many strategists recommend trading in these currency pairs while you’re still improving your grasp of forex trading. You're also in luck, in that, Fusion Markets is the lowest cost regulated broker on the market. Start trading today!

We’ll never share your email with third-parties. Opt-out anytime.