Sobre Nosotros

- Quienes Somos

- ¿Por Qué Fusión?

- Lo que otros dicen

- Nuestro blog

- Reglamento

- Documentación de identificación

Fusion Markets

Legal

Trading

- Productos y Cuentas

- Cuenta Cero

- Cuenta Clásica

- Demo Account

- Cuentas Swap-Free

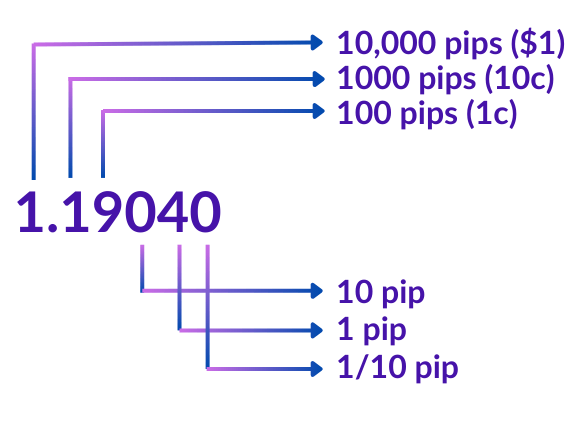

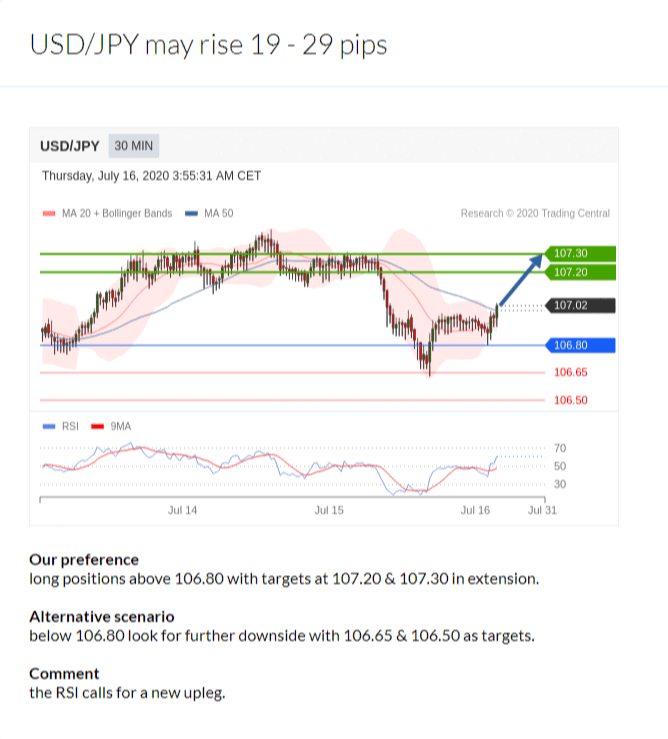

- Forex

- Metales

- Índices

- Energía y materias primas blandas

- CFD de Criptomonedas

- CFD sobre acciones estadounidenses

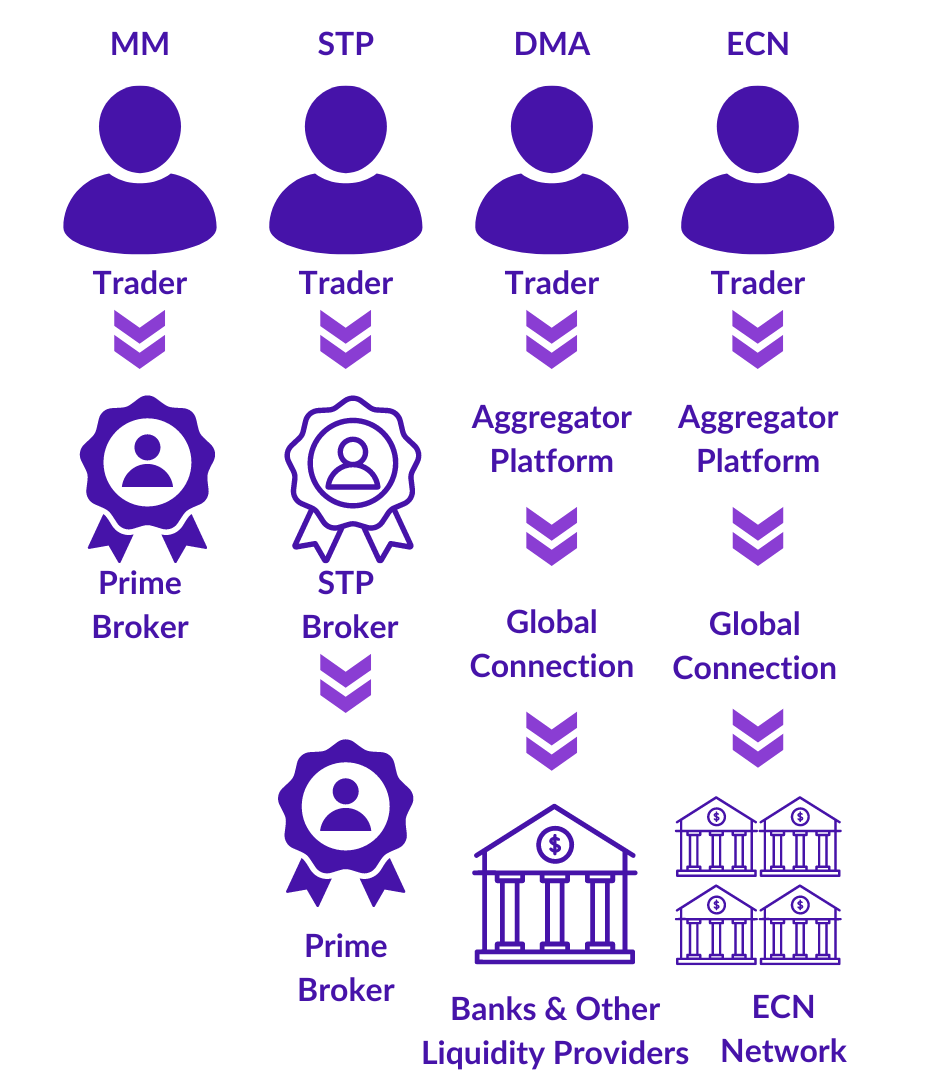

- Condiciones comerciales

- Opciones de depósito

- Opciones de Retiro

- Calculadoras comerciales

- Calendario Económico

- Herramientas de comercio

- Fusion+ Sistema de copiar

- VPS patrocinado

Productos y Cuentas

Mercados

Recursos

Plataformas y herramientas

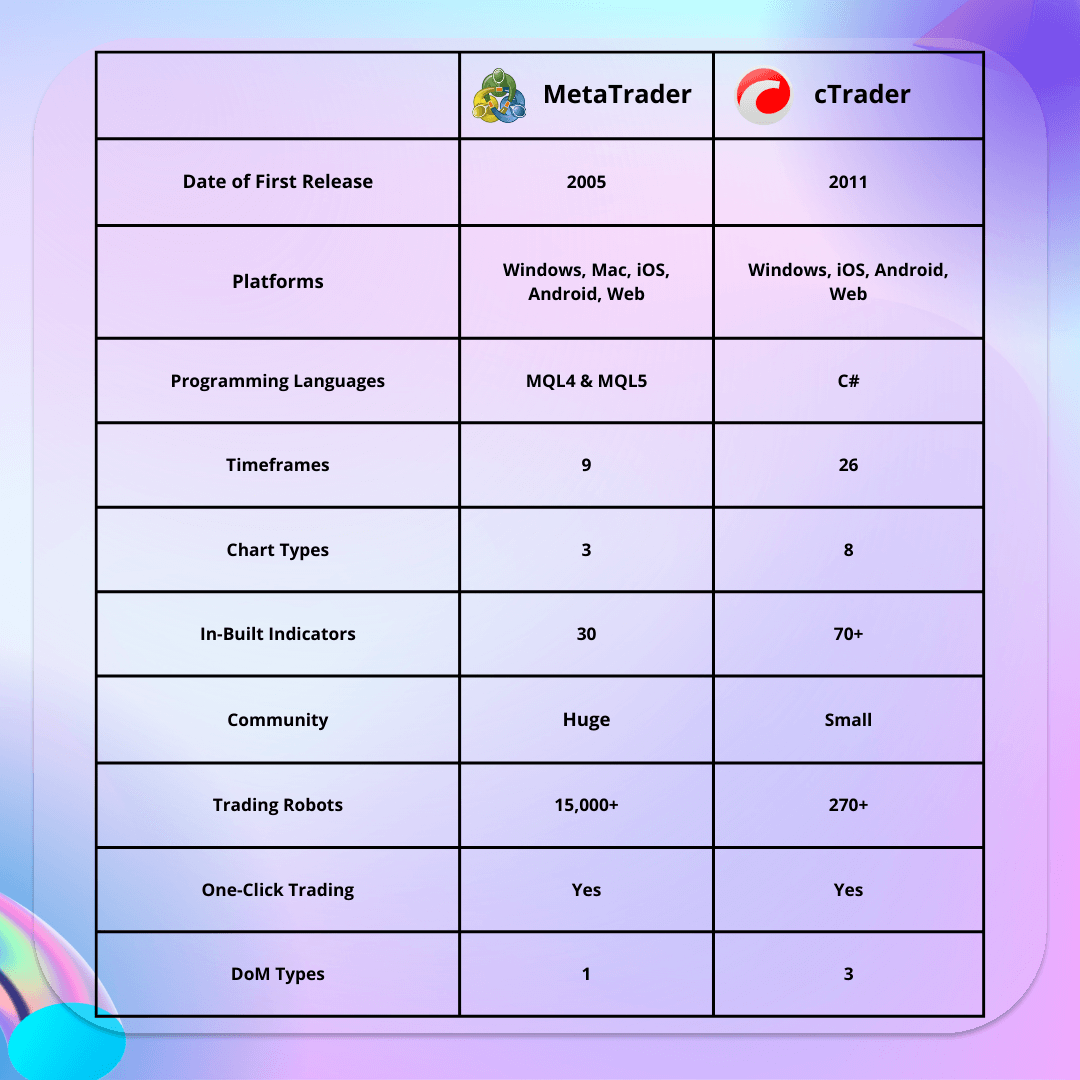

- MetaTrader 4

- MT4 para Móvil

- WebTrader para MT4

- MetaTrader 5

- TradingView

- TradingView Para Movil

- cTrader

- cTrader para Móvil

- cTrader para Web

- Gerente de Cuentas Múltiples

- DupliTrade

MetaTrader 4/5

TradingView

cTrader

Más plataformas

Asociarse con nosotros

Ayudar