Learn

What are CFDs?

Video Transcript

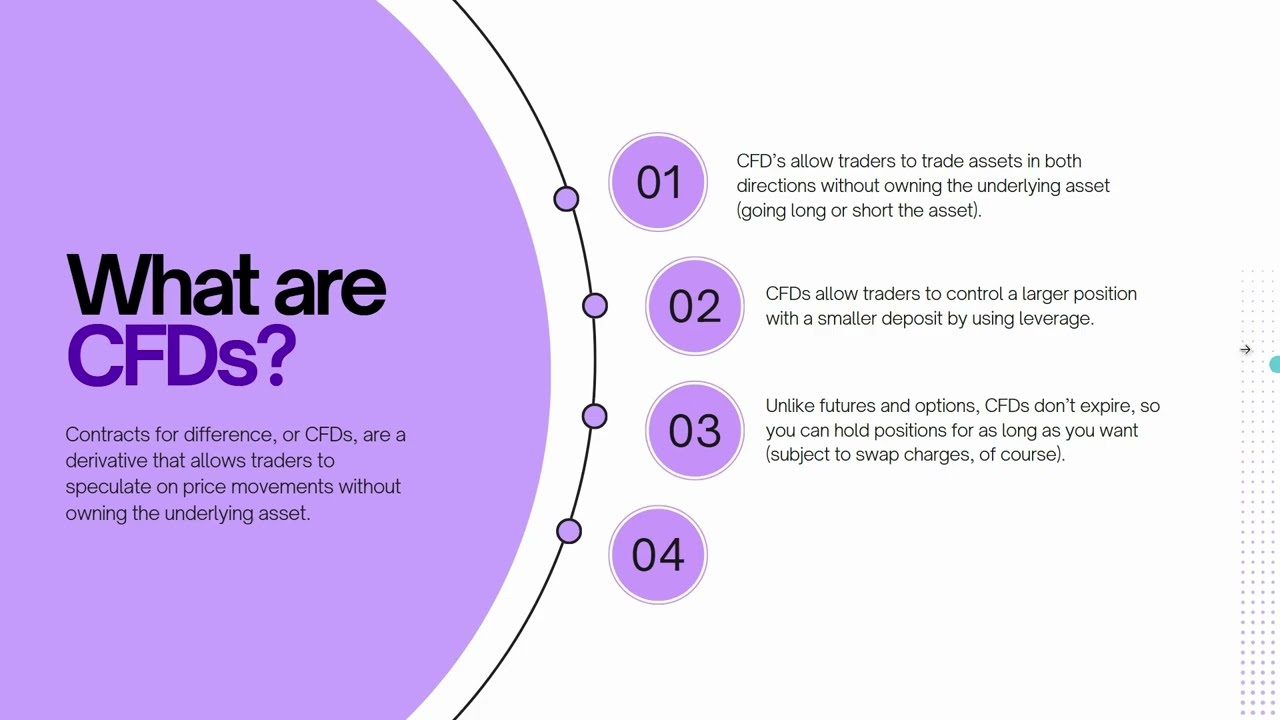

The simplest way for retail traders to participate in the market is through financial instruments like derivatives. One of the most popular types of derivatives for trading purposes is a Contract for Difference, or CFD. With CFDs, traders never own the underlying asset that they are trading, whether it’s a stock, or equity index, or currency or commodity or bond. Through CFDs they aren’t buying and selling the actual asset, rather, they are simply speculating on the future price movement of the asset, without having to own the asset they are speculating on.

So unlike traditional investing where you can only profit if the prices go up, CFDs allow you to go long (buy) or short (sell) on an asset.

You can Go long or buy If you believe an asset will increase in value.

Or you can Go short or sell If you expect an asset to decline

In other words, you can capitalize on both bullish and bearish market conditions, making CFDs highly flexible for different trading strategies.

2. Secondly, CFDs allow traders to control a larger position with a smaller deposit by making use of leverage.

When it comes to trading with CFDs, leverage is a very important topic to understand. Let’s take a quick look at what leverage is. In a nutshell, leverage is a fantastic tool that allows traders to control large positions in the market with a relatively small account size. For example, with 1:500 leverage, a trader with just $100 in their account can control a $50,000 position in the market. How cool is that!? This means traders can access opportunities they wouldn’t usually be able to afford in more traditional or institutional markets. In this sense, leverage is especially useful for retail traders because it allows them to participate in global markets without needing a large amount of starting capital. Before you get too excited, the benefit of controlling more significant positions in the market also comes with increased risk. Like Spiderman said, with great power comes great responsibility…

Let me explain…

A big benefit is that small deposits can control significant positions, allowing trades to take advantage of markets they might not be able to access.

The risk is that if a trade moves against you, losses can accumulate very quickly, potentially wiping out your account, or having losses that exceed deposits. Yikes!

Another advantage of leverage is that you can amplify or magnify your potential wins and grow your account substantially fast.

However, the corresponding risk is that your losses are also magnified. This means a small account can reach margin call levels very quickly, forcing the broker to close out positions.

Another benefit of leverage is that traders can diversify across different assets without tying up large amounts of capital.

However, with higher leverage, traders can be tempted to take oversized positions, overleverage their accounts, and increase the risk of larger drawdowns.

To summarize…leverage can be a valuable tool when used correctly, but managing risk carefully is important. Alright, now that we have the concept of leverage nailed down, let’s continue to see some of the other benefits of trading with CFDs.

3. The third benefit of CFD trading is unlike futures or options contracts with expiration dates, CFDs don't expire, meaning you can hold positions for as long as you want.

So, where futures & options require traders to roll over contracts before expiry, which adds complexity, CFDs allow traders to stay in positions based on market conditions, not contract expiry dates. In other words, CFDs give more flexibility for short-term and swing traders who don’t want to worry about contract rollovers. Now, even though this means that CFD traders can hold positions for a very long time, this advantage does come at a cost, and these costs are what we call swap fees. But don’t worry we’ll explain that in a bit more detail later in the video. So, coming back to the benefits of CFD trading.

4. The fourth benefit is that CFDs provide access to a wide range of global markets, all from a single trading account.

Trader can trade anything from stocks to forex, to indices, to commodities, and even cryptocurrencies with CFDs. There is no need to open multiple accounts to get exposure to different asset classes. In other words, through CFDs one trading account can provide diversified market exposure, giving traders flexibility across multiples financial instruments.

Relevant videos