About Us

- Who We Are

- Why Fusion?

- What Others Say

- Our Blog

- Regulations and Legal Documents

- ID Documentation

Fusion Markets

Legal

Trading

- Products and Accounts Overview

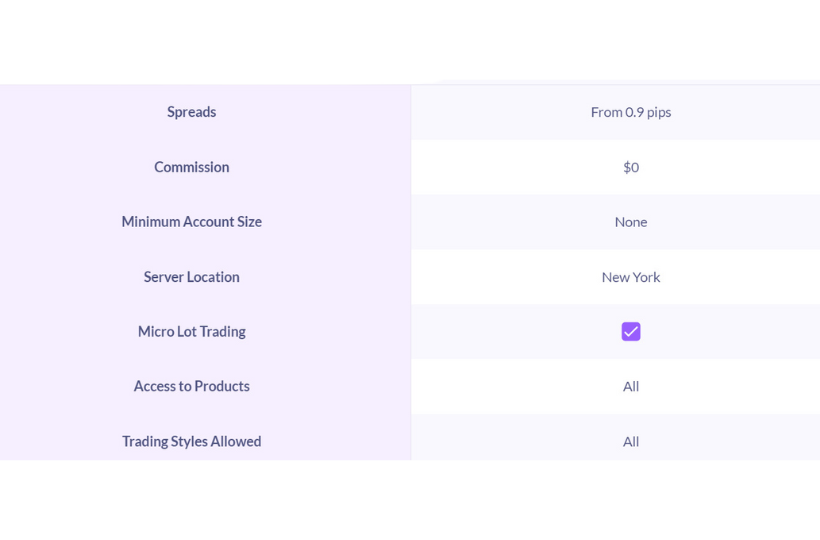

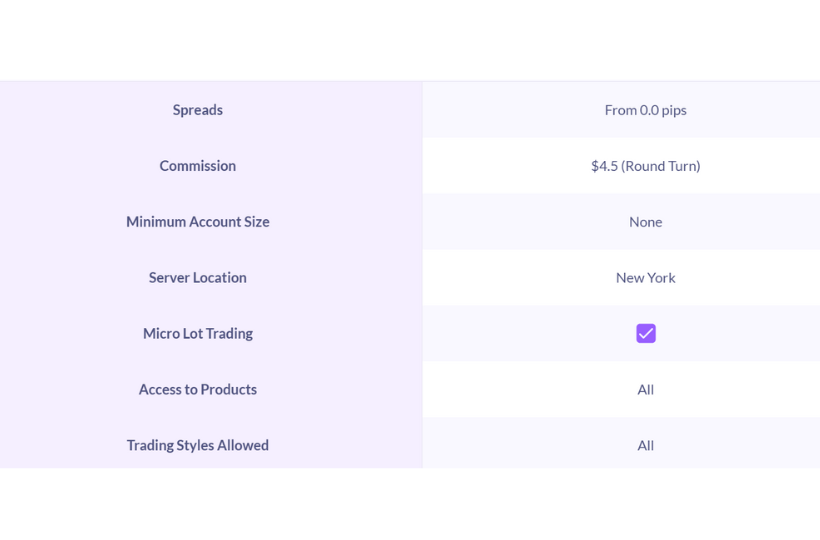

- Zero Account

- Classic Account

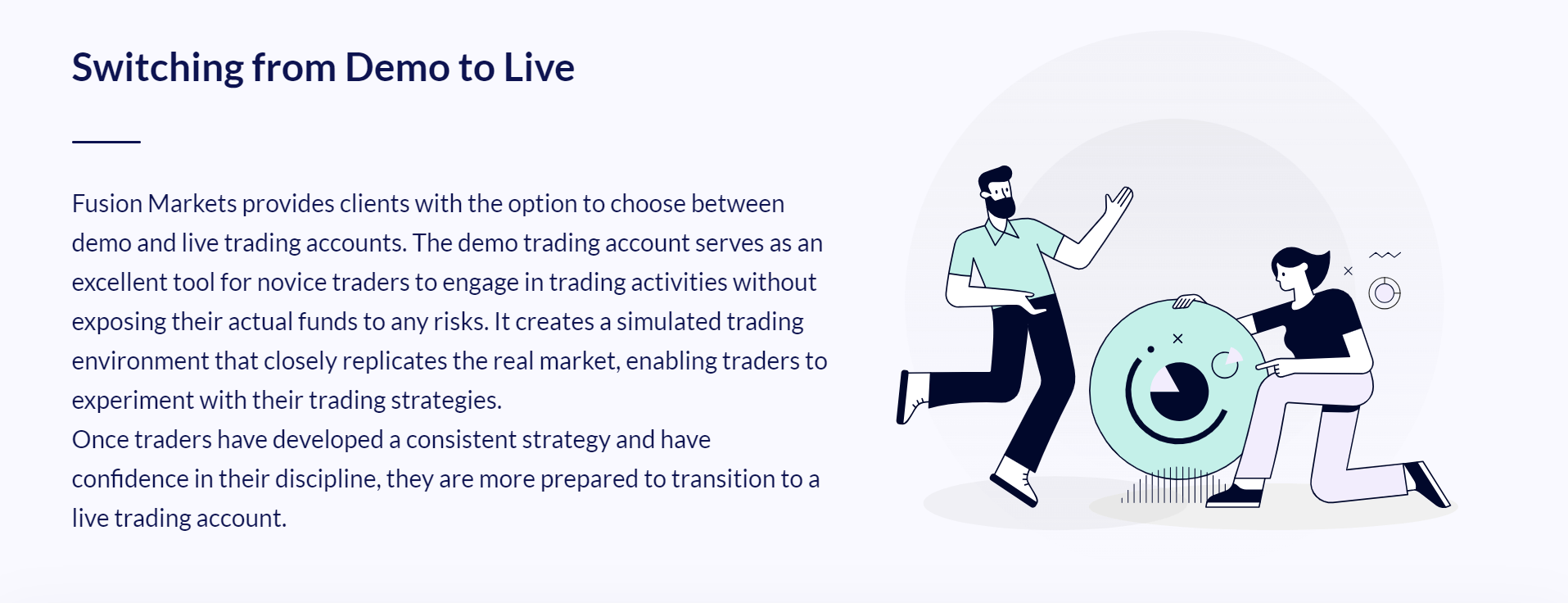

- Demo Account

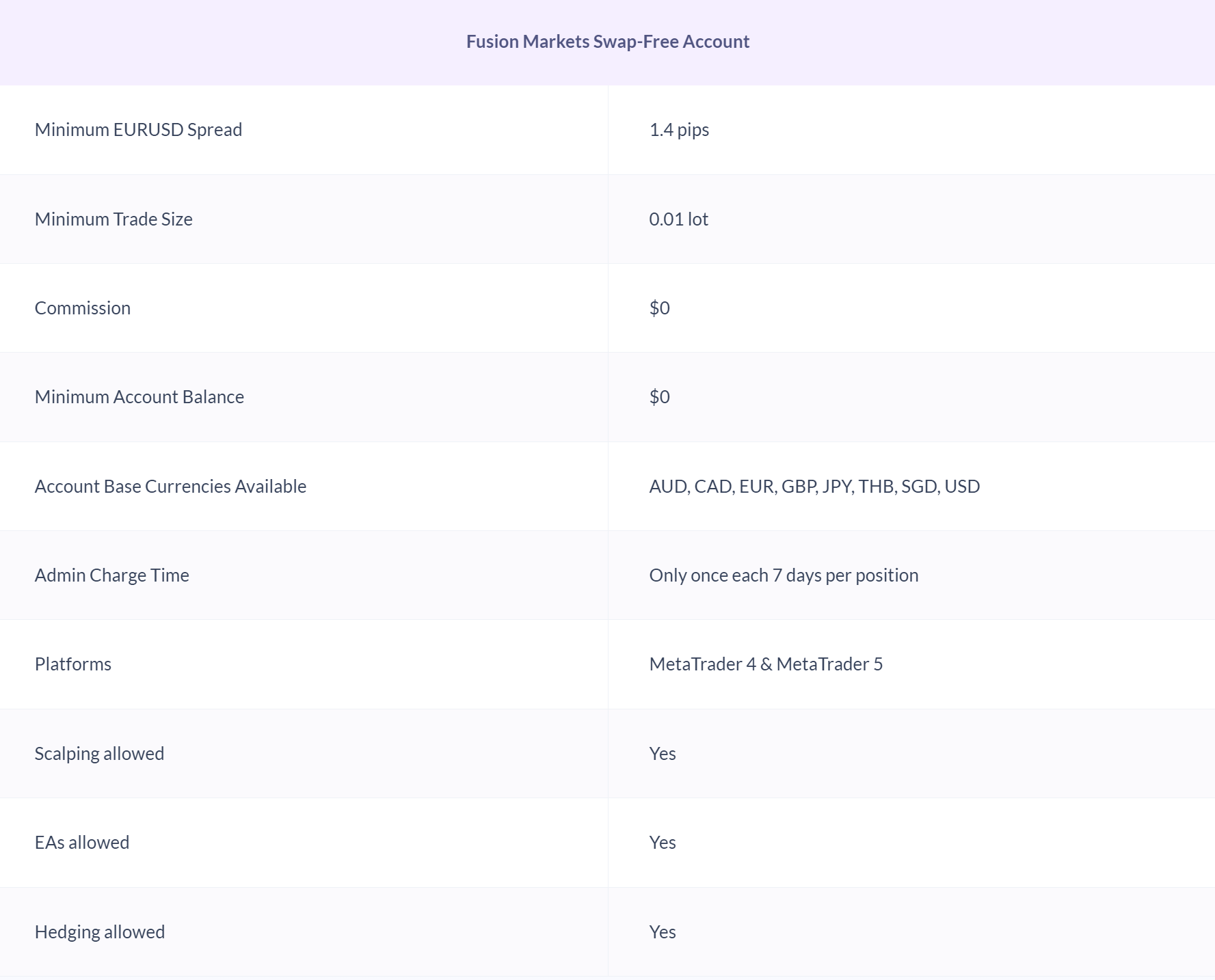

- Swap Free Accounts

- Forex

- Metals

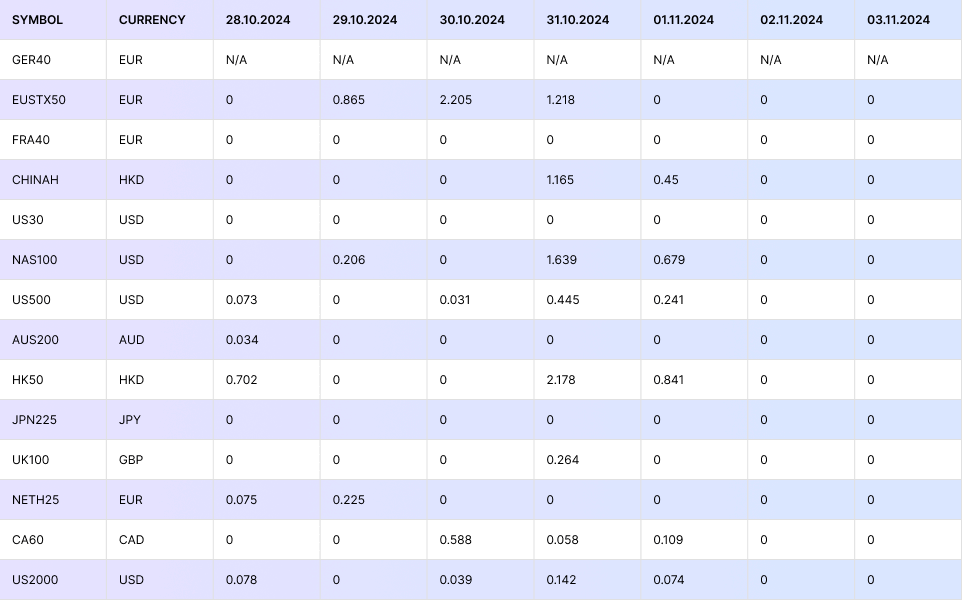

- Indices

- Energy & Soft Commodities

- Cryptocurrency

- US Share CFDs

- Trading Conditions

- Deposit Options

- Withdrawal Options

- Trading Calculators

- Economic Calendar

- Live and Historical Spreads

- Trading Tools

- Fusion+ Copy Trading

- Sponsored VPS

Products and Accounts

Markets

Resources

Platform & Tools

- MetaTrader 4

- MT4 Mobile Apps

- WebTrader for MT4

- MetaTrader 5

- TradingView Desktop

- TradingView Mobile

- cTrader Desktop

- cTrader Mobile

- cTrader Web

- Multi Account Manager

- DupliTrade

MetaTrader 4/5

TradingView

cTrader

More Platforms

Partner with us

Help

- Contact Us

- FAQ

Help

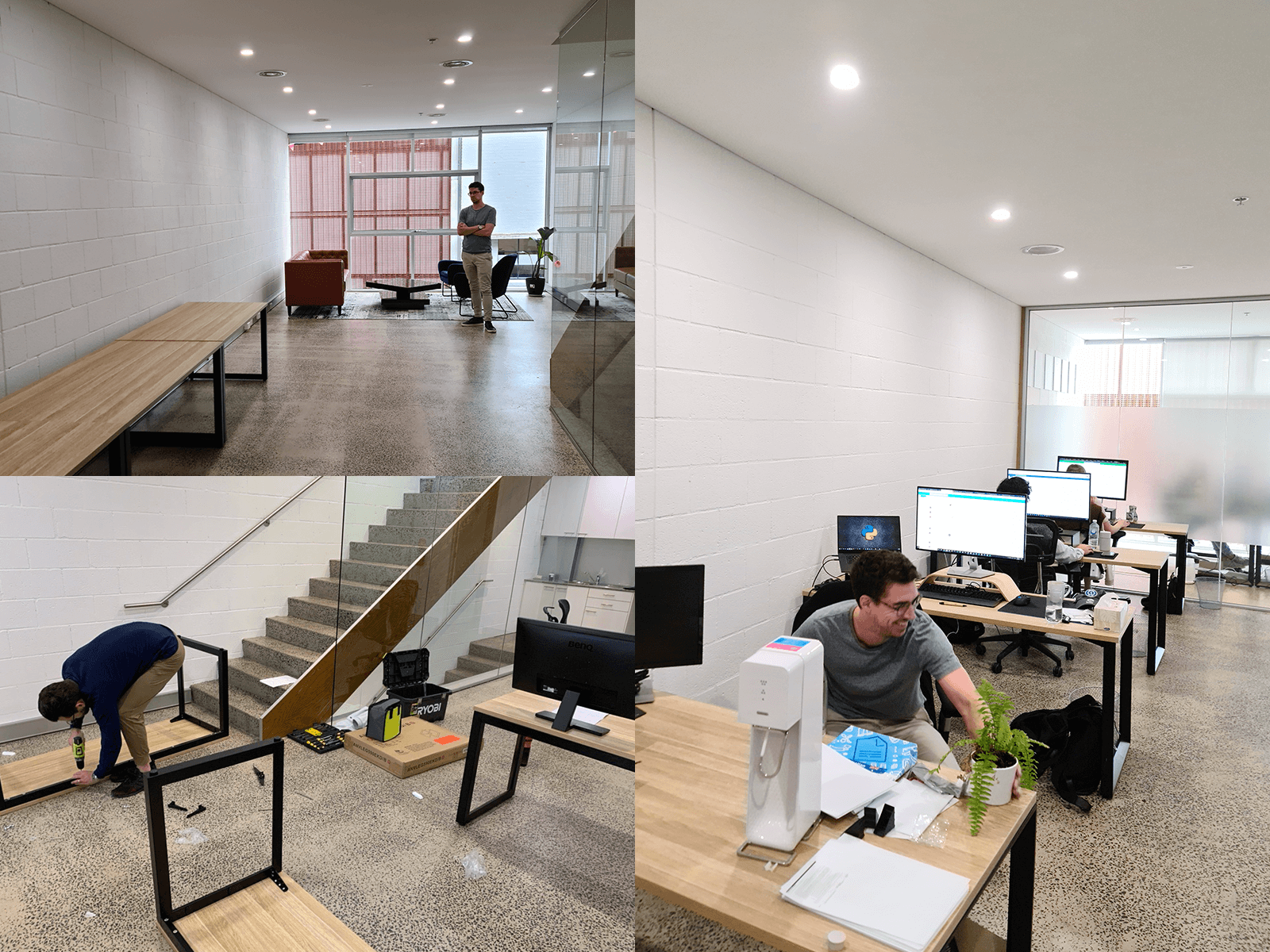

Firing on all Cylinders at Fusion Markets' South Yarra HQ

Firing on all Cylinders at Fusion Markets' South Yarra HQ