New Deposit Method with Interbank FX Rates

Interbank FX conversion rates are now at your fingertips. Our latest bank deposit method allows our clients to deposit 30+ different currencies and receive some of the best FX rates on the market. This means you’ll pay less when depositing your local currency into your trading base currency, putting the savings back into your trading bankroll.

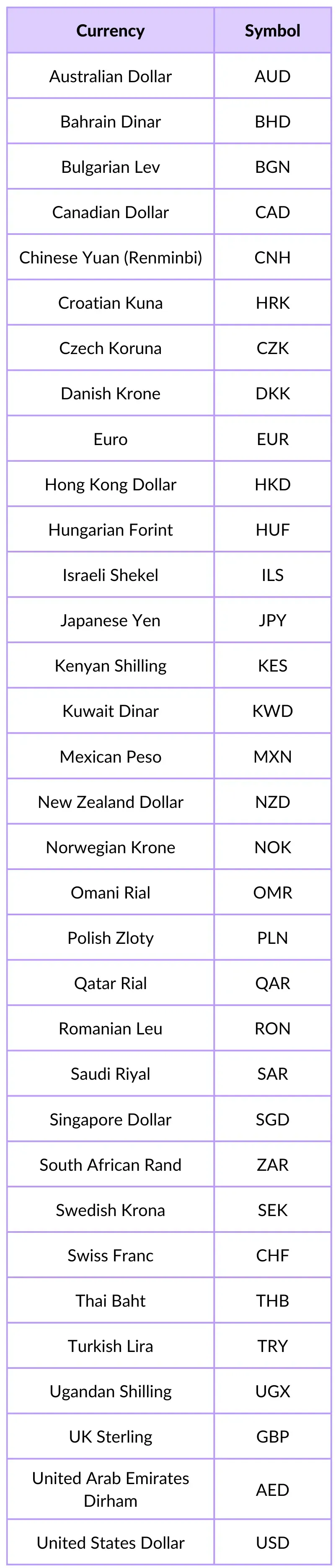

See below to see the full list of the 30+ currencies accepted for this funding method.

How does it work?

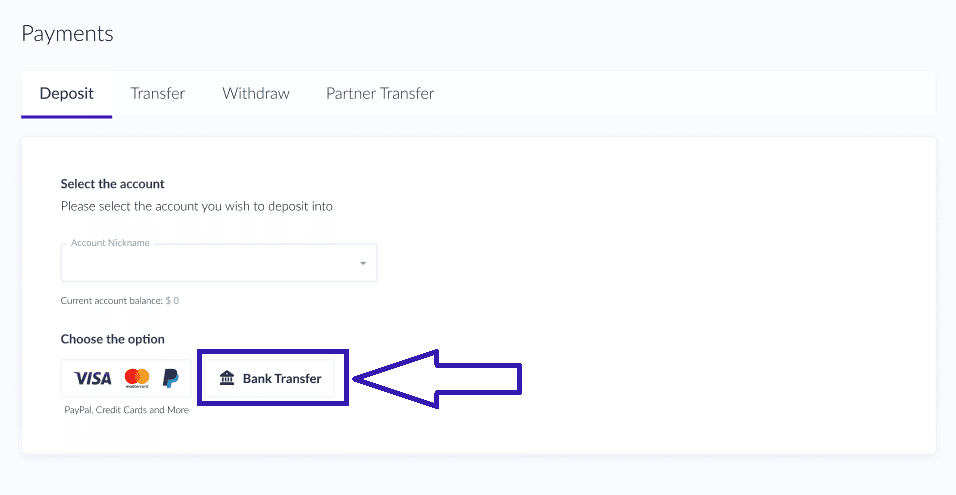

To receive interbank FX conversion rates, login to your Client Hub and click “Bank Transfer” on the right of the screen.

Select your trading account you’d like to deposit into (e.g. USD, GBP, AUD), and deposit into the bank address listed.

When we receive your fund they’ll then be converted to your base currency account at industry-leading FX conversion rates.

Which Currencies Can I Deposit With?

Can I still use old bank wire transfers?

Yes! Click on the icon on the left in your payments sections to see access to our older bank transfer methods. You still may want to use this method if your country has local bank funding options.

How long will it take until my deposit is processed?

Depending on your bank and region, your deposit can from 1-5 business days to process. You’ll receive an email from us once your funds are ready to trade.

Can I use this method to transfer funds from one base currency trading account to the other?

This functionality will be coming soon!

Can I also withdraw using this method?

This is something we’re looking to integrate in the future, at the moment, we’ll only be accepting deposits using this method.

I have more questions

If you’d like to know more, please contact our help team - they’re available 24/7.

We’ll never share your email with third-parties. Opt-out anytime.