Our Top Five Most Used Tools

Hi Traders,

By popular demand, we wanted to share our top five most used tools and features that are provided to you for free in our client area.

These are a bit like my Top Five Tools for Traders, but these are a little different as they're all internal rather than other websites or companies.

Here are 5 of the most popular tools (in order) our clients are loving:

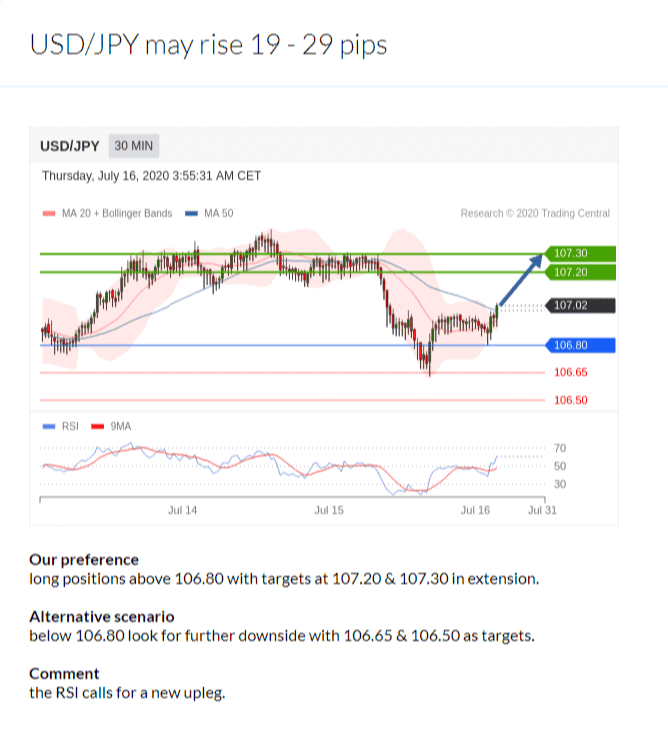

#1 - Analyst Views by Trading Central. This is my personal favourite. You can view it in the hub now, download it and use it as an indicator on MT4 desktop (in "Downloads on Hub) or visit your "News" tab in MT4 where it's constantly updated too.

#2 - The Economic Calendar is a must too. Are you using this already? If you're trading and don't know what announcements are coming up, you could easily be blown away by a big move and have no idea why. My favourite is that it will show you the historical price impact of previous announcements. You can even save the future events as a calendar invite!

#3 - News Tab - Knowledge is power. You know that already. You might already have your own news sources which are cool, but with Fusion's news tab, you can create a personalised feed (e.g. only show me EURUSD) or see what's most popular for others. Don't be an uninformed trader.

#4 - Sentiment - I love the idea of knowing what the crowd is bullish or bearish on. What are people talking about? Why are they talking about it? Check out our post on why this is important.

#5 - Technical insight is excellent if you'd like to go into a deeper dive on technical analysis on Forex and Indices. I prefer these charts over MT4 truth be told and want to know short, medium and long term outlook for each trade I'm considering.

That's it for now. We've built these for you and believe they'll truly help you excel as a trader.

#6 – Historical and Live Spreads Tool - with this tool, you can see how spreads have fluctuated over time, as well as the current live spreads. This information can be incredibly valuable in helping you make informed decisions about when to enter and exit trades. No more surprises, no more hidden fees – just transparent, competitive pricing. Read our blog post to learn how spreads actually affect your trading costs.

To start using these tools now, create a Fusion account.

We’ll never share your email with third-parties. Opt-out anytime.