The Hidden Forces Driving Price

Movements

Read Time: 5 minutes

There are true complexities that drive price movements in the forex market. Beneath the surface of visible price changes lies the market’s microstructure; an intricate web of factors influencing how prices fluctuate.

Market microstructure focuses on the mechanics of trading, the behaviour of participants, and their involvement in the fluctuations of price. Understanding these hidden forces gives traders a clearer picture of market behaviour, equipping them to make more informed decisions in a competitive and chaotic environment.

- Components of Forex Market Microstructure

- Price Discovery Process

- Order Types and Their Impact

- Microstructure Anomalies and Opportunities

- Conclusion

Order Flow Trading

Order flow is the net volume of buy and sell orders in the market and plays a major role in shaping price movements. Increased buying pressure can push prices up, whilst selling pressure often leads to declines. By analysing order flow, traders can gauge momentum and anticipate short-term price shifts.

Bid-Ask Spreads

The difference between the bid (buy) and ask (sell) prices reflects market liquidity and can vary depending on trading volume and volatility. Wider spreads generally indicate lower liquidity or heightened risk, while narrower spreads signal a more stable and liquid market. Monitoring bid-ask spreads helps traders assess market conditions and transaction costs.

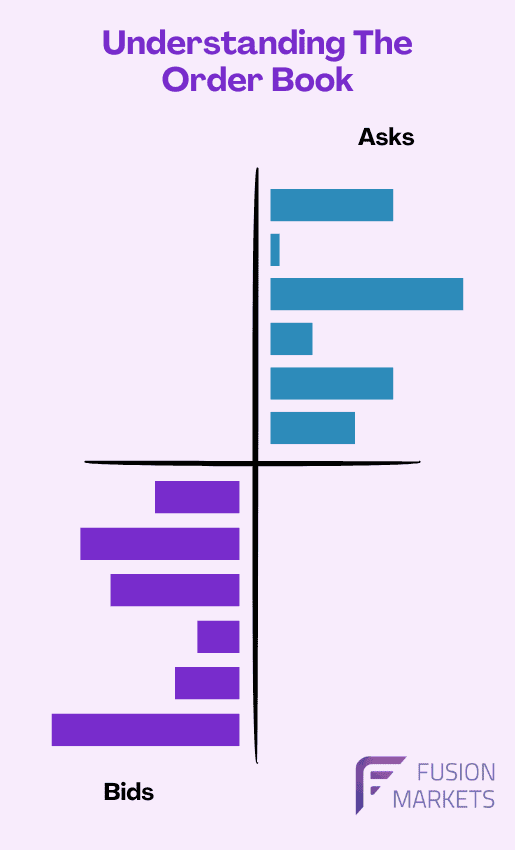

Market Depth and Forex Liquidity

Market depth refers to the volume of buy and sell orders at various price levels, offering insights into forex liquidity. High market depth indicates robust liquidity, making it easier to execute large trades without impacting prices. Shallow depth, however, can lead to higher volatility, as fewer orders can cause rapid price changes.

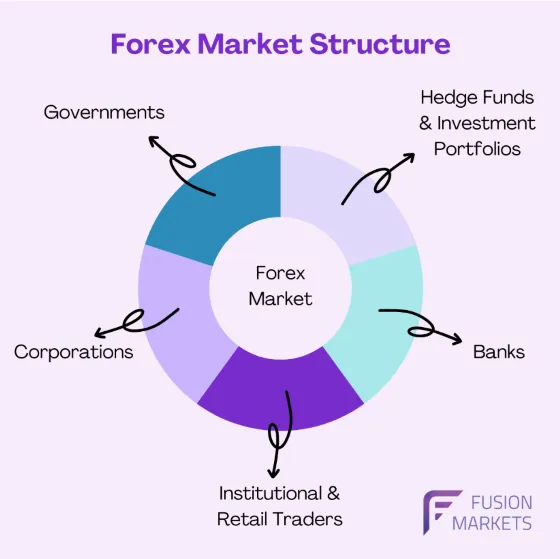

Market Participants

The forex market comprises of various participants, including;

- Governments

- Banks – Central & Commercial

- Hedge funds & Investment portfolios

- Corporations

- Institutional Traders

- Retail traders

Large players such as banks and hedge funds have a significant influence on price movements due to their transaction volume. In contrast, retail traders have less influence individually but can impact markets in aggregate, particularly in lower liquidity situations.

Price discovery is the process by which the forex market determines the price of a currency pair. This process is heavily influenced by information asymmetry, where certain participants have more information than others, often leading to advantages in trading. For instance, institutional traders may have access to economic forecasts before retail traders, potentially moving prices before the data reaches the wider market.

High-frequency trading (HFT) has also become a significant part of price discovery. HFT involves executing trades at extremely high speeds, often driven by algorithms designed to capitalise on minute price discrepancies. While HFT can add liquidity, it can also cause rapid price changes that impact the price discovery process.

Liquidity Providers and Market Makers

Liquidity providers, such as banks and large financial institutions, ensure the forex market operates smoothly by offering to buy or sell at quoted prices, maintaining liquidity.

Market makers are liquidity providers who actively facilitate trades by setting bid and ask prices. By adjusting these prices, market makers can influence short-term price movements, especially in low-liquidity situations.

Market makers operate through both electronic trading and voice trading channels.

- Electronic trading, facilitated by platforms and algorithms, is known for its speed and efficiency.

- Voice trading, on the other hand, is often reserved for complex or large orders requiring negotiation, allowing for nuanced price adjustments in response to changing market conditions.

The type of order a trader places can affect market dynamics significantly:

- Limit Orders: These are orders to buy or sell at a specified price or better. They contribute to market depth and can create temporary support and resistance levels, as these orders accumulate in the order book.

- Market Orders: Executed immediately at the current price, market orders can trigger rapid price shifts, especially if large orders are placed in low-liquidity periods. Market orders are often used to enter or exit positions quickly but may lead to slippage.

- Stop Orders: These orders, triggered when prices reach a specified level, can amplify market moves as clusters of stop orders trigger simultaneously. This is common in trending markets, where stop-loss orders cascade as prices rise or fall.

- Hidden and Iceberg Orders: Hidden orders are not visible in the order book and are typically large institutional orders that aim to reduce market impact. Iceberg orders reveal only a portion of the total order, with the remainder hidden until the visible part is filled.

Understanding market microstructure can help traders identify unique trading opportunities:

- Flash Crashes and Liquidity Holes: Flash crashes occur when liquidity temporarily dries up, causing sharp, rapid price declines. Such anomalies are often triggered by HFT algorithms or large, sudden orders in thin markets, such as the Asia session. Identifying potential liquidity holes can help traders avoid losses in volatile moments.

- Arbitrage Opportunities: Discrepancies in currency prices across different platforms or regions can lead to arbitrage opportunities. While these are usually short-lived, microstructure knowledge can help traders identify and act on price inefficiencies quickly.

- Leveraging Microstructure Knowledge: Advanced traders can use microstructure insights to make informed decisions, such as placing orders at levels where hidden liquidity or large stop orders might exist. This allows them to anticipate moves driven by institutional activity or market maker adjustments.

Forex market microstructure highlights the true forces that drive price movements, from order flow trading and market depth to the impact of different participants. For traders, understanding these components is crucial to being successful in the forex market. By analysing and having a thorough understanding of microstructure, you can gain a competitive edge, interpreting price action in real-time and making more strategic decisions.

As the forex market continues to evolve, staying updated on microstructure concepts and integrating them into trading strategies can lead to a deeper understanding of market behaviour. This knowledge can enable you to adapt and succeed over the long-term.

We’ll never share your email with third-parties. Opt-out anytime.