Tentang Kami

- Siapa Kami

- Mengapa Fusion?

- Apa Kata Mereka

- Blog Kami

- Regulasi

- Dokumentasi Identitas

Fusion Markets

Informasi hukum

Trading

- Produk & Akun

- Akun Zero

- Akun Klasik

- Demo Account

- Akun Bebas Swap

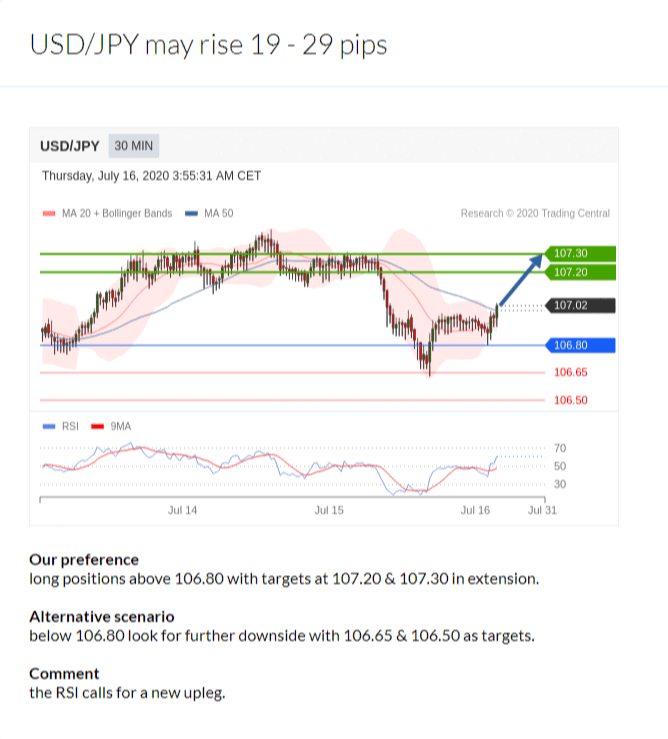

- Forex

- Logam

- Indeks

- Energi dan Komoditas Lunak

- Kriptokurensi

- CFD Saham AS

- Ketentuan Trading

- Pilihan Deposit

- Opsi Penarikan

- Kalkulator Trading

- Kalender Ekonomi

- Alat Trading

- Spread Forex dan CFD kami

- Fusion+ Copy Trading

- VPS Bersponsor

Produk dan Akuna

Markets

Sumber daya

Platform & Alat

- MetaTrader 4

- Aplikasi Seluler MT4

- WebTrader untuk MT4

- MetaTrader 5

- TradingView

- TradingView untuk Seluler

- cTrader

- Aplikasi Seluler cTrader

- cTrader untuk Web

- DupliTrade

MetaTrader 4/5

TradingView

cTrader

Platform Lain

Bermitra dengan kami

Bantuan

- Hubungi Kami

- FAQ

Bantuan